A look at key US Dollar support and resistance levels

Bullion.Directory precious metals analysis 13 November, 2014

Bullion.Directory precious metals analysis 13 November, 2014

By Terry Kinder

Investor, Technical Analyst

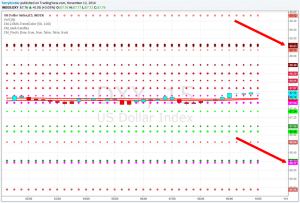

With the US Dollar trading above the $88.00 level recently, many have wondered if it is going higher and what key US Dollar support and resistance levels are. Below is a chart I use frequently while trading that shows important price pivot points.

US Dollar Support and Resistance Levels: This chart from one of my trading screens shows key support and resistance levels.

On the chart you will notice small circles, larger circles and plus signs. The smaller circles represent daily resistance levels. The larger circles represent weekly resistance levels and the plus signs are monthly resistance levels. There are also pivot points represented on the chart, but for the purposes of this article they are not important.

What is important, however, is the areas where the arrows point to the price levels. These levels are $86.17, $86.22, $88.83 and $88.86. The way this chart is designed is that when two resistance levels are very close to each other on the chart such as $86.17, represented by the pink plus sign, and $86.22, represented by the large green circle, that tells you it is – in this case – a strong level of support. The $88.83 – $88.86 is a strong area of resistance.

Other potential key US Dollar support and resistance levels are:

Support

- $86.89

- $86.20

- $85.71

- $84.56

Resistance

- $88.06

- $88.85

- $89.22

- $90.40

Given the daily resistance at $88.74 on the chart, plus the monthly at $88.83 and weekly at $88.86 I believe it is going to be challenging for the dollar to rise above $89.00. Of course that doesn’t mean it won’t happen, but it will have to overcome significant overhead resistance to punch through $89.00.

Will be writing an article soon covering the Yen / Dollar and gold price. It’s beginning to look like the Yen could be heading back up relative to the Dollar and that we cold also see a further rise in the price of gold to go with the Yen price reversal. Stay tuned.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply