Finally, Powell admitted higher inflation risks and gold jumped above $1,800. Before anyone noticed, however, it plummeted below the key level again.

Bullion.Directory precious metals analysis 21 December, 2021

Bullion.Directory precious metals analysis 21 December, 2021

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

Since we all know the answer to the first question, let’s focus on the second one. Markets decided that Powell’s last press conference was rather dovish, but a careful reading doesn’t support this view. The main dovish signal was Powell’s emphasis that quantitative easing tapering and interest rate hikes are separate issues, as the tightening cycle criteria are stricter.

So, the first rate hike may not come immediately after the end of tapering, which is scheduled for mid-March.

Even if they are separate, we shouldn’t expect a long break between the end of quantitative easing and the first rate hike. This gap will definitely be shorter than in 2014-2015. In the last tightening cycle, the Fed ended asset purchases in October 2014, while the first increase in the federal funds rate occurred in December 2015.

Powell himself, however, pointed out that the economy is much stronger, while inflation is much higher, so a long separation before interest rate hikes is not likely:

I don’t foresee that there would be that kind of very extended wait at this time. The economy is so much stronger. I was here at the Fed when we lifted it off last time and the economy is so much stronger now, so much closer to full employment. Inflation is running well above target and growth as well above potential. There wouldn’t be the need for that kind of long delay (…) The last cycle that was quite a long separation before interest rates, I don’t think that’s at all likely in this cycle. We’re in a very, very different place with high inflation, strong growth, a really strong economy (…) So this is a strong economy, one in which it’s appropriate for interest rate hikes.”

In fact, this delay may be very short. On Friday, Fed Governor Chris Waller said that the interest rate increase will likely be warranted “shortly after” the end of asset purchases, possibly even at the FOMC meeting in March 2022.

Another hawkish message sent by Powell was his acknowledgment of stronger inflation risks, i.e., that inflation may turn out to be more lasting than expected now:

There’s a real risk now, we believe, I believe, that inflation may be more persistent and that may be putting inflation expectations under pressure. And that the risk of higher inflation becoming entrenched has increased, it’s certainly increased. I don’t think it’s high at this moment, but I think it’s increased. And I think that’s part of the reason behind our move today, is to put ourselves in a position to be able to deal with that risk.

Thus, the Fed has become more concerned about high inflation and has timidly started reacting to it. The acceleration in the pace of tapering was, except for the more hawkish rhetoric, the first step – but not the last one.

Implications for Gold

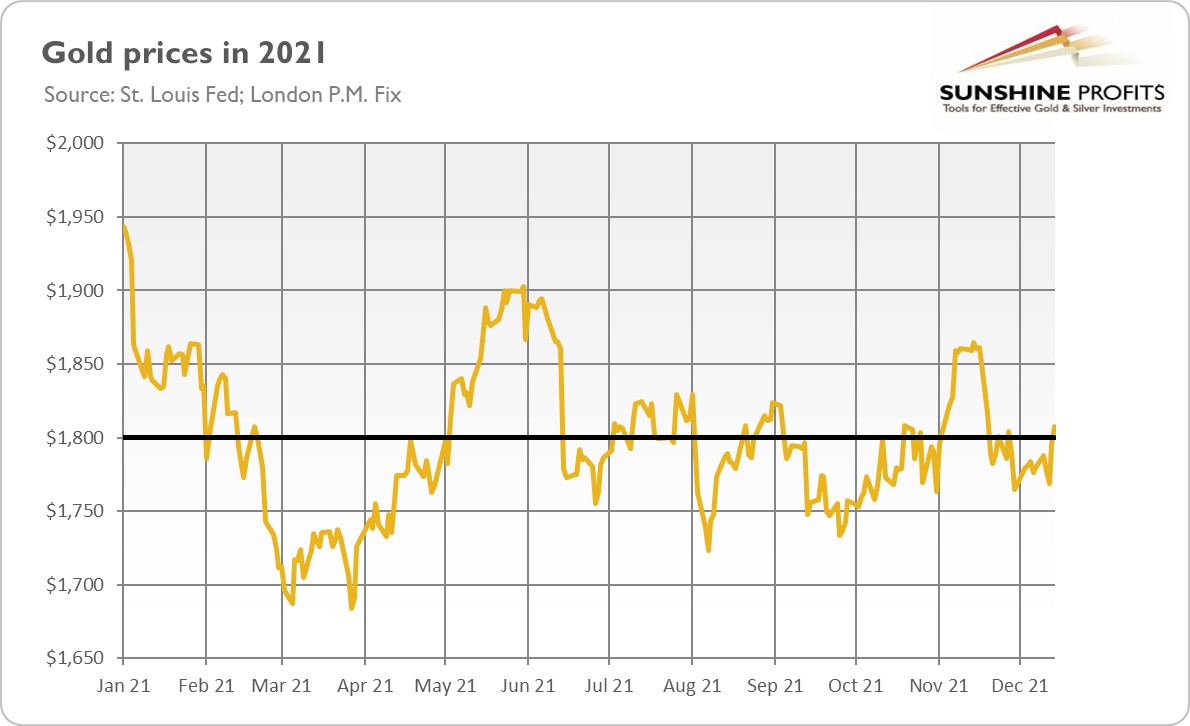

The yellow metal responded surprisingly well to the last FOMC meeting, at which the Fed announced a more aggressive pace of tapering and rate hikes next year. As the chart below shows, gold rose almost $40, or more than 2%, from Wednesday to Friday last week, jumping again above the key level of $1,800.

Perhaps investors expected even more forceful actions. After all, despite all the hawkish reaction, the Fed remains behind the curve and shows no hurry to become really proactive. Such a passive attitude is really risky, as history teaches us that high inflation doesn’t just go away on its own, but its stabilization requires a decisive tightening of monetary policy. The longer the Fed waits, the more severe reaction would be needed, which increases the odds of putting the economy into recession.

All this seems bullish for gold prices. However, gold was unable to retain its position above $1,800 and declined on Monday (December 20, 2021), so gold bulls can only hope that the yellow metal will the find strength to rally next year.

It’s possible if inflation wreaks more havoc in 2022, but a hawkish Fed’s rhetoric remains an important headwind for the gold market.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Leave a Reply