Central banks are not in a hurry to normalize policy.

Bullion.Directory precious metals analysis 21 May, 2015

Bullion.Directory precious metals analysis 21 May, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Twitter @Lemieux_26

The dollar pulled back slightly, following yesterday’s FOMC minutes which suggested nothing particularly new in regards to the Federal Reserve’s stance on monetary policy.

As much as they would like the markets to believe a rate hike could happen at any minute, if the financial markets and economy could tolerate such moves, they would have happened already.

Global data is still showing weakness, while leading some to believe central banks are just not ready to normalize policy nearly a decade after the financial crisis.

The European PMI data was mixed. French services and manufacturing PMI data improved modestly, but both still remain below the key 50-point level that indicates whether there is contraction or expansion.

Germany, Europe’s strongest economy, is showing continued weakness that is worrying analysts. Both the services and manufacturing PMI data contracted to 52.9 and 51.4, respectively.

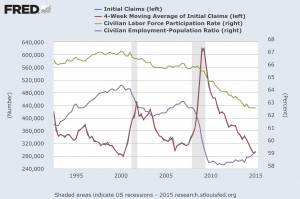

In the US, initial jobless claims rose higher than expected to 274,000 claims, versus expectations of 271,000. This was 10,000 more claims then last week’s print.

Many recovery bulls point to the jobless claims as a sign that the labor market is strengthening, even though the four-week average of initial jobless claims outpace non-farm payrolls.

The fact is, jobless claims has tracked the multi-decade low participation rate since the end of the recession. This could suggest that Americans are simply opting out of the labor market.

Furthermore, the employment-to-population level stands at 59.3 – a level not seen since the mid-1980s.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply