2022 may be the year of Fed hawks. After tapering, they may hike rates and then start quantitative tightening. Will they tear gold apart? Now, I could exclaim that hawks are coming, but that wouldn’t necessarily give hope to anyone fighting the bearish trends in the gold market.

Full Article →There’s no question, we are living in uncertain economic times. This year is already off to a roaring start, as easily spooked Wall Street investors are “bracing for” the Fed’s first rate hike in three years. Of course, that’s just one piece of the uncertainty puzzle as 2022 starts to take shape…

Full Article →After the CPI surged last year to its highest level since 1982, politicians are feeling pressure from constituents to do something about it. Biden announced $1 billion in grants, loans, and other assistance for small meat producers. Another costly government program will, supposedly, help tame rapidly rising beef and poultry costs…

Full Article →Is the 2022 Economic Bubble Going to Pop?

In this video, Devlyn Steele outlines the definition of a financial bubble, the history of bubbles, and his outlook for 2022 and beyond. It’s time to get serious, the big question is, what is economically going to happen in 2020? We’ve never faced the challenges we’re facing here in 2022.

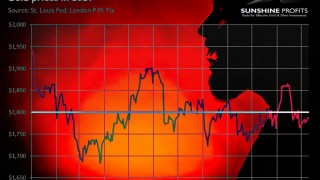

Full Article →Bang to Plunge: 2022 Gold Replays 2021

The start of 2021 wasn’t successful for gold: after a few days of rally, the yellow metal entered a bearish trend. 2022 looks uncomfortably similar. Will the yellow metal resume its long-term bullish trend in 2022? Well, this is what a majority of investors that took part in Kitco News’ annual outlook survey believe…

Full Article →The Ship of Theseus is an old philosophical thought experiment and asks a question about identity. Suppose you replace all of the boards of a ship with new ones—is it still the same ship? We are not going to try to resolve this millennia-old paradox. Instead, we are going to add one more element, and then tie it to the monetary system.

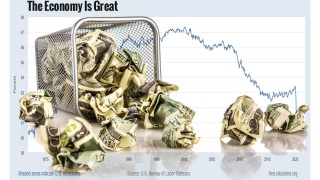

Full Article →One of, if not the primary concerns of the stock market boom over the past two years is that it’s powered by printed money instead of a strong economy. Given that the U.S. stock market was already in its longest bull run in history prior to 2019, and that seemingly every analyst was already tapping a foot…

Full Article →Mr Gold – What Year Is It?

Although your calendar may say otherwise, gold is in the 1960s. The question is whether we will move into the 1970s or speed-run to the mid-2010s. Did you go overboard with your time travel and lose track of time? Probably not, but just in case, I assure you that the current year is 2021.

Full Article →Is Build Back Better Dead?

In this video, Devlyn Steele examines projections about this bill and its potential to harm America and American retirement accounts. It’s gratifying to see a United States senator going with his gut — using good sense instead of politics to determine whether a bill is good for the country or not.

Full Article →How High Inflation Wrecks Nations

Will Inflation Crash the Economy in 2022? It’s understandable if you’re tired of hearing about rising inflation. But it has become an economic mainstay in the Biden Administration. And each month seems to bring fresh records not experienced in decades.

Full Article →There’s Never Been a Worse Time to Retire

Why Retiring In 2022 Could Be the Worst Decision of Your Life: If you were planning on retiring in 2022 or soon after that, thanks to several recent economic developments, now might be the worst time to do that…

Full Article →2022: The Year of (Gold) Inflation

High inflation won’t go away in 2022. Good for gold. However, it is likely to continue to climb and reach its peak. That sounds a bit worse for gold. If 2021 was tough for you, I don’t recommend reading Nostradamus’ predictions for the next year. This famous French astrologer saw inflation, hunger, and much more coming in 2022…

Full Article →Is the End of ‘Transitory’ Inflation the End of Gold Bulls?

Welcome, my son. Welcome to the inflationary machine. Welcome to the new economic regime of elevated inflation. That’s official because even central bankers have finally admitted what I’ve been saying for a long time: the current high inflation is not merely a transitory one-off price shock…

Full Article →Three Reasons 2022 Will Be Unforgettable

After the crazy year we’ve just had, one good question to ponder for a moment is: What does the U.S. economy look like as we head into next year? To answer that, this article will examine three sectors by looking at economic activity (including Wall Street), the inflation situation, and of course physical gold. So brace yourself…

Full Article →Who’s Pulling Santa’s Sleigh: Bulls or Bears?

Santa Claus is coming to town! What will he give gold: a gift or a rod? Like most of 2021, gold has been rubbing against $1,800 this week but did not have the strength to permanently rise above this level thus, we could say that gold was rather naughty this year and doesn’t deserve gifts from Santa.

Full Article →Powell Sends Gold Over $1800 – But only Briefly

Finally, Powell admitted higher inflation risks and gold jumped above $1,800. Before anyone noticed, however, it plummeted below the key level again. Who are you Mr Powell? A reptilian or a human? A dove or a hawk?

Full Article →Shock And Awe Inflation

The Producer Price Index (PPI) is a measure of inflation expectations by industry producers. Most investors keep an eye on the Consumer Price Index (CPI). However, the CPI gauge is not only incomplete, it is, as U.S. Global’s Frank Holmes likes to say, “backward looking”

Full Article →Inflation and Gold: What Gives?

The Different Theories on What Moves Gold and Silver Prices: In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the:

Full Article →New Inflation Numbers Prompt Questions About Economic Future

In this brief video, Devlyn Steele, Augusta’s on-staff Harvard-trained economist crunches some of the numbers relating to inflation. Last week, new inflation numbers came out and there’s a lot of discussion about whether the numbers are reliable…

Full Article →Not Only Gold Lacks Energy – We ALL Do Now!

First a pandemic, then inflation, and now an energy crisis. Should you buy gold when preparing for the winter? Brace yourselves, winter is coming! Not only does gold lack energy to fuel its rally right now, but people from all over the world lack it to fuel their operations and to heat their houses…

Full Article →The Cost of Biden’s Plan is Probably More Than They Say

Through the Build Back Better Act (BBB), President Biden suggests he’s decided to close out his political career by trying to create a legacy of governmental progressivism the likes of which we’ve not seen up to this point in America.

Full Article →Fed Accelerates Tapering But Gold Shows Resilience

The Fed begins to get up steam and has finally turned its hawkish mode on. Was it something the gold bulls wanted to hear? The Fed’s full capitulation and unconditional surrender of the doves!

Full Article →Inflation Beast Roars – Gold Only Modestly Up

The inflation beast is growing stronger. Unfortunately for gold bulls, we cannot say the same about the yellow metal. Is sacrifice going on tomorrow? November readings clearly falsify central banks’ narrative about transitory inflation (which was already partially abandoned) and confirm my claim that inflation will stay longer

Full Article →Bond King Gundlach Bullish on Gold Long-Term

DoubleLine CEO Jeffrey Gundlach, who is perhaps best known as the “Bond King” for his legendary forays into the bond market, recently spoke about the current state of the markets and a preview of the new year. Gundlach’s primary forecast for gold is that it’s set to become a long-term hold despite a relatively quiet year.

Full Article →Lies, Damn Lies, and Government Inflation Statistics

Consumer prices are rising at the fastest pace in 40 years. The official report for November showed an increase of 0.8% versus October (9.6% annualized) and 6.8% over the past twelve months. What’s more, the month-over-month increases show inflation accelerating.

Full Article →Transitory is Out: Inflation is IN

One thing is certain, inflation is no longer officially “transitory.” For months, Federal Reserve Chairman Jerome Powell kept telling the public that rising inflation was transitory, and would soon subside. It hasn’t, and isn’t likely to in the near future either.

Full Article →Gold and Silver Stand Out as Inflation Ruins the Economic Picture

A recent survey of institutional asset managers revealed that 40% of those that don’t own gold presently plan to buy it within the next three years. The survey also found that 40% of those that do own gold right now expect to buy more of it within the same time period.

Full Article →Gold Stuck Between High Inflation and Strong Dollar

I have good and bad news. The good is that the price of gold rose 2% in November. The bad – is that the price of gold rose 2% in November. It depends on the perspective we adopt. Given all the hawkish signals sent by the Fed and all the talk about tapering of quantitative easing a small increase is an admirable achievement…

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.