Something seems to be brewing in the commodities markets. Is it the signal of something ominous?

Bullion.Directory precious metals analysis 13 January, 2015

Bullion.Directory precious metals analysis 13 January, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Senior FX and Commodities Analyst at FX Analytics

I support the idea that we are on the precipitous of something disastrous.

Those who constantly look at underlying factors and notice the shifts in the FX, commodity and economic data are witnessing that the latest boom cycle is on its last leg.

Precious metals had a disastrous year in 2013, and 2014 was slightly better considering the horrid sentiment surrounding gold and silver – but it is the price action that I focused on.

In 2008, gold fell in the commodity storm and on the hope that the US economy was amazing, the dollar surged. However, as deflation took hold in 2009, the Federal Reserve began its infamous quantitative easing program which was designed to prop up both inflation and asset prices. In response, gold began to rise and increase to an all-time high of $1,923 per toz.

Since then, gold has meandered its way back down – eventually reaching prices not seen since 2008. And, that is where I believe a new cycle started. A sort of a “restart”.

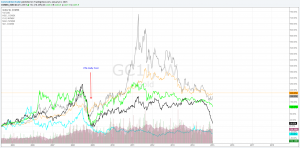

Last year a new commodity storm was created. Crude was cut in half over a period of months, natural gas tanked, copper was melted on fears of a global growth slowdown, and precious metals were guilty by association. It is as if history truly repeats itself.

Currently, energies are diving lower despite every analyst calling for a bottom, and copper (a growth indicator) is down over 22 percent since the beginning of 2014.

However, as we since in 2008/9, precious metals are rallying amid the turmoil. It’s even perking the interest of precious metal bears as somewhat perplexing. It seems as the decline in other commodities, along with equity volatility, is causing precious metals to rally first. Perhaps, gold could be telling the market of disaster ahead. We are likely to see another round of of hopeless quantitative easing.

Here is a current picture of key commodities: Commodities in 2008/9:

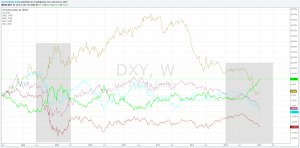

Commodities were not the only movers prior to the financial crisis. The foreign exchange (FX) markets have seen a lot of action. Major currencies that were pegged to the dollar free-fell on a strengthening dollar. In late 2008, the dollar began to increase, and this was a leading indicator of potential deflation leading into 2009.

The yen, which fell throughout 2008, began to rally on concerns things were building up to a climax.

Here is a picture of FX majors leading into 2009 and current. Deja vu? The yen is now rallying with the dollar as it did in 2008. The dollar’s rally has also halted near an 11-year resistance level. The Federal Reserve continues to pigeon-hole themselves by using language like “considerable time” and “patience.”

Here is a picture of FX majors leading into 2009 and current. Deja vu? The yen is now rallying with the dollar as it did in 2008. The dollar’s rally has also halted near an 11-year resistance level. The Federal Reserve continues to pigeon-hole themselves by using language like “considerable time” and “patience.”

The Fed has no idea what to do, as if they ever did. Traders are now looking at an interest rate hike in early-to-mid 2015 as a long shot. We also have global consumer prices ever-declining. The elusive “two percent” inflation target sought after by major central banks have been a pipe dream of sorts.

The Fed said that the decline in consumer prices, largely contributed by a decline in energies, is transitory. Yeah, so did the European Central Bank back in early 2014. Now, the eurozone is heading into a deflationary environment. Not to mention consumer prices in the United Kingdom, China and other major economies are fractions of what they were even a year or two ago.

Here is the US 10-year note and Euro Bund. Bonds, too, look to be in need of a correction:

2015 is going to be mercurial…

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply