Unless they secure a requested extension, European banks will have to comply with Net Stable Funding Requirements by the end of June. Along with other effects, these regulations could make trading in the gold and silver derivatives markets less profitable to them.

Full Article →As The Daily Reckoning contributor Jim Rickards notes on Zero Hedge, the worst-case scenario for gold appears to be running its course. It’s often stated that the stock market is gold’s primary competitor, but the inverse correlation between the markets has been absent for some years.

Full Article →This week has been truly brutal for the entire cryptocurrency sector, with the prices of major currencies like Bitcoin and Ethereum crashing at least 30%. The overall sector has shed trillions of dollars in value. The recent carnage for holders of digital currencies could be due to many factors including profit taking spurred by Elon Musk.

Full Article →The Pros and Cons of Diversifying Your Retirement Portfolio With Proof Coins: Even today less than honest bullion dealers are regularly sanctioned by the government for taking advantage of naive investors and selling proof coins far above market value…

Full Article →These “Fedcoins,” according to The Economist, “are a new incarnation of money. They promise to make finance work better but also to shift power from individuals to the state, alter geopolitics and change how capital is allocated.” But perhaps more importantly, “Fedcoins” could signal the beginning of an abandonment of the U.S. dollar

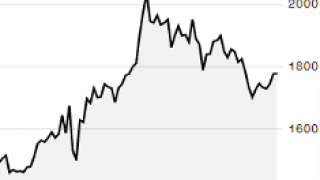

Full Article →GOLD PRICES hit and rallied from 1-week lows Thursday in London, falling within $10 per ounce of $1800 as crypto currencies sank and global stock markets extended yesterday’s steep drop on Wall Street following news of the strongest ‘core’ inflation in the USA for 25 years.

Full Article →As the Biden administration showers the nation in debt-funded handouts and federal bailouts, new concerns are emerging as to the likelihood of a “Great Reset” in the value of our currency. However, this potential dollar rout has been in the making for many years.

Full Article →There has been no shortage of stories of big-name investors touting or turning to gold over the past few years, and especially over the course of last year as the Federal Reserve sparked widespread inflation concerns with its multi-trillion-dollar stimulus.

Full Article →The yellow metal gained over $20 per ounce on the news. The jobs report was a major piece of economic data-possibly the most important of the month.

Full Article →Why do portfolio investors typically spread risk across different asset classes like stocks and commodities? This is the most basic form of building a diversified portfolio, with investor’s aim being to minimize risk and maximize gains.

Full Article →Is it a temporary blip… or the beginning of a long-term trend? That’s the key question facing consumers, investors, and retirees when it comes to inflation.

Full Article →Strong demand for bullion products amid tight market conditions and unprecedented “stimulus” measures from Washington have lots of people asking lots of questions. Here we will answer a few of the most pressing questions currently on the minds of precious metals investors.

Full Article →The simple rule is: Don’t listen to WHAT people say, but HOW they say it. Already 50 years ago the Mehrabian model concluded that words only convey 7% of a message, body language accounts for 55% and tone of voice delivers 38%. That is why you should never focus on the words of a speaker since they are the least important.

Full Article →Many traders, investors, and momentum players will closely examine the market trend to determine if and when to enter or exit the market. A market with a strong technical foundation can launch to dizzying heights, while a market displaying weak technicals will have a tough time putting together any sustainable upside.

Full Article →Ronan The Destroyer’s Fight Against Metals Market Manipulation

Ronan Manly – aka Ronan the Destroyer – is one of the industry’s most outspoken critics, regularly releasing in-depth research examining the institutional corruption, market manipulation and shady practices at the heart of precious metals trading.

Full Article →Is Bitcoin Losing its Luster?

Prices for the cryptocurrency have slid from a high of over $64,000 on April 14th to under $48,000 in trading this past weekend. The 25% sell-off would be akin to a crash in the S&P 500. But for crypto markets, that kind of volatility is fairly routine.

Full Article →Will Biden’s ‘Green Reset’ Be Great For Silver?

As top officials around the world convene this week for a “climate summit,” President Joe Biden’s administration is planning the most radical expansion of government’s role in the economy since FDR’s New Deal.

Full Article →The LBMA and Comex clan has sold their physical silver up to 1,000X over. The current silver price has nothing to do with supply and demand. In a real market the Price of Silver would be substantially higher. In a fake market, the manipulators have no problem to suppress the price by selling virtually unlimited fake paper silver.

Full Article →The Next Key Level for Gold

Gold rallied last week toward the top of a down-trending channel that has been in force since prices peaked last summer. A breakout attempt in early January failed. The gold market subsequently slumped to a potential double-bottom low in March around $1,675/oz.

Full Article →Central Banks Ramp Up Gold Buying

Ignore what central bankers are saying; instead, watch what they are doing. While they poo-poo gold or pretend it doesn’t exist, global central banks have been quietly but aggressively accumulating gold bullion for several years now. The Central Bank of Russia, for example, has been a consistent buyer of gold.

Full Article →The U.S. economy isn’t a light switch that can be flipped on and off at will. Yet that didn’t stop the majority of state governors from turning off their economies in 2020 — causing financial misery for tens of millions of people.

Full Article →What Skyrocketing Home Prices Say About Inflation

Housing costs are skyrocketing. The median sales price of existing homes has spiked 16% over the past 12 months – the fastest pace in 15 years. The real estate market is being pressured not only by a low inventories of houses listed for sale, but also by rising prices for construction materials.

Full Article →William Watts with MarketWatch sees the “biggest Inflation scare in 40 years” on its way. Bullion.Directory precious metals analysis 12 April, 2021 By Clint Siegner Director of Money Metals Exchange […]

Full Article →Rarely do markets move straight up or straight down. The stock market has, however, essentially moved straight up since the March 2020 mini-crash. As the market moves higher, an increasing number of “analysts” are calling for even higher equity prices.

Full Article →As NFTs (Non-Fungible Tokens) rapidly become mainstream investments it’s starting to seem like there’s nothing that cannot be made into a cryptographic unit and sold to ravenously excited Bitcoin millionaires.

Full Article →What Biden’s Infrastructure Push Means For Silver

The federal government is spending and redistributing newly created cash so rapidly, it’s becoming difficult to keep track of which trillions are going where. This week, President Joe Biden will pitch a $3 trillion “green” infrastructure package. That’s on top of the $1.9 trillion economic “relief” bill he recently signed into law.

Full Article →There has been considerable discussion in recent weeks about the prospect and threat of rising inflation. This inflationary scare comes at a time when the government is unleashing massive stimulus measures to bailout states, businesses, and consumers – all in the name of combatting the pandemic.

Full Article →An economic framework called Modern Monetary Theory (MMT) governs the financial world today, but fails to account for the consequences of its practices. In fact, MMT is leading us to an extremely dangerous financial situation that could blow up at any time.

Full Article →