Experts from the World Bank finally admitted that the risk of stagflation is getting bigger and more real. For gold, however, that’s pretty good news. Better Late Than Never – First they ignore you, then they laugh at you, then they fight you, and finally you win.

Full Article →Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

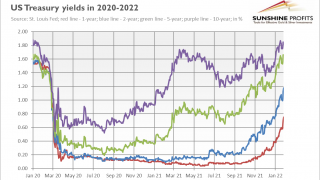

Real Interest Rates Turn Positive, but It’s Negative for Gold

The recipe for happiness is to see the bright side of even negative situations. Positive interest rates are rather bad news for gold. Here’s why. This is a huge change, perhaps a game-changer! What do I mean?

Full Article →Is there Gold in the Metaverse?

Imagine all the people… living life in the Metaverse. Once we immerse ourselves in the digital sphere, gold may go out of fashion. Or maybe not? Do you already have your avatar? If not, maybe you should consider creating one

Full Article →Gold Jumps In Spite of Ultra-Hawkish Fed

The FOMC finally raised interest rates and signaled six more hikes this year. Despite the very hawkish dot plot, gold went up in initial reaction. It’s also worth mentioning that the Fed deleted all references to the pandemic from the statement. Instead, it added a paragraph related to the war in Ukraine,

Full Article →Gold Falls Despite Ongoing War and Inflation Surge

It seems that the stalemate in Ukraine has slowed down gold’s bold movements. Will the Fed’s decision on interest rates revive them again? Bullion.Directory precious metals analysis 15 March, 2022 […]

Full Article →Gold Likes Recessions – Will High Interest Rates Lead Us There?

We live in uncertain times, but one thing is (almost) certain: the Fed’s tightening cycle will be followed by an economic slowdown – if not worse. There are many regularities in nature. After winter comes spring. After night comes day. After a Fed tightening cycle comes a recession.

Full Article →Two Weeks and Counting – How Does War Affect Gold?

With each day of the Russian invasion, gold confirms its status as the safe-haven asset. Its long-term outlook has become more bullish than before the war. Two weeks have passed since the Russian attack on Ukraine. Two weeks of the first full-scale war in Europe in the 21th century, something I still can’t believe is happening.

Full Article →Ukraine’s Defense Shines – As Does Gold

Russian forces have made minimal progress against Ukraine in recent days. Unlike the invader, gold rallied very quickly and achieved its long-awaited target – $2000! Russian troops continued their offensive and – although the pace slowed down considerably – they managed to make some progress

Full Article →Fighting Continues: Good for Ukraine… and GOLD

What does the ongoing war in Ukraine mean for the precious metals market? Well, the continuous heroic stance of President Volodymyr Zelenskyy and Ukrainian defenders is not only heating up the hearts of all freedom-lovers, but also gold prices.

Full Article →As Ukraine Resists Will Gold Withstand Bear Invasion?

What does the war between Russia and Ukraine imply for the gold market? Initially, the conflict was supportive of gold prices and the price of gold soared on Thursday. However, the rally was very short-lived, as the very next day, gold prices fell and gold’s performance looked like “buy the rumor, sell the news.”

Full Article →Do We Prepare for the Worst and Buy Gold?

As the COVID-19 pandemic has shown, it is worth being better prepared for a possible crisis. Does that mean it pays to have some gold up your sleeve? I have to confess something. I always laughed at preppers. C’mon, who would take these freaks seriously?

Full Article →Gold a Shelter as Russia Invades Ukraine

The war has begun: after a few weeks of tense situation, Russia has taken a radical step and started an invasion of Ukraine. How will this affect gold? Well, risk aversion has soared amid the conflict. Equities are plunging while safe-haven assets are soaring.

Full Article →When The Russian Bear Roars Will It Wake Gold Bulls?

The current military tensions and the Fed’s sluggishness favor gold bulls, but not all events are positive for the yellow metal. What should we be aware of? It may be quiet on the Western Front, but quite the opposite on the Eastern Front. Russia has accumulated well over 100,000 soldiers on the border with Ukraine

Full Article →Inflation Peak: High Risk or Golden Opportunity?

If only you weren’t in a coma last year, you would have probably noticed that prices had been surging recently. For instance, America finished the year with a shocking CPI annual rate of 7.1%, the highest since June 1982

Full Article →Is it Worth Adding Gold to Your Portfolio in 2022?

