Gold Price Extends Rebound as US Stimulus ‘Lets Rip’, ECB Vows to Cap Bond Yields

Bullion.Directory precious metals analysis 11 March, 2021

Bullion.Directory precious metals analysis 11 March, 2021

By Adrian Ash

Head of Research at Bullion Vault

Widely criticized for allowing its weekly bond purchases to slow down amid the recent turmoil in bond markets, the ECB’s Governing Council will now buy assets “at a significantly higher pace”, aiming to boost bond prices and so cap bond yields “with a view to preventing a tightening of financing conditions that is inconsistent with countering the downward impact of the pandemic on the projected path of inflation.”

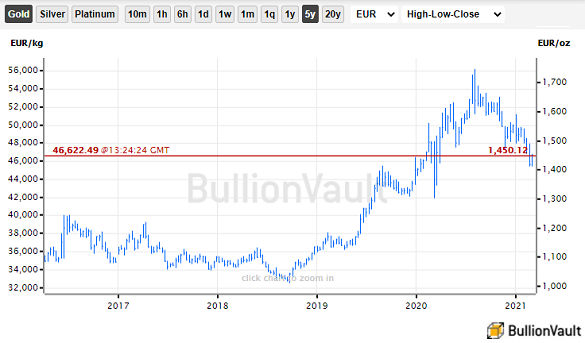

Ahead of the ECB’s March meeting announcement, gold priced in the Dollar this morning extended its rally from Monday’s new 9-month low to 3.7% in Dollar terms and to 3.1% in Euro terms from last week’s 12-month low at €1411 – a level first reached in December 2019.

Gold priced in Euros rose after the ECB news to 2-week highs at €1450 per ounce.

The Euro currency meantime held around 1-week highs against the Dollar after extending its rally to 1.5 cents from Tuesday’s 3-month low of $1.18355.

The Dollar also slipped further from Monday’s 3-month highs against all major currencies after Democrat US President Joe Biden secured approval of his $1.9 trillion Covid relief and stimulus bill – but with no support from any Republican Senators.

“For a decade after the global financial crisis of 2007-09 America’s economic policymakers were too timid,” says The Economist magazine. ” Today they are letting rip.

“[This] takes the amount of pandemic-related spending passed since [Biden’s election victory last November] to nearly $3trn…14% of pre-crisis GDP,” with a total of $6trn now “paid out since the start of the [Covid] crisis. On current plans the Federal Reserve and Treasury will also pour some $2.5trn into the banking system this year, and interest rates will stay near zero.”

>After China’s year-on-year deflation in consumer prices came in smaller than analysts forecast, with the No.2 economy’s CPI slipping 0.2% rather than 0.4% as predicted, core inflation in the United States was reported at 1.3% per year for February, one tick below Wall Street consensus.

Washington’s monthly budget deficit meantime blew past forecast, totalling $311 billion – a new record outside last April-May-June’s historic spike.

Back in Frankfurt, and vowing to “recalibrate” the Pandemic Emergency Purchase Program’s “envelope” limit of €1.85 trillion if necessary, the ECB is meantime continuing additional support for government bond prices with €20bn per month of spending through its ongoing Asset Purchase Programme, first begun after the global financial and then Eurozone debt crises of a decade ago.

European shares today hit a new 1-year peak ahead of the ECB’s statement, recovering almost all of March 2020’s one-third crash from all-time highs on the EuroStoxx 600 index.

“The gold market is unwinding its oversold position at present,” says Rhona O’Connell at brokerage StoneX.

” Gold’s current infatuation with bond yields has seen the price rise on lower-than-expected inflation numbers in the States, but given that inflation is low and unemployment still elevated, this should not come as a surprise.”

Adrian Ash

Adrian Ash is director of research at BullionVault, the physical gold and silver market with bullion owned by the citizens of over 175 countries and worth more than $2 billion.

Formerly head of editorial at London’s top publisher of private-investment advice, he was City correspondent for The Daily Reckoning from 2003 to 2008, and is now a regular contributor to many leading analysis sites including Forbes and a regular guest on BBC national and international radio and television news.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply