The Fed’s balance sheet pushes through $4.4 trillion, and we get a “moderately OK” economy.

Bullion.Directory precious metals analysis 9 October, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

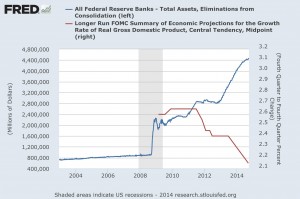

Quantitative easing was presented as a last case scenario to stop the economic hemorrhaging, which was caused from financial institutions’ reckless risk management and unsavory practices. The Fed cut the key benchmark rate to zero-to.25 percent and bought treasuries and asset-backed securities, pushing their balance sheet from nearly $800 billion in 2008 to well above $4 trillion today.

We would expect that a few trillion in stimulus and near-zero interest rates would buy a lot more than two percent growth within the world’s largest economy.

Former Fed Chairmen Alan Greenspan, who was largely labeled the creator of the 2007/8 housing bubble, was on CNBC last Friday. What he said was remarkable:

Without low rates, we wouldn’t have at least a moderately OK economy that now exists. There’s a significant plus here.

The significant plus is still yet to be determined, but his words at least bring clarity within the current situation.

The kitchen sink seemed to have been thrown at the economy, and it’s only “OK.” The Fed’s policies have only helped a little and the impending risks are still unknown.

This is an unprecedented period in monetary history. We’ve never been through this. We really cannot tell how it will work out.

The blind leading the clueless. Take a look at the Fed’s growing asset hoard compared to their own real GDP forecasts (midpoint):

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply