All as Opec Extends Oil Cap and Bitcoin Whips 17% Below New Peak

Bullion.Directory precious metals analysis 30 November, 2017

Bullion.Directory precious metals analysis 30 November, 2017

By Adrian Ash

Head of Research at Bullion Vault

Crypto-currency Bitcoin jumped and slumped again, retouching yesterday’s low of $9,300 to trade 17% below Wednesday’s fresh all-time record above $11,300.

Gold fell 1.7% from Monday’s attempt at 6-week highs of $1300 per ounce, trading down at $1278 as silver fell over twice as hard, down to 8-week lows at $16.44.

Platinum prices held firm again, unchanged from last week’s finish at $941 per ounce.

Crude oil rose meantime towards this month’s 2.5-year highs at $64 per barrel of Brent after the Opec cartel of major producers, meeting in Vienna, said they’re ready to extend a cap on output to the end of 2018.

Major government bond prices edged lower with gold, nudging 10-year US Treasury yields up to 2-week highs at 2.39%.

But South African and London-listed gold miners added 0.5% as a group for the day by lunchtime, as Harmony (JSE:HAR) jumped 2.3% following the re-start of work at its Hidden Valley project in Papua New Guinea two weeks ahead of schedule.

The UK gold price in Pounds per ounce fell to its lowest level since mid-July at £950, down over 8% from start-September’s 10-month highs above £1000.

Euro priced gold meantime fell back near its cheapest level since early August at EUR 1081 per ounce.

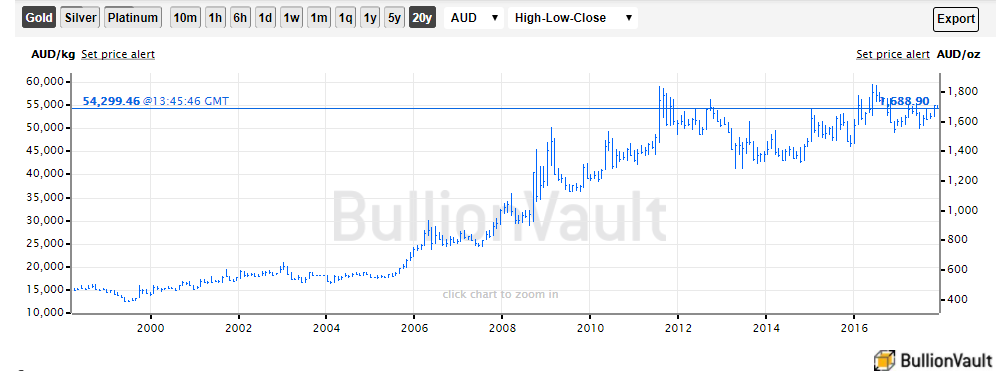

Gold priced in Australian Dollars meantime erased this week’s earlier 1.1% gain, but held within 9% of mid-2016’s return to the all-time record highs of mid-2011.

With the Australian Dollar falling over 30% against the US Dollar since 2011, gold mining costs in the world’s No.2 producer have fallen sharply compared to other countries’, with annual output rising by more than one-tenth.

Over the first half of this year Australia’s average mining costs rose 3% per ounce, driven mostly by a rally in the AUD’s exchange rate according to specialist analysts Thomson Reuters GFMS, but its total “all in sustaining costs” still held below the global average.

Today the ASX stock exchange in Sydney opened trading in Canada-based Kirkland Lake Gold (TSX:KL), now operating a quarter-million ounce mine in the east of Australia and one of 25 listed companies exploring the nugget-rich edge of the western Pilbara region.

“In the past year,” says Mining Weekly, “a record 1,896 gold prospecting licenses were granted by the Western Australia Department of Mines,” mostly to individual prospectors using metal detectors.

“The Pilbara will be the next big thing or we’ll be looking back in 12 months saying, ‘Oh, that was interesting and that’s all’,” says Joe Treacy of Australian gold explorer Marindi Metals.

>Currently trading 94% below its share-price peak of start 2011, Marindi reports finding 63 nuggets of gold in Pilbara this month, “the biggest a 6mm nugget” says Mining Weekly.

Contrary to other forecasts of gently declining gold mine output worldwide, consultants BMI Research now forecast annual average growth of 2.3% over the next decade, a “slight deceleration [from] the previous eight-year average of 3.1%.”

BMI expects the growth to come from mining companies in China — now the No.1 producer since 2007 — as they buy and expand new projects overseas in a bid to meet the country’s growing consumer demand for the metal.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply