In what must be the fastest volte-face in listing history, CME Group delists Al Etihad Gold days after approving the company for Good Delivery status.

Bullion.Directory News 10 August, 2020

Bullion.Directory News 10 August, 2020

By Alison Macdonald

Commercial Editor at Bullion.Directory

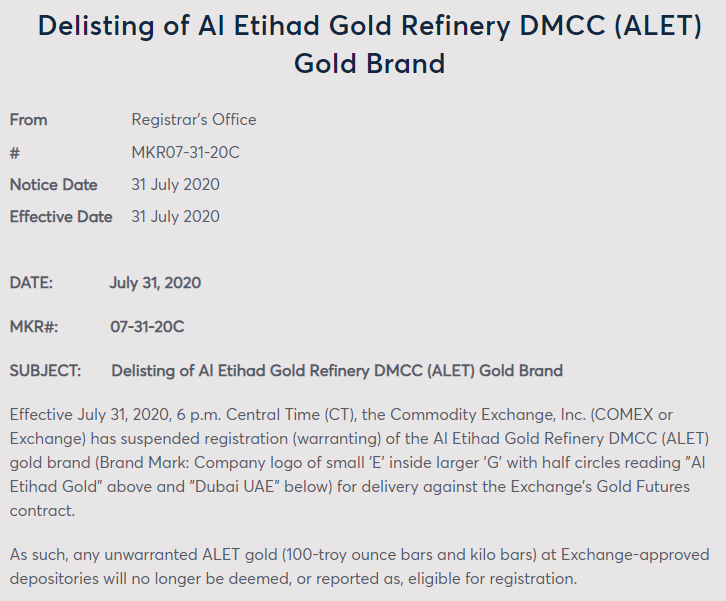

CME Group has quietly delisted Al Etihad Gold only three weeks after the Dubai refiner was granted admission to the exclusive club.

The exchange quietly announced the notice of delisting via a link without any further explanation – something which one would expect given this sudden and unexpected change of heart.

Added on July 9th and removed on July 31st, Dubai gained and then lost a coveted jewel in their crown practically overnight.

So what is behind this latest blow to Dubai’s gold industry?

Market commentators have been left confused with several taking to LinkedIn and calling foul on what is being seen as a protectionist move.

Ronan Manly, Precious metals Analyst at BullionStar summed up the situation perfectly as bullion dealers and investors called for clarity on the matter, saying

As CME approved Al Etihad on 9th July and then backtracked on 31st July, this means that the refinery fulfilled the approval criteria, so something after that triggered the decision to delist Al Etihad again. If it was political if shows interference and CME corruption. If it was technical then it shows incompetence in the initial approval and looks bad for CME.

Spencer Campbell, director at SE Asia Consulting didn’t pull any punches stating,

How embarrassing it is for the CME Group, egg on their face for sure! Time for an Asian exchange to accept Dubai good delivery and move away from the old boys club!

Mr Campbell continued, adding it was time for the U.S. Commodity Futures Trading Commission to take a look into the CME Group Regulatory Reporting on the issue.

While there was suggestion that this may be an indicator of inherent dirt within the Dubai precious metals supply chain – other comments pointed out the disparity and open hypocrisy inside the system where markets widely known to have supply chain issues continue operations with zero comeback and pristine status.

Unfortunately until we receive further clarification from CME for the reasoning behind this bizarre 180, we’re going to see further speculation on the matter.

Was there pressure on CME to delist? Was there wrongdoing on behalf of Al Etihad? Is there protectionism at the heart of the Good Delivery system?

As one anonymous commentator put it “It’s a club. Old white men smoking cigars controlling the market and they don’t want to share”

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

The political establishment in the UAE must raise to defend it own when share business principles fail.

In the absence of details and befitting explanations and reasoning, I suspect foul play.

Kwesi Ntodi Anim Adu

There is shocking hypocrisy in the market. Dubai is singled out time and time again for issues that are ignored elsewhere. If we policed the whole market with the vigour we show in Dubai there would be no good delivery gold. Switzerland would run dry in days.