Gold Falls Near $1800 as Tech Stocks and Crypto Plunge on Inflation ‘Fact, Not Fears’

Bullion.Directory precious metals analysis 13 May, 2021

Bullion.Directory precious metals analysis 13 May, 2021

By Adrian Ash

Head of Research at Bullion Vault

Japan’s Nikkei lost 2.5% as Taiwan’s main index, home to major electronics and semiconductor suppliers, saw its worst 1-day drop since March 2020’s Covid Crash.

US Treasury bonds fell in price yet again, pushing 10-year yields up to 1-week highs of 1.7% per annum after yesterday’s core CPI figure came in 3.0% above April last year, the fastest inflation since January 1996.

European borrowing costs jumped faster however, hitting the highest in 2 years today as benchmark UK Gilt yields rose above 0.9% per annum and Germany’s benchmark Bund yield – which has now been negative since May 2019 – came within 0.1% of zero.

“Stocks plunged because investors are terrified of inflation, which is now a reality,” says Barron’s magazine of yesterday’s Wall Street drop.

“If you’re valuing a high-growth company based on its earnings ten years out,” adds an analyst to Reuters, “those earnings into the future are worth a lot less today at higher inflation levels.”

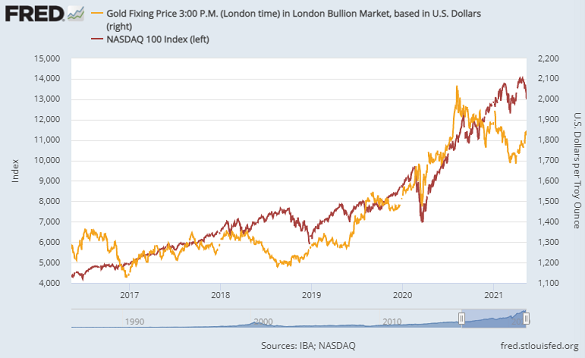

Gold and the tech-heavy Nasdaq index of US-listed corporations last year showed an unlikely coupling, both surging as lockdown drove a collapse in economic activity and interest rates but a boom in home shopping, teleconferencing and streaming entertainment.

“Inflation is a tale of two markets for gold,” says the precious metals team at French bank and London bullion market maker BNP Paribas.

“On the one hand, higher inflation will lead the Federal Reserve to drop the dovish tone and come back into a more conservative policy of interests rates hike in the medium term.

“On the other, if…higher inflation persists…people’s purchasing power will suffer in many parts of the world. Gold being a global asset, liquid and available, could see more investment demand from retail accounts across the world, in a bid to shield their hard-earned cash against loss of purchasing power.

“Maybe cryptocurrencies can also do the job but I believe that, in the case of unexpected inflation, people would direct their wealth into tried and tested products.”

Already falling after the US inflation data, Bitcoin sank over 12% in barely an hour last night after tech-celeb Elon Musk said his electric-car company Tesla (Nasdaq: TSLA) will stop accepting the so-called crypto-currency in payment for new customer orders, blaming the “insane energy use trend” in its proof-of-work creation and confirmations.

Comedy-crypto Dogecoin – worth almost $100bn at last week’s peak, matching the market cap of giant German automaker VW – meantime fell below $0.40 for the 1st time in 10 days, down by 45% from the eve of Musk promoting it on Saturday’s US entertainment show SNL.

“Do you want Tesla to accept Doge?” Musk asked his Twitter followers only on Tuesday, pulling 3.9 million votes with 78% saying “Yes”.

Tesla put $1.5 billion of its corporate cash into Bitcoin February and began accepting it from customers to much fanfare in late-March.

Shares in TSLA have now fallen by one-third from January’s record high. Even after today’s plunge, DogeCoin has jumped 75-fold so far in 2021.

Going into Wednesday’s inflation data report, “Gold initially tested the resistance band through $1840-1845 into the CPI print,” says today’s trading note from Swiss refining and finance group MKS Pamp, “however it collapsed to a session low of $1814 late in trade.

“Key down-side supports around $1800-1795 are now in play.”

Silver meantime extended the drop in gold prices Thursday, falling through $27 per ounce as platinum fell back near $1200, erasing last week’s 4.7% gain.

Adrian Ash

Adrian Ash is director of research at BullionVault, the physical gold and silver market with bullion owned by the citizens of over 175 countries and worth more than $2 billion.

Formerly head of editorial at London’s top publisher of private-investment advice, he was City correspondent for The Daily Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply