The Fed begins to get up steam and has finally turned its hawkish mode on. Was it something the gold bulls wanted to hear?

Bullion.Directory precious metals analysis 16 December, 2021

Bullion.Directory precious metals analysis 16 December, 2021

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

It took them only half a year to figure it out, but better late than never. Additionally, the Fed practically rejected its new monetary framework called “Flexible Average Inflation Targeting”, which allowed inflation to run hot for some time. In November, we could read:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.

The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.

In the last statement, however, this mammoth paragraph was substantially altered.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation having exceeded 2 percent for some time, the Committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment.

What is missing is the reference to the Fed’s tolerance of inflation above its target. This means that the US central bank has turned the hawkish mode on. Indeed, in line with expectations, the Fed has accelerated the pace of tapering of its quantitative easing. The Committee announced a doubling of the monthly reduction in the purchased assets from $10 billion for Treasuries and $5 billion for MBS to, respectively, $20 and $10 billion. It means that the Fed will end its asset purchase program by March rather than by mid-year.

In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities.

Dot-Plot and Gold

These are not all December monetary fireworks we got, though. The statement was accompanied by fresh economic projections conducted by FOMC members.

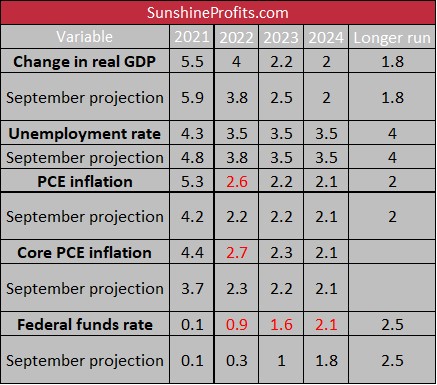

How do they look at the economy right now? As the table below shows, central bankers expect faster economic growth and a lower unemployment rate next year compared to the September projections. This is not something the gold bulls would like to hear.

More importantly, however, FOMC participants see inflation as more persistent at the moment because they expect 2.6% PCE inflation at the end of 2022 instead of 2.2%.

In other words: inflation is currently believed to reach this level only a year from now! Interestingly (at least for economic nerds like me), Committee members expect that core PCE inflation will be higher than the overall index in 2022, and will amount to 2.7%. It is an indication that the Fed considers inflation more broad-based now than just driven by rising energy prices.

Last but definitely not least, more interest rate hikes are coming. According to the latest dot plot, FOMC members see three increases in the federal funds rate next year as appropriate.

That’s a huge hawkish turn compared to September, when they perceived only one interest rate hike as desired. Central bankers expect another three hikes in 2023 (the same as in September) and additional two in 2024 (one less than in September). Hence, the whole forecasted path of the interest rates becomes steeper and the Fed is now anticipating eight 25-basis point rate hikes from 2022 to 2024, one more than they saw in September.

Implications for Gold

Given the hawkish FOMC statement and economic projections, gold is doomed, right? Well, in theory, a more aggressive Fed’s tightening cycle should boost bond yields and strengthen the greenback, pushing gold prices down.

However, what does gold say to the God of Bears? Not today!

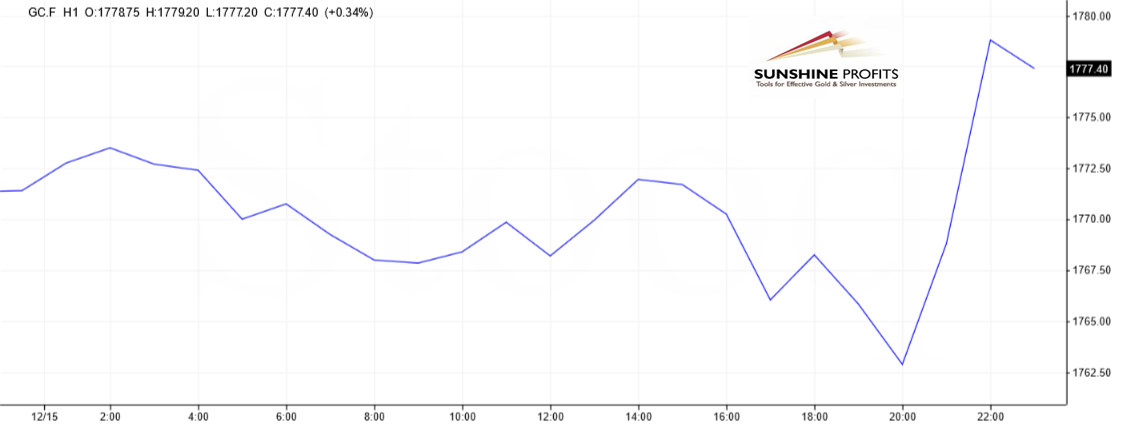

Indeed, the chart below shows that theory and practice are not the same. Initially, the price of gold declined from around $1,765 to around $1,755, but it quickly rebounded and even increased to $1,780.

So, what happened and what does it imply for gold’s future? Well, gold didn’t panic, as hawkish statements and dot-plot were widely anticipated. They were probably a little more hawkish than expected, but, on the other hand, Powell’s press conference was deemed as more dovish than predicted. Since Powell’s earlier transparency and dovish heart rescued gold from falling down, gold bulls may breathe a sigh of relief.

However, we believe that this wasn’t the Fed’s last word. Inflation is likely to increase further next year; so, the US central bank, which is terribly behind the curve, could be forced to tighten its monetary policy even more.

Thus, although my worries about this FOMC meeting turned out to be unnecessary, they could materialize later.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Leave a Reply