Gold is an excellent portfolio diversifier, as it is negatively correlated with risk assets, and – importantly – this negative correlation increases as these assets sell off. Hence, adding gold to a portfolio could diversify it, improving its risk-adjusted return, and also provide liquidity to meet liabilities in times of market stress.

Full Article →The ECB Awakens. Will Gold Feel The Force?

The ECB has awoken from its ultra-dovish lethargy. Lagarde opened the door to an interest rate hike, which gave the European Central Bank a hawkish demeanor. Does it also imply more bullish gold?

Full Article →Strong Payrolls Can’t Knock Gold

The latest employment report strongly supports the Fed’s hawkish narrative. Surprisingly, gold has shown remarkable resilience against it so far – especially given that the surprisingly good nonfarm payrolls came despite the disruption to consumer-facing businesses from the spread of the Omicron variant of the coronavirus.

Full Article →Will the Fed Tighten Gold?

Beware, the Fed’s tightening of monetary policy could lift real interest rates! For gold, this poses a risk of prices wildly rolling down. The first FOMC meeting in 2022 is behind us. What can we expect from the US central bank this year and how will it affect the price of gold?

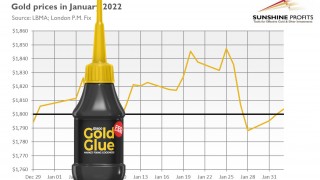

Full Article →Gold Ended January Glued to $1800 – Will it Ever Detach?

What does gold’s behavior in January imply for its 2022 outlook? Well, I must admit that I expected gold’s performance to be worse. Last month showed that gold simply don’t want to either go down (or up), but it still prefers to go sideways, glued to the $1,800 level.

Full Article →Gold Defended $1800 Bravely. Then Gave Up.

The evil FOMC published its hawkish statement on monetary policy. Gold fought valiantly, gold fought nobly, gold fought honorably. Despite all this sacrifice, it lost the battle. How will it handle the next clashes?

Full Article →Gold 2022: Between Inflationary Rock and Hard Fed

In the epic struggle between chaos and order, chaos has an easier task, as there is usually only one proper method to do a job – the job that you can screw up in many ways. Thus, although economists see a strong economic expansion with cooling prices and normalization in monetary policies in 2022, many things could go wrong.

Full Article →Gold Plunges But Doesn’t Knuckle Under Hawkish Fed

The Battlecruiser Hawk is moving full steam ahead! The FOMC issued yesterday (January 26, 2022) its newest statement on monetary policy in which it strengthened its hawkish stance. First of all, the Fed admitted that it would start hiking interest rates “soon”

Full Article →Gold Slides and Rebounds in 2022

So, 2021 is over! 2022 will be better, right? Yeah, for sure! Just relax, what’s the worst that could happen? My outlook for the gold market in 2022 suffers from manic depression: I see first a period of despair and an elevated mood later. But seriously, what can we expect from this year?

Full Article →Inflationary Hydra & Russian Bear Send Gold Soaring

Gold soared as investors got scared by reports of an allegedly impending military conflict. Was it worth reacting sharply to geopolitical factors? What happened? Investors got scared of the Russian bear and inflationary hydra. The threat of Ukrainian invasion and renewal of a conflict weakened risk appetite among investors.

Full Article →Neither Inflation Nor Fed Moves Gold

Inflation spiked 7.1% in December, and the Fed is likely to raise interest rates already in March. Still, gold remains uninterested. “Inflation is too high,” admitted Lael Brainard during her nomination hearing in the Senate for the Vice Chair of the Fed. You don’t say, Governor Obvious!

Full Article →Powell Lends Smile to Gold

Powell testified before the Senate. He didn’t say anything new, but gold rallied a bit. “We are going to end asset purchases in March. We will raise rates. And at some point this year will let the balance sheet runoff,”

Full Article →Weak Payroll Saved Gold: For How Long?

Job creation disappointed in December. However, it could not be enough to counterweight rising real interest rates and save gold. Luckily for the yellow metal, nonfarm payrolls disappointed in December. Last month, the US labor market rose, adding just 199,000 jobs (see the chart below), well short of consensus estimates of 400,000.

Full Article →Gold Market 2022: A Story of Fall & Revival?

2021 will be remembered as the year of inflation’s comeback and gold’s dissatisfying reaction to it. Will gold improve its behavior in 2022? You thought that 2020 was a terrible year, but we would be back to normal in 2021? Well, we haven’t quite returned to normal.

Full Article →Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.