For as much as we struggle to compare present day to any point in U.S. history, the 1970s to early 1980s are an almost eerily accurate parallel. People on the street didn’t have a smartphone in their hands, and mail took a bit longer to arrive. But the economic conditions are all here.

Full Article →Even if nominal GDP were to grow a full 20% over the next two years, not out of reason in today’s historically high inflationary environment, there is the potential for a further 78% decline in stock prices from current levels to settle at the low multiples of the last stagflationary era.

Full Article →Talk of “peak inflation” is helping to drive investor inflows back into stock and bond markets. As the narrative goes, inflation readings have hit their highs for the year. The Federal Reserve will hike rates until monetary policy “normalizes,” then declare victory over the very problem its policies unleashed.

Full Article →There are conflicting views amongst experts around where this unprecedented economic setup ends. Much of the market is sitting on its hands unsure as to what to. Ray Dalio last week reminded us that ‘cash is trash’ so where does one invest now?

Full Article →Inflation, and now possible recession, are damaging more than prices, but spending less and working harder may not be enough to overcome lower wages, savings & living standards. More than one-third of U.S. households said they had trouble paying bills from April 27 through May 9.

Full Article →Retirees are struggling to make ends meet due to falling Social Security payments and rising prices. In the following Touchpoint video I’m going to delve into the details. Odds are stacked against retirees: Social Security purchasing power is down 40% & we need to fight inflation!

Full Article →Criticism continues to mount on the Reserve Bank of Australia for acting with too little too late in containing inflation in Australia. Having lifted rates for the first time in a decade to just 0.35% earlier this month, most other central banks are aggressively hiking.

Full Article →Two of the world’s best-known economists say it’s we may be headed toward a painful combination of high inflation and economic downturn that we call stagflation. Noted economists Mohamed El- Air E Yawn and Stephen Roach recently sounded the stagflation alarm…

Full Article →Last night saw even more poor economic data and Fed minutes confirming they have no intention of backing off at least for 3 more rounds of 50bps hikes. Clearly fuel for more share market falls one would think… However the market seemed to somehow latch on to the hope the Fed will stop in September?

Full Article →It turns out that quality growth stocks do not always outperform; that the Federal Reserve will not always step in to protect your wealth… and that the prices of the growth stocks in your portfolio have long been more a function of loose monetary policy than the priceless nature of innovative thinking.

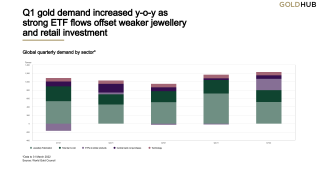

Full Article →The World Gold Council recently released their first quarter gold demand trends report for 2022. As usual we give you an expanded summary of this quarterly snapshot of global demand and supply.

Full Article →Central bankers and bureaucrats are seizing on recent turmoil in cryptocurrency markets to push aggressively for central bank digital currencies (CBDCs). They made their case to other global elites gathered in Davos on Monday…

Full Article →No doubt Biden administration officials are urging the Fed to assure Americans their central bank is taking decisive action. So far, however, there isn’t much reason to believe Esther George and her comrades are planning to do much more than talk.

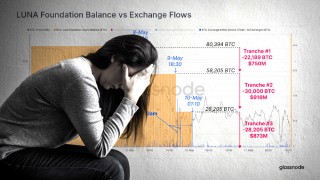

Full Article →After the industry-wide sell-off alongside the collapse of LUNA and UST last week, markets have entered a period of consolidation. In the shorter term, we can also see that the Monthly Return profile for Bitcoin has been underwhelming. In effect, Bitcoin has lost 1% of its market value every day over the last month.

Full Article →Its now official. After the NASDAQ long since crossed the rubicon, the world’s biggest equities index, the US S&P500 officially turned to bear market having crossed the 20% loss line on Friday night.

Full Article →While a first glance at the latest inflation figure may indicate improvement, a second look at the numbers raises the possibility it actually could be getting worse. And as bad as that news is for all Americans, it may be especially troubling for seniors.

Full Article →Gold Demand Rising While Inflation Remains High: Inflation has been rising – and so has physical gold demand. World Gold Council’s latest report shows a 34% jump in Q1 2022. Amazing!

Full Article →More red on Wall Street last night on growing concerns about the US economy and its ability to handle higher rates. Whilst ending the session lower the S&P500 again miraculously bounced off the -20% bear market line in the sand without crossing it.

Full Article →Although we set up the Dubai company several months ago now, it’s taken quite a while to get set up personally with residence visas and government IDs – but today after more than a few delays and roadblocks – we’re here, we’re official and we’re open!

Full Article →At this point, it has almost become cliché to say that “inflation is accelerating,” and that it’s taking a bite out of retirement savers income. But just how big is that bite? According to this Moody’s analysis, that bite amounts to hundreds of dollars a month consumed by the tax nobody voted for

Full Article →Sri Lanka is running out of petrol. Citizens are being implored not to line up, that petrol will be available within the next two days. Sri Lankan news channels warn power cuts may rise to 15 hours per day, and there are numerous reports of Sri Lankans struggling to find essentials

Full Article →Economists agree both gold and silver share many virtues: Easily accessible and redeemable, highly liquid, historically money, intrinsically valuable and free of counterparty risk. The parallels lead some to call silver “poor man’s gold.” That’s not a helpful description…

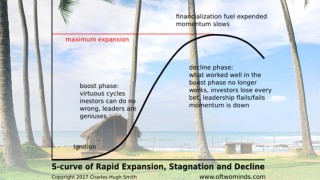

Full Article →At a time of monumental change in our global economic and geopolitical setup, financial commentator and author Charles Hugh Smith yesterday looked back at his calls on what he sees as the 5 ‘long-wave cycles’ that he first posited in 2007.

Full Article →The globalists are preparing to roll out Central Bank Digital Currencies. If they can convince people to adopt this next evolution of fiat money, they will attain a level of information and control that prior generations of central bankers only dreamt of.

Full Article →The cryptocurrency markets experienced a week of historic volatility and chaos, with the exchange rate for two stablecoins, UST and USDT taking centre stage. Over just a few days, two top 10 digital assets by market cap (LUNA and UST) erased nearly $40 Billion in investor value.

Full Article →The consumer price index (CPI) for April registered at 8.3%. That’s a slight improvement in the headline number over March’s 8.5%, but only slight. Notably, core CPI – the “underlying” CPI that excludes volatile food and energy prices – rose 6.2% year-over-year

Full Article →Its hard to pick up a paper or read the news without headlines around plummeting auction clearance rates, stalled house sales, predictions of big house price falls, and then late last week we got the ABS stats showing new home and construction finance commitments literally halved…

Full Article →On Thursday May 12, the price of silver fell about a buck. But… As with every one of these big price moves, the question is: what really happened? There is a theory which is often touted in the precious metals community. According to this theory, the banks sell futures to manipulate prices.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.