Yen jumped following comments out of the Bank of Japan.

Bullion.Directory precious metals analysis 10 June, 2015

Bullion.Directory precious metals analysis 10 June, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Twitter @Lemieux_26

Last September, I had the pleasure of being on Dukascopy TV; and, I said the BoJ bit off more than they could chew. The day of reckoning for central banking policy is quickly approaching.

BoJ board member Takehiro Sato warned that the central bank’s quanitative easing policy could see diminishing returns and risks from prolonging monetary stimulus. Then again, it’s hard to call it stimulus because the only thing it succeeded in was sending the yen to new lows.

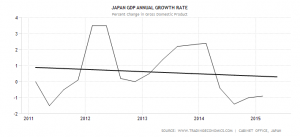

The Japanese yen has declined over 40 percent, prior to today’s pop, in two years. The BoJ hoped it would stimulate growth and spur inflation. It has sporadically, but neither benchmark has been able to keep the trend going.

The decline in the yen has eroded purchasing power, causing the Japanese to spend much less prior to the “QQE” program:

Furthermore, inflation jumped higher only to collapse under one percent again and likely to push Japan back into deflationary territory. This further indicates that QE does not work:

Sato included that “at some point, the BoJ may fail to draw enough bids in its bond-buying program (Reuters),” which it has previously and caused yields to spike higher.

The Bank of Japan is currently purchasing $650 billion annually, and it is only going to take a few years before the central bank soaks up all the debt issued by Japan. Basically, the program is financing the nation into a larger debt burden via deficit spending.

Japan’s GDP-to-debt ratio is the largest in the world and still growing:

BoJ Governor Haruhiko Kuroda also commented that the yen was “very weak,” and that caused traders to rebalanced. The USDJPY had recently overtaken 125 (125 yen per dollar), and some analysts believed that 124 was really the tipping point in regards to how far the yen’s decline can be stabilized.

This comes at a time when the Federal Reserve looks to potentially rise interest rates, but they are unlikely to do so with the dollar at multi-year highs.

The yen and dollar typically move inverse of each other, and comments out of the BoJ have caused the dollar to further deteriorate. This gives the Federal Reserve more breathing room.

Markets that have risen from central bank policy will undoubtedly fall from central bank policy. And the way down is much more chaotic.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply