Given the Australian Government’s potential decision to grab Aussie’s wealth through a tax on bank deposits, it’s looking like the two safest places for your money are either under your mattress or in gold.

Bullion.Directory precious metals analysis 29 March, 2015

Bullion.Directory precious metals analysis 29 March, 2015

By Terry Kinder

Investor, Technical Analyst

Martin Armstrong has highlighted how increasingly cash strapped governments, including the Australian Government, will go to almost any lengths to grab the wealth of their citizens.

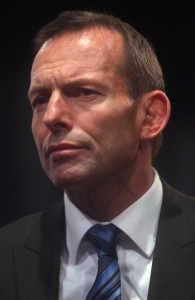

The latest act of government desperation comes from Australia where Prime Minister Tony Abbott appears poised to break his election promise not to tax bank deposits.Just when it seems it can get no worse, with deposits earning little to no interest, the Australian government’s latest scheme to extract the last of its citizens wealth proves that it can always get worse – all it requires is a politician or government bureaucrat to find a way.

As The Guardian reported:

The prime minister, Tony Abbott, says the upcoming budget will contain some tough measures, with one tipped to be a tax on bank deposits which will raise about $500m a year.

That’s not confirmed but Labor said it appeared the government was again breaking its promise of no new taxes.

Of course, the no new taxes pledge should sound familiar to Americans.

But perhaps President Bush’s speech writer forgot the comma. It wasn’t meant to be “No new taxes.” Instead, the text should have read, “No, new taxes.” Regardless, the government, Australian or otherwise, can always find a clever way – whether new or old – to increase the tax burden on citizens.

Somehow, some citizens have not caught on to the ridiculous games of government, first using their own money to bribe them for votes, and then later, taking back everything they were given when the politicians are finally forced to acknowledge the impossibility of delivering on their pie in the sky promises.

Alan Greenspan, former Fed Chairman, knew of gold’s role as a bulwark against the welfare state and government wealth confiscation schemes:

This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.

Whether the gold price moves up or down, the latest rumored wealth grab of the Australian government, provides yet another reason why you need the protection of gold versus the ever increasing schemes of the state to extract every last bit of wealth from their citizenry.

* “Tony Abbott – 2010” by MystifyMe Concert Photography (Troy) – Opposition Leader Tony Abbott (16). Licensed under CC BY 2.0 via Wikimedia Commons – http://commons.wikimedia.org/wiki/File:Tony_Abbott_-_2010.jpg#/media/File:Tony_Abbott_-_2010.jpg

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply