Precious Metals Market Report

Monday 21 August, 2017

Fundamentals and News*

Gold prices retreated on Friday after surging to their highest level in nine months

Gold prices retreated on Friday after surging to their highest level in nine months earlier on the back of concerns over U.S. political uncertainty and amid safe haven buying in the wake of a terrorist attack in Spain.

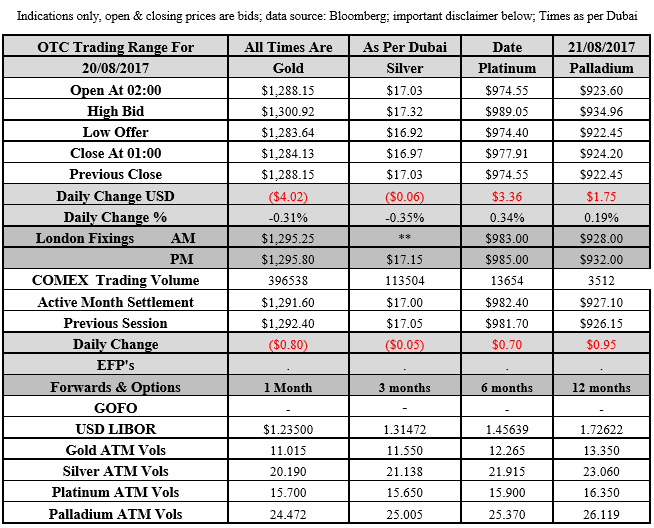

Gold futures for December delivery settled down 0.16% at $1,290.27 on the Comex division of the New York Mercantile Exchange, after rising as high as $1,306.9 earlier, the highest level since November 11.

The precious metal reversed course after reports that senior White House advisor Steven Bannon was leaving his post, in what was seen as a positive for the Trump administration’s agenda.

Ongoing uncertainty over the economic agenda of U.S. President Donald Trump and doubts that the Fed will deliver a third rate hike this year have been factors underpinning gold demand.

Gold prices have risen around 11% this year due in large part to the weaker dollar.

The dollar surged to 14-year highs after Trump’s November election on hopes that his plans for fiscal stimulus and tax reform would bolster the economy. The dollar has since given up its postelection gains amid mounting concerns about the administration’s ability to deliver on its agenda.

A weaker U.S. currency makes the dollar-denominated metal cheaper for foreign buyers.

Gold prices rose above the $1,300 level earlier Friday, a key psychological barrier for many investors, after a terrorist attack killed at least 13 people in Barcelona.

Elsewhere in precious metals trading, silver was at $16.98 a troy ounce late Friday, while platinum settled at $981.75 and palladium slid 0.14% to $924.85 a troy ounce.

Among base metals, cooper ended at $2.94 a pound, after closing at the highest level since November 2014 on Wednesday amid expectations that ongoing demand from China will continue to support prices.

In the week ahead, investors will be looking ahead to speeches by central bankers at the Fed’s annual central bank symposium in Jackson Hole, Wyoming.

Investors will also be watching U.S. data on housing and durable goods to gauge how it will impact on Fed policy, while the euro zone is to release data on private sector activity.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

(*source Bloomberg)

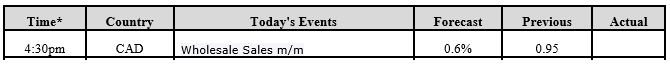

Data – Forthcoming Release

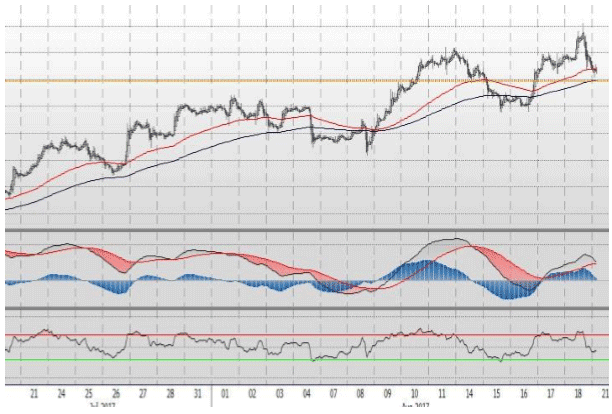

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1284.13 an ounce; wit loss of $4.02 or 0.31 percent at 1.00 a.m. Dubai time closing, from its previous close of $1288.15

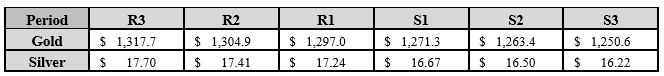

Spot Gold technically seems having resistance levels at 1297.0 and 1304.9 respectively, while the supports are seen at $1271.3 and 1263.4 respectively.

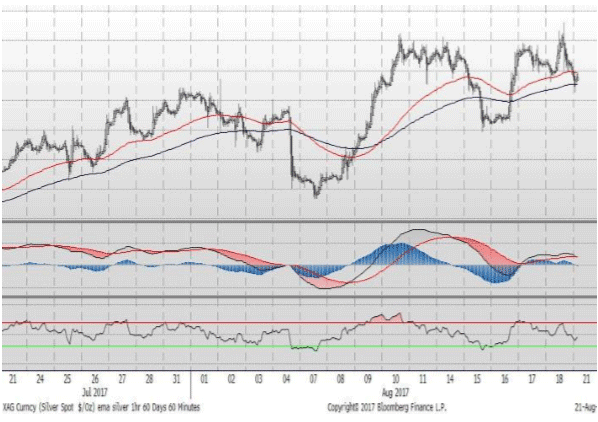

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.97 with the loss of $0.06 or -0.35 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.03

The Fibonacci levels on chart are showing resistance at $17.24 and $17.41 while the supports are seen at $16.67and $ 16.50 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply