2022 may be the year of Fed hawks. After tapering, they may hike rates and then start quantitative tightening. Will they tear gold apart?

Bullion.Directory precious metals analysis 06 January, 2022

Bullion.Directory precious metals analysis 06 January, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

Yesterday (January 5, 2022), the FOMC published the minutes from its last meeting, held in mid-December. Although the publication doesn’t reveal any revolutions in US monetary policy, it strengthens the hawkish rhetoric of the Fed.

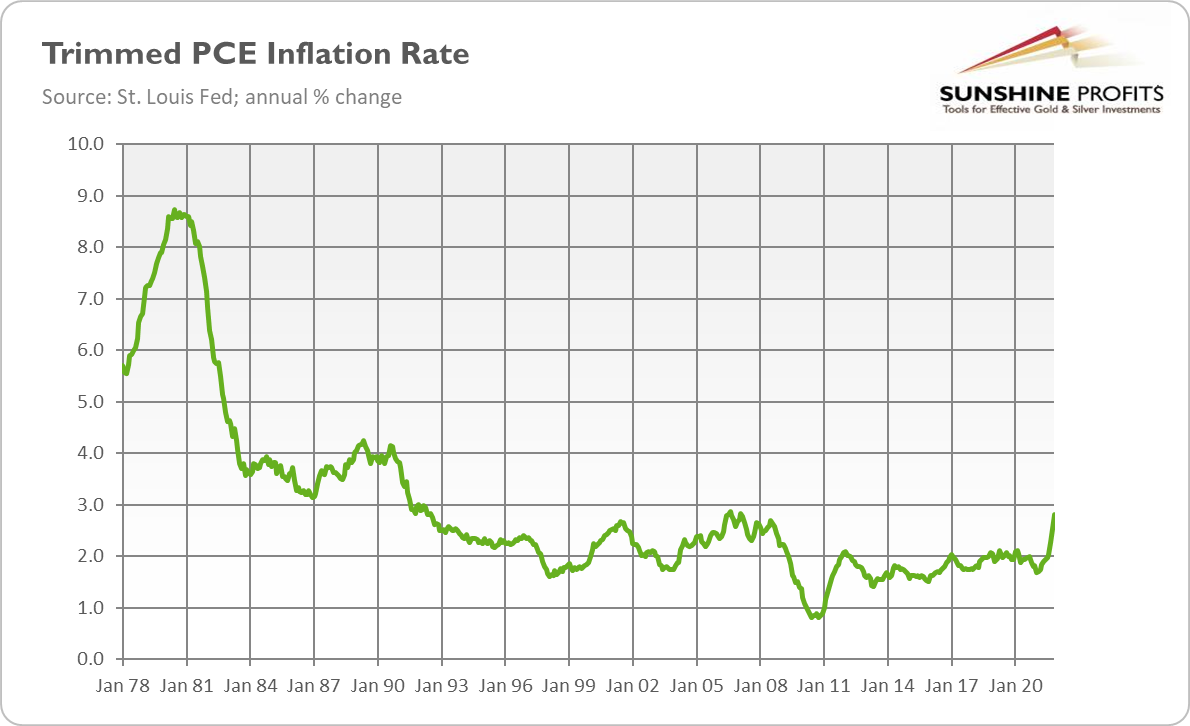

Why? First, the FOMC participants acknowledged that inflation readings had been higher, more persistent, and widespread than previously anticipated. For instance, they pointed to the fact that the trimmed mean PCE inflation rate, which trims the most extreme readings and is calculated by the Dallas Fed, had reached 2.81% in November 2021, the highest level since mid-1992, as the chart below shows. It indicates that inflation is not limited to a few categories but has a broad-based character.

The Committee members also noted several factors that could support strong inflationary pressure this year. They mentioned rising housing costs and rents, more widespread wage growth driven by labor shortages, and more prolonged global supply-side frictions, which could be exacerbated by the emergence of the Omicron variant; as well as easier passing on higher costs of labor and material to customers. In particular, supply chain bottlenecks and labor shortages could likely last longer and be more widespread than previously thought, which could limit businesses’ ability to address strong demand.

Second, the FOMC admitted that the US labor market could be tighter than previously thought. They judged that it could reach maximum employment very soon, or that it had largely achieved it, as indicated by near-record rates of quits and job vacancies, labor shortages, and an acceleration in wage growth:

Many participants judged that, if the current pace of improvement continued, labor markets would fast approach maximum employment. Several participants remarked that they viewed labor market conditions as already largely consistent with maximum employment.

The consequence of higher inflation and a tighter labor market would be, of course, a more hawkish monetary policy. Although the central bankers didn’t discuss the appropriate number of interest rate hikes, they agreed that they should raise the federal funds rate sooner or faster:

Participants generally noted that, given their individual outlooks for the economy, the labor market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.

Additionally, Fed officials also discussed quantitative tightening. They generally agreed that – given fast economic growth, a strong labor market, high inflation, and bigger Fed assets – the balance sheet runoff should start closer to the policy rate liftoff and be faster than in the previous normalization episode:

Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate. However, participants judged that the appropriate timing of balance sheet runoff would likely be closer to that of policy rate liftoff than in the Committee’s previous experience. They noted that current conditions included a stronger economic outlook, higher inflation, and a larger balance sheet and thus could warrant a potentially faster pace of policy rate normalization.

Implications for Gold

What do the recent FOMC minutes imply for the gold market? Well, referring once more to the Lord of the Rings, they are more like the Nazgûl that wreak despair rather than the Eagles offering hope. They were hawkish – and, thus, negative for gold prices. The minutes revealed that after tapering of quantitative easing, the Fed could also reduce its overall asset holdings to curb high inflation.

In December, the US central bank accelerated the pace of tapering and signaled three interest rate increases in 2022. The minutes went even further, signaling a possibility of an earlier and faster rate hike and outright reduction in the Fed’s balance sheet:

Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate. Some participants judged that a less accommodative future stance of policy would likely be warranted and that the Committee should convey a strong commitment to address elevated inflation pressures.

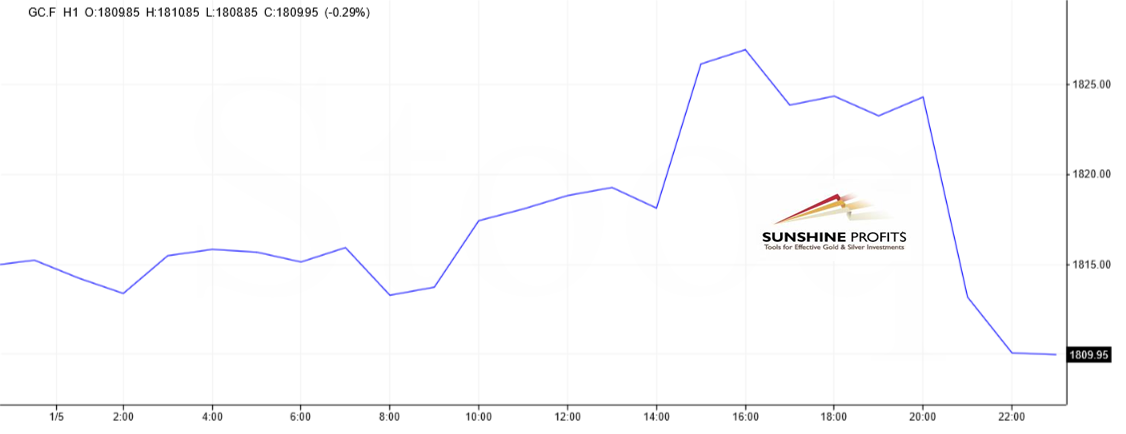

Hence, the price of gold responded accordingly to the FOMC minutes and declined from about $1,825 to $1,810, as the chart below shows. Luckily, there is a silver lining: the drop hasn’t been too big, at least so far. It may indicate that a lot of hawkish news has already been priced into gold, and that sentiment is rather bullish.

However, the hawks haven’t probably said the last word yet. Please remember that the composition of the Committee will be more hawkish this year, but also that the mindset is changing among the members. For example, Minneapolis Fed President Neel Kashkari, one of the Committee’s most dovish members, said this week that the U.S. central bank would have to need to raise interest rates two times this year.

Previously, he believed that the federal funds rate could stay at zero until at least 2024. Thus, although inflationary risk may provide support for gold, the yellow metal may find itself under hawkish fire in the upcoming weeks.

We will see whether it will stand its ground, like the soldiers of Gondor.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Leave a Reply