Traders await Swiss vote that could cause sharp movement in markets

Bullion.Directory precious metals analysis 29 October, 2014

Bullion.Directory precious metals analysis 29 October, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

On November 30, there will be be a vote to determine whether or not the Swiss National Bank (SNB) will have to hold one-fifth, or 20 percent, of their reserves in physical gold. The vote is being pushed by the ultra-conservative Swiss People’s Party, and the referendum also includes that the SNB must repatriate all gold holdings outside of the country.

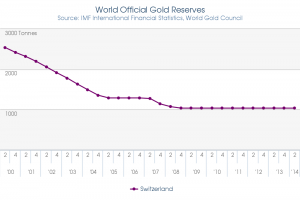

Historically, the Swiss central bank has held gold reserves in excess of 20 percent. However, the SNB has gone on a selling spree. Since 2000 to Q4 2014, Swiss national gold reserves have been halved. A “yes” majority vote would mean the selling of gold would stop, and the 20 percent benchmark must be met within five years.

This is important for the Swiss franc (CHF) because it would mean that the SNB would have to stop encouraging inflation by printing CHFs.

This vote will, too, hold a great impact for the foreign exchange world. In 2011, the SNB began to pegged the the CHF to the euro at 120 CHF per euro in order to keep the Swiss economy competitive. If the referendum passes, traders could begin to attack this “floor” put in by the SNB, which would provoke euro weakness.

A more expensive CHF would mean that Swiss exports become more expensive and make them less competitive.

In order to finance the purchasing of gold bullion, the SNB would have to sell roughly $68 billion in FX reserves via the US dollar and euros, according to Sebastian Galy at Societe Generale. If euro weakness is triggered through a “yes” vote, expect gold priced in euros to see strength.

The vote would be an important one to ensure a more sound currency.

![]() This license allows for redistribution of this article, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to Bullion.Directory, linking to the original article.

This license allows for redistribution of this article, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to Bullion.Directory, linking to the original article.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply