In his new research paper, Wharton finance and economics professor Urban Jermann proposed that investors and market participants have been misinterpreting the true value of gold as an investment asset. In particular, more attention should be paid to…

Full Article →Inflation Shoots Above 1980 Peak

Americans get fed a lot of BS when it comes to price inflation. Prices in the U.S. are rising faster than they were in the late 1970s when gasoline shortages triggered an economic crisis. Today, supply chain disruptions and exploding prices are also nearing crisis levels.

Full Article →Could China & Russia Speed Up Dollar Drop?

Both China and Russia play hugely important roles in the global economy. Both face economic sanctions from the United States. And both are eyeing long-term strategies for shifting the locus of global trade away from the Federal Reserve Note “dollar.”

Full Article →The ECB Awakens. Will Gold Feel The Force?

The ECB has awoken from its ultra-dovish lethargy. Lagarde opened the door to an interest rate hike, which gave the European Central Bank a hawkish demeanor. Does it also imply more bullish gold?

Full Article →Is Valentines Day Cancelled?

Has the Supply Chain Crisis Killed Romance? Expressing our love could be in danger due to recent flower shortage. It’s one thing not to be able to buy toilet paper, but now expressing our love is in danger when we can’t buy flowers.

Full Article →It’s 2022: Will You Protect Your Retirement Account With the #1 Choice?

What if this was one of your publicly declared New Year’s resolutions: “This year I’m going to protect my retirement account.” Here’s the thing – the moment you say it out loud, you and everyone around you will wonder why you’ve waited even this long to do something that clearly is so important.

Full Article →State Reserve Funds Dangerously Exposed to Inflation

The recent explosion in inflation rates caused by runaway debt-funded federal spending and Fed money printing has sparked renewed interest in state legislatures in the role gold and silver play in hedging against systemic risks.

Full Article →Strong Payrolls Can’t Knock Gold

The latest employment report strongly supports the Fed’s hawkish narrative. Surprisingly, gold has shown remarkable resilience against it so far – especially given that the surprisingly good nonfarm payrolls came despite the disruption to consumer-facing businesses from the spread of the Omicron variant of the coronavirus.

Full Article →UBS: Gold is ‘Tried-and-Tested Insurance’

UBS strategists said that gold’s “tried-and-tested insurance characteristics” had again shined brightly, especially compared to other common portfolio diversifiers, including digital assets such as bitcoin. (Recently, bitcoin’s price has been more closely correlated with stocks than previously, reducing its effectiveness as a hedge.)

Full Article →Why Fed Note Decline is FAR Worse than Reported

Americans are waking up to some uncomfortable truths. One of these is the fact that government bureaucrats and the corporate media regularly lie about what is going on in the world. The real inflation numbers may be close to double what’s reported officially. Alternative data sets are out there, but, predictably…

Full Article →Will the Fed Tighten Gold?

Beware, the Fed’s tightening of monetary policy could lift real interest rates! For gold, this poses a risk of prices wildly rolling down. The first FOMC meeting in 2022 is behind us. What can we expect from the US central bank this year and how will it affect the price of gold?

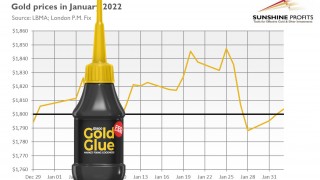

Full Article →Gold Ended January Glued to $1800 – Will it Ever Detach?

What does gold’s behavior in January imply for its 2022 outlook? Well, I must admit that I expected gold’s performance to be worse. Last month showed that gold simply don’t want to either go down (or up), but it still prefers to go sideways, glued to the $1,800 level.

Full Article →Crisis Ahead: New National Debt Milestone

The U.S. reached a $30 trillion milestone this week. Instead of signifying a great achievement, though, it serves as a dire warning for American workers, investors, and retirees.

Full Article →2022 Gold Outlook

In the full Outlook Report, we take an in-depth look at the market players, dynamics, fallacies, drivers, and finally give our predictions for gold and silver over the coming year. Our unique analysis of precious metals, encapsulated in our Supply and Demand model, is a true signal in an otherwise very noisy market.

Full Article →Gold Defended $1800 Bravely. Then Gave Up.

The evil FOMC published its hawkish statement on monetary policy. Gold fought valiantly, gold fought nobly, gold fought honorably. Despite all this sacrifice, it lost the battle. How will it handle the next clashes?

Full Article →Can The Fed Save US Economy?

Can the Fed Fix the Economy? The general mood over the economy is negative. People are worried and upset. Can the fed give us some hope? CEOs are expecting the supply chain issues to run into 2023, so monetary policy from the fed may be the only way in which we can combat this inflation.

Full Article →Goldman Sachs Rushes to Buy Up Gold in 2022

Financial reporter Emma Dunkley directed our attention to the latest commodities research report from Goldman Sachs, titled Gold: Time to buy the defensive real asset. Goldman’s researchers offer a number of compelling reasons for concerned investors to consider…

Full Article →Gold 2022: Between Inflationary Rock and Hard Fed

In the epic struggle between chaos and order, chaos has an easier task, as there is usually only one proper method to do a job – the job that you can screw up in many ways. Thus, although economists see a strong economic expansion with cooling prices and normalization in monetary policies in 2022, many things could go wrong.

Full Article →Should Investors Fear Fed Rate Hikes?

Officials in Washington who insist things are looking up in the economy just don’t get it (or, in many cases, are deliberately misleading). Ordinary Americans, however, do get it. They know they are losing out to inflation as 61% of Americans say their family incomes are falling behind their costs of living…

Full Article →Gold Plunges But Doesn’t Knuckle Under Hawkish Fed

The Battlecruiser Hawk is moving full steam ahead! The FOMC issued yesterday (January 26, 2022) its newest statement on monetary policy in which it strengthened its hawkish stance. First of all, the Fed admitted that it would start hiking interest rates “soon”

Full Article →Retiring in the Next 10 Years? Read This.

It looks as though the next few years will be a bumpy ride for retirement savers. Not welcome news, considering the fact that today’s “stubbornly, persistently high” inflation looks like it will stick around. Worse yet, some projections forecast a negative annual return on stocks for the next decade.

Full Article →Fed Chair Resigns on Trading Scandal

With the Fed printing trillions of dollars and sending it directly into the banking system, it’s no surprise that the banks are doing well. But maybe we should be surprised… wasn’t the point of printing all this money to get it to people like you and me?

Full Article →Billionaires Make Trillions in Health Crisis

While most of us are worried about a bubble burst, labor shortages, and our portfolios keeping up with inflation, billionaires made a fortune thanks to trillions of dollars printed by the Federal Reserve. How does this happen and what does it mean for our economy?

Full Article →Fed Digital Currency Paper: A Response

The Federal Reserve published Money and Payments: The U.S. Dollar in the Age of Digital Transformation, and solicits comments about its ideas for a central bank digital currency (CBDC). This is our extended commentary offered in response…

Full Article →When Inflation Safe Havens Are in Shortage Too…

Americans who own only conventional assets, such as stocks and bonds, but now many are thinking about when to cash out and which assets will be best to hold as they hunker down. So far, the investor flight to safety has been modest, but portfolio de-risking is now set to grow and will stocks remain available?

Full Article →Gold to Soar Under Fed No-Win Situation

Inflation began soaring last April. The latest Consumer Price Index (CPI) registered at 7% –- the highest year-over-year CPI in nearly 40 years. So … higher interest rates are a given, then, right? Maybe not. The Federal Reserve is saying rate hikes are a “go,” but some economists believe the risks to equities and real estate are just too great.

Full Article →Gold Slides and Rebounds in 2022

So, 2021 is over! 2022 will be better, right? Yeah, for sure! Just relax, what’s the worst that could happen? My outlook for the gold market in 2022 suffers from manic depression: I see first a period of despair and an elevated mood later. But seriously, what can we expect from this year?

Full Article →Fed Rate Hike To Trigger Recession – And Higher Gold?

President Biden said at the beginning of last month that the U.S. economy was in “strong shape,” but it’s clear that everyday Americans aren’t anywhere near as optimistic in their outlook as the nation’s chief executive is. Economists are concerned Fed actions will lead to not only inflation, but recession.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.