Fed officials flexed their muscles during the last FOMC meeting. Silver tripped and fell in response, but that didn’t last long – why? The hawkish force was strong with this FOMC!

Full Article →Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

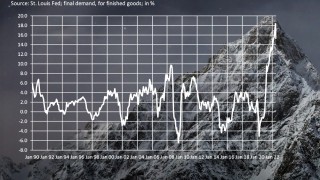

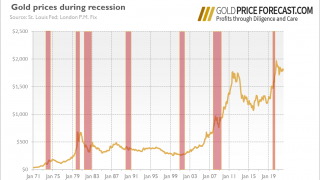

Stagflation: the Worse for Us, the Better for Gold

Stagflation is coming – and it could make the 1970s look like a walk in the park. As you’ve probably noticed, I expect a recession next year, and I’m not alone, as this has become the baseline scenario for many financial institutions and analysts

Full Article →Another Jumbo Rate Hike, Another Gold Decline

The Fed delivered another 75-basis points hike. Gold didn’t like the FOMC meeting and declined further. Bullion.Directory precious metals analysis 03 November, 2022 By Arkadiusz Sieroń, PhD Lead Economist and […]

Full Article →A Recession Is Coming, But Gold Feeds on Fear

I know that people can get fed up with recession warnings at some point, as they did with the boy who was constantly crying wolf. But there are more and more disturbing signals about black clouds gathering over the economy, despite the fact that the American GDP rose 2.6%,

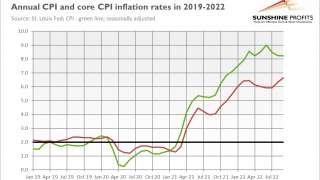

Full Article →Inflation Refuses to Go Away, Gold Refuses to Go Up

The recent CPI report shows that inflation remains high. It implies a hawkish Fed and bearish gold. To paraphrase a famous Pink Floyd song, I wish you weren’t here, inflation! The CPI increased 0.4% in September, after rising 0.1% in August, according to the Bureau of Labor Statistics.

Full Article →FOMC Minuites Offer No Hope For Gold

For all those looking forward to the Fed’s pivot, I have bad news. The recently published FOMC minutes from the September meeting reveal strong concerns about “unacceptably high” inflation. The central bankers admitted that inflation is not falling as quickly as expected (is this surprising?).

Full Article →Gold Back Above $1,700. For How Long?

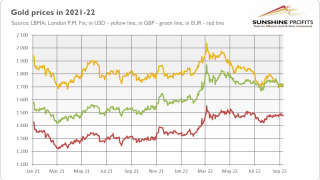

Gold has returned above $1,700! Does it mean that the worst is behind us and now the yellow metal can only go up? Well, such conclusions would definitely be premature. Let’s remember that September was really awful for the gold bulls, as the average monthly price plunged 4.7% compared to August.

Full Article →The Queen is Dead, King Dollar Lives On

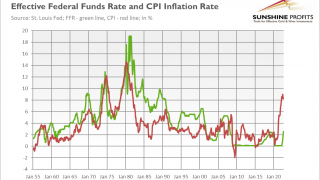

Queen Elizabeth II died, but King Dollar is the strongest in decades. Gold doesn’t like it. The price of the yellow metal declined from above $2,000 to below $1,700, a slide that occurred during the highest inflation since the great stagflation of the 1970s.

Full Article →All Gold and Quiet on the Eastern Front

The war in Ukraine has entered its seventh month and some people believe that China is gearing up for a war with Taiwan. Will bulls invade the gold market? What are the implications for gold? Well, the war shows that gold bulls shouldn’t count on geopolitical events…

Full Article →Gold Wonders How Severe This Recession Will Be

Economic contraction is unfolding – but how painful will it be? The deeper the recession, the better for gold. Let’s make it clear: an economic downturn is coming. We are already in a technical recession despite the White House’s attempts to change its definition.

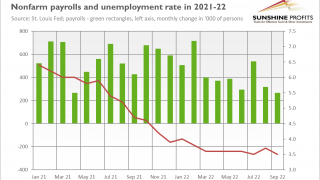

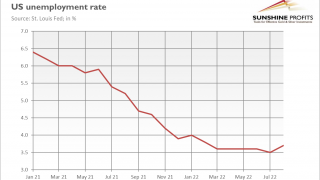

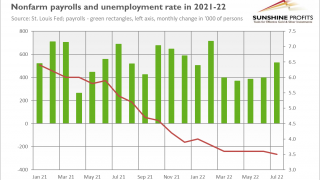

Full Article →When Rising Unemployment is Not Good for Gold

Powell, we could have a problem! According to the BLS, the U.S. unemployment rate rose to 3.7% in August from 3.5% in the previous month. It seems to be a fatal blow to the narrative of a strong labor market. What does it all mean for the gold market?

Full Article →After July Slowdown Has Inflation Finally Peaked?

Inflation moderated a bit in July, fueling hopes that it has peaked. Are they justified? Yes and no, but before I elaborate on this enigmatic answer, let’s see what happened in July. On a monthly basis, the CPI was unchanged then, after rising 1.3 percent in June

Full Article →Gold Falls as Powell Appears Hawkish in Jackson Hole

Importantly, Powell downplayed July’s deceleration in inflation, saying that “a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down”.

Full Article →Steep Decline in PMI Didn’t Move Gold Higher

The latest S&P Global Flash US Composite PMI doesn’t bode well for the U.S. economy. The headline Flash US PMI Composite Output Index declined from 47.7 in July to 45 in August, as the chart below shows. It was the second successive monthly decrease in total business activity.

Full Article →Gold Barely Reacts to July FOMC Minutes

Although gold barely reacted to the July FOMC minutes, the Fed worries about an economic slowdown. That bodes well for the long-term outlook for gold. First, Fed officials continue to worry about inflation, believing it will remain elevated for some time…

Full Article →Does Gold Know a Recession Is Coming?

Recession has already occurred or is on its way.. Somebody should tell gold about it! Is a recession really coming? We already know that the yield curve inverted last month for the second time this year, but what are other indicators of looming economic troubles?

Full Article →Strong Jobs Shift Upper Hand from Gold to Fed

Strong Job Creation Shifts the Upper Hand from Gold to the Fed. The US economy generated almost 530,000 jobs in July. That’s good for monetary hawks but bad for gold bulls.

Full Article →The Yield Curve Inverts. Time for Gold to Turn Back

Ever wondered what the yield curve’s favorite song is? Neither have I, but I bet in July it was Britney Spears’ hit, Oops, I Did It Again, as the yield curve inverted again last month, for the second time in 2022. It means that long-term rates fell below those on shorter-dated bonds.

Full Article →Recession Good For Gold – Crisis Even Better

Ladies and gentlemen, please welcome the technical recession! According to the initial measure of the Bureau of Economic Analysis, real GDP dropped 0.9% in the second quarter, following a 1.6% decline in the first quarter

Full Article →Gold The Dovish Light In Fed’s Hawkish Night

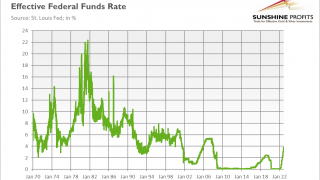

Support for aggressive tightening has strengthened within the FOMC. Indeed, the current tightening cycle is much steeper than the two previous ones, in which the Fed usually raised interest rates in 25-basis point moves, as the chart below shows.

Full Article →Recession is Coming: Gold Will Come Out Stronger

An economic hurricane is coming. Brace yourselves! This is at least what Jamie Dimon suggested last month. To be precise, he said: “Right now, it’s kind of sunny. Everyone thinks the Fed can handle this. That hurricane is right out there down the road, coming our way.

Full Article →When Fed Takes Punch Bowl Away, Stick to Gold

The hangover is coming. The best cure is – except for the broth – gold. 75 basis points! This is how much the FOMC raised interest rates in June. As the chart below shows, it was the biggest hike in the federal funds rate since the 1990s.

Full Article →Bears Mauled Market But Not Gold

The bears awoke from their winter sleep and took control of Wall Street. However, they haven’t conquered the gold market yet! It’s official: there is a bear market in equities! We can firmly state that bears took control of Wall Street for the first time since the pandemic crash.

Full Article →Fed Afraid of Inflation and Tightens Hawkish Stance

Yesterday the FOMC published the minutes from its last meeting, held in mid-June. Although the publication reveals no major surprises about US monetary policy, it shows rising worries within the Fed and also strengthens its hawkish rhetoric.

Full Article →Powell Stagflation Could Make Gold Investors Happy

There are many terrifying statements you can hear from another person. One example is: “Honey, we need to talk!” Another is: “I’m from the government and I’m here to help.” However, the scariest English word, especially nowadays, is “stagflation.” Brrr!

Full Article →Unlike Gold, The Fed Doesn’t Want a Recession…

Last week, Powell testified before Congress. He reiterated many things he said during his recent press conference, but I believe that a few issues deserve our attention. First, Powell repeated that the Fed is strongly committed to additional rate hikes coming.

Full Article →Will Gold Save Souls in the Inflationary Apocalypse?

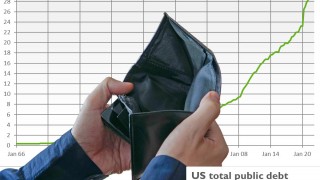

The end is nigh! There should be no doubt about it now, as more horsemen of the Apocalypse are coming. The first was Pestilence. Two years ago, the COVID-19 pandemic plunged the world into a Great Lockdown and the deepest recession since the Great Depression.

Full Article →Why Did Gold Fall Despite Accelerating Inflation?

According to the Bureau of Labor Statistics, the CPI increased 1.0 percent in May, after rising 0.3 percent in April. This is a huge increase, especially since we are talking here about changes from month to month. The core CPI, which excludes energy and food prices, rose 0.6%, the same increase as in April.

Full Article →Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.