A Gold IRA can form an important element of any diversified portfolio, helping hedge a retirement plan from risks of market downturn and financial crisis.

Not only does gold in an IRA protect wealth, Gold IRA‘s are one of the most tax-efficient routes to buying gold. It makes sense for anyone with an interest in metals or coins to take advantage of this.

This page aims to provide you with clear and impartial information examining the need for a Gold IRA, the rules behind opening and taking full advantage of a Gold IRA as well as looking at our listed Gold IRA Specialists

“Gold should be a bedrock asset in any investment portfolio – and retirement plans are no exception. Gold in an IRA isn’t just a precaution, it’s essential insurance.”

Gold IRA Rollover

The gold IRA rollover is a tax efficient way to add precious metals to your retirement portfolio

If you’re looking to add gold in your retirement account – then chances are high that you’ll need to use a gold IRA “rollover” or transfer.

It’s important to have a good grasp of how a gold IRA works – the gold IRA rollover process, either as part of a DIY approach, or to better track your IRA provider and custodian’s progress (and see just how they earn their fees!)

The rollover process is usually relatively simple, and using the skills of a gold IRA specialist will ensure it’s completely painless.

But before getting started with an IRA rollover, you need to ask yourself is gold in your IRA the right asset for you?

Gold is a proven hedge against risk and stock-market crashes and has been seen to maintain spending power across millennia – despite inflation. This is why gold is so popular as a wealth-preservation tool among the wealthy, and why it forms the bedrock of most central banks’ assets.

But for all gold’s great advantages, there is an inescapable fact – it doesn’t pay interest or dividends.

Instead it acts as a stabilizer for more risky portfolio elements and because it will typically rise in value when paper assets decrease, it helps take away the pain of financial crises. In 2008 while the markets crashed and burned, gold saw massive growth.

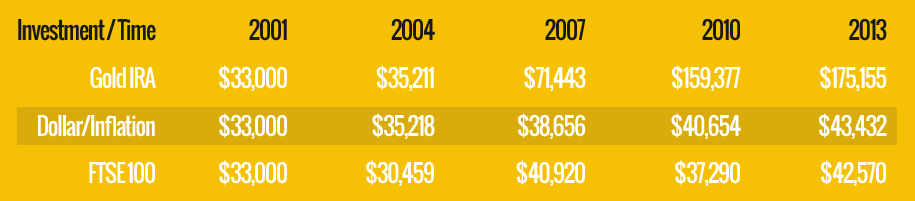

By way of an example, a $33k gold IRA taken out in 2001 would have been worth $175,155 by 2013, while a paper-backed account would have struggled to $42,570 as the markets began a slow recovery post-crash.

And thanks to inflation, by 2013 you would have needed $43,432 to achieve the same spending power as that original $33k in 2001 – meaning the stock-market investment would have made an overall loss in real terms. A loss, versus a 430% profit with gold.

You must ask yourself if you want to reduce the part of your IRA that rises with the stock markets and pays dividends, and replace that part with what amounts to an insurance policy.

If you don’t – then gold is not for you.

What is a Gold IRA Rollover?

You carry out a gold IRA rollover if your existing retirement plan is unable to contain physical precious metals.

When the IRS relaxed rules on bullion in retirement funds, precious metals immediately became an essential part of many retirement accounts. However even today a number of accounts can’t or won’t accept physical gold, hence the need for a rollover.

In essence a gold IRA rollover consists of three simple stages

![]() Gold IRA Rollover Step #1: Select a custodian / trustee to accept your rollover.

Gold IRA Rollover Step #1: Select a custodian / trustee to accept your rollover.

Our directory lists 78 gold IRA specialists, some of which are metals dealers and some custodians, but any one of them will be able to set up an IRA tailored to allow tax-free investment in physical bullion. Popular specialists include Goldco Precious Metals and Birch Gold (two of our top-rated bullion dealers in 2023)

To get started you fill in a simple form to create a suitable new self-directed IRA account (now known as a Gold IRA) – which will then be active in 2-5 days, sometimes sooner.

![]() Gold IRA Rollover Step #2: The rollover of funds

Gold IRA Rollover Step #2: The rollover of funds

You now take a distribution from your existing retirement plan. You can ask your plan administrator to make the payment directly into your newly set up gold IRA. Alternatively the administrator will issue your distribution in the form of a check made payable to your new account. Either way there are no taxes withheld from your rollover.

![]() Gold IRA Rollover Step #3: Buying precious metals

Gold IRA Rollover Step #3: Buying precious metals

Now the fun part! If you set up your account directly through Goldco, Birch Gold – or any of our 67 listed specialists it’s time to select the precious metals you want to buy for your gold IRA.

Specialist IRA gold dealers and IRA lawyers or accountants will help advise the best metals to buy in line with your needs (some portfolios can be built with an eye on potential capital appreciation as well as wealth protection) and lock the prices at a rate you’re happy with. After this selection process your trustee wires the funds to the dealer.

Secure delivery sees your metals delivered directly into your trustees vault at a chosen depository and that’s you – you’ve completed a gold IRA rollover!

When and why would you use a rollover?

Ordinarily*, a distribution (withdrawal of funds) from a retirement account is a taxable event. The amount of the distribution is added to your income for that year and taxed at your standard rate.

By rolling over your distribution from one plan to another or carrying out a direct trustee-to-trustee transfer, you generally don’t pay any tax on it until you finally withdraw it from the new plan.

The IRA rollover allows more of your money to continue growing thanks to being tax-deferred.

*(other than qualified Roth distributions and any amount already taxed – check with an registered IRA Advisor for up to date legislation)

Remember the one rollover per year rule

From January 1, 2015, you were only permitted to make one rollover from one IRA to another IRA in any 12-month period, regardless of the number of IRAs you own.

There are exemptions from this rule, that the one-per year limit does not apply to:

- rollovers from traditional IRAs to Roth IRAs (conversions)

- trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers

- plan-to-IRA rollovers

- plan-to-plan rollovers

You must include in gross income any previously un-taxed amounts distributed from an IRA if you made an IRA-to-IRA rollover (other than above exceptions) in the preceding 12 months. You may also be subject to a 10% early withdrawal tax on the amount you include in gross income if you are aged less than 59.5.

Full details of the One Rollover Per Year rules on the IRS site.

What IRAs can be rolled over?

| Roth IRA | Trad. IRA | Simple IRA | SEP-IRA | |

|---|---|---|---|---|

| Roth IRA | YES 1 | NO | NO | NO |

| Trad. IRA | YES 2 | YES 1 | NO | YES 1 |

| Simple IRA | YES 2 (after 2 yrs) | YES 1 (after 2 yrs) | YES 1 | YES 1 (after 2 yrs) |

| SEP-IRA | YES 2 | YES 1 | NO | YES 1 |

| *1: Only one rollover in 12 months *2: Must include in income | ||||

Gold IRA Transfer

Much like a rollover, a gold IRA transfer is a tax efficient way to add precious metals to your retirement portfolio

Rollovers are not the only game in town. Often an IRA transfer is the more appropriate approach to adding gold to your IRA.

A direct transfer of funds from one account to another sounds simple, but some providers don’t always work well with other providers and need to pre-approve the transfer.

Another key difference between a gold IRA transfer and a rollover is that of fees and tax implications.

When would you carry out a Gold IRA Transfer?

You carry out a gold IRA transfer if your existing retirement plan is unable to contain physical precious metals.

Despite it now being several years since the IRS relaxed it’s rules on holding investment-grade bullion in retirement funds, there are still a significant number of trustees who can’t or won’t accept physical gold, hence the need for a transfer.

In essence a gold IRA transfer consists of three simple stages

![]() Gold IRA Transfer Step #1: Select a custodian / trustee to accept the transfer.

Gold IRA Transfer Step #1: Select a custodian / trustee to accept the transfer.

If you don’t already have a suitable IRA, our directory lists 78 gold IRA specialists, some of which are metals dealers and some custodians, but any one of them will be able to help you set up a transfer to an IRA tailored to physical bullion. Popular specialists include Goldco and Birch Gold.

To begin the transfer process you would simply fill in an appropriate form provided by your specialist – this can be a paper form or be filled online.

![]() Gold IRA Transfer Step #2: The trustee-to-trustee transfer

Gold IRA Transfer Step #2: The trustee-to-trustee transfer

If you’re taking a distribution from an existing IRA, you simply ask the financial institution holding your current IRA to make the payment transfer directly from your IRA to another IRA or to a retirement plan, transferring the funds directly from one account to the other. Importantly there are no taxes withheld from this transfer.

![]() Gold IRA Transfer Step #3: Buying precious metals

Gold IRA Transfer Step #3: Buying precious metals

If you set up your account directly through Birch Gold, Goldco – or any of our 78 listed gold IRA specialists you now choose the precious metals you’d like to buy through your gold IRA.

Specialist IRA gold dealers can help advise the best metals to buy based on your needs and will watch the market prices locking the trade for you at a rate you’re happy with and placing your order, before your trustee wires the funds to the dealer.

Secure delivery sees your metals into your trustees vault at a chosen depository and that’s you – you’ve completed a gold IRA transfer!

Transfers are exempt from the one rollover per year rule

From January 1, 2015, you were only permitted to make one rollover from one IRA to another IRA in any 12-month period, regardless of the number of IRAs you own. Gold IRA Transfers are exempt from this rule

This extra headache will no doubt see a reduction in gold IRA rollovers and an increase in gold IRA transfers

Gold Ira Rules

Gold IRA rules are relatively simple, but a common mistake can quickly lead to unexpected taxation and penalties

Since the IRS relaxed it’s rules on physical gold in retirement funds, precious metals have unsurprisingly formed an essential part of many American IRAs. Get your set up, content or distributions wrong however and you could be looking at double taxation – or worse.

You know the US Government and the IRS likes their regulations – so it’s not surprising that setting up a gold IRA is no exception.

We’ve got up to date gold IRA rules listed below in plain English, so you don’t necessarily have to be an IRA lawyer or accountant to get a basic grasp of these complex regulations.

IRA Basics: Contribution Limits:

For 2023, your total contributions to all of your traditional and Roth IRAs cannot be more than:

* $6,500 ($7,500 if you’re age 50 or older), or

* your taxable compensation for the year, if your compensation was less than this dollar limit.

For 2023, your total contributions to all of your traditional and Roth IRAs cannot be more than:

* $6,500 ($7,500 if you’re age 50 or older), or

* your taxable compensation for the year, if your compensation was less than this dollar limit.

The IRA contribution limit does not apply to rollover contributions or qualified reservist repayments

Required Minimum Distributions

Unlike with precious metals outside of a retirement account, you cannot keep retirement funds in your IRA indefinitely. You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach age 70½.

Your required minimum distribution is the minimum amount you must withdraw from your account each year.

* You can withdraw more than the minimum required amount.

* Your withdrawals will be included in your taxable income except for any part that was taxed before (your basis) or that can be received tax-free (such as qualified distributions from designated Roth accounts).

For IRAs (including SEP and SIMPLE IRAs) this starts at April 1 of the year following the calendar year in which you reach age 70½.

The IRS has prepared worksheets where you can easily calculate your minimum distributions.

For full details on distribution, early distribution and taxation, see the Full IRS Guide

By following these IRA rules and the following rules specifically looking at precious metals IRAs – you will keep your hard-earned retirement funds out of the clutches of the IRS

Rules Specific to Gold IRAs

The Collectables Trap

The Taxpayer Relief Act of 1997 allowed us to add gold and precious metals to our Individual Retirement Accounts, opening the floodgates to those desperate for a tax-efficient hedge in a diversified retirement portfolio.

The Taxpayer Relief Act of 1997 allowed us to add gold and precious metals to our Individual Retirement Accounts, opening the floodgates to those desperate for a tax-efficient hedge in a diversified retirement portfolio.

Designed to be relatively simple to operate and set up, the gold IRA is an immensely popular vehicle, but there are still a number of potential pitfalls for the unwary in buying retirement gold.

As is typical with the IRS – this apparent simplicity can at times hide complicated rules and restrictive clauses in an otherwise perfect retirement plan.

As take-up of previously restricted asset classes, notably hard assets like gold and silver becomes widespread, these hidden rules and exceptions have begun to catch out more and more investors.

Adding to the problem – there’s a huge amount of misinformation online and it’s not unknown for unscrupulous dealers to take advantage, knowingly selling high mark-up coins as suitable for an IRA when they’re absolutely not.

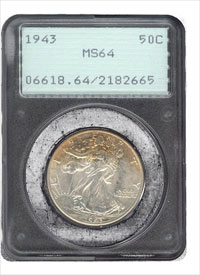

Collectible Coins and Section 408(m) of the Internal Revenue Code

When most people think of collectibles they tend to think of art, antiques and ornaments – so it’s often a surprise when they realize a huge part of the precious metals market is classified as collectibles.

The simple mistake of buying the wrong gold coins for your IRA can result in a huge and unexpected tax bill.

For example if $15,000 of your IRA funds are used to invest in coins classified as collectibles, the IRS will view your transaction as a $15,000 distribution. This means the $15,000 should be reported as being part of your gross income, and liable to income tax at your standard tax rate.

It gets worse. In addition to being hit for tax on the $15,000 there’s an additional 10% penalty tax if you’re younger than 59.5.

But it doesn’t end there. You’ve already paid tax on the distribution and a penalty on the price when you mistakenly added the collectibles. But fast forward to the eventual selling of these collectible coins and the proceeds of the sale being distributed to the IRA owner or beneficiaries.

As a prohibited transaction this sale will again form part of gross income for the year of the distribution, meaning a further tax hit, with no credit being given for previous penalty tax. Effectively double taxation.

What is a collectible coin?

With the exception of a few special US coins*, if a coin is sold on the basis of any special merit over and above the value of it’s precious metal content, then it’s a collectible.

With the exception of a few special US coins*, if a coin is sold on the basis of any special merit over and above the value of it’s precious metal content, then it’s a collectible.

Rare coins, miss-strikes, antique coins, proof coins, slabbed coins, specially graded coins, limited edition coins, enamelled coins, coins in presentation cases – are typically collectibles and therefore not allowed in a gold IRA.

Play safe. Stick to buying standard bullion coins and rounds of sufficient purity, from mints recognized by the IRS. We list them here.

You’ll know a coin is effectively standard bullion by it’s price. Standard bullion coins and rounds sell at the spot price, plus a small premium of 5-20%. To be extra safe, only buy coins listed as being definitively suitable for an IRA. Not coins that should be suitable or may be suitable.

The Exception: Gold and Silver American Eagle Proofs in an IRA

Despite being very obviously “collectibles”, there are gold and silver proof coins that can be added to a gold IRA but they must be American Eagle proofs.

Proofs are beautiful coins. The gleam with a true mirror finish and when looked at next to a regular bullion coin, the regular coin seems almost disappointing. Extra care goes into a proof coin’s production, and they tend to be sold in display cases – adding to their overall beauty.

It’s this beauty that commands higher premiums and greater dealer markups and commission. Is that beauty worth an extra 20%, 30% 50%, even 100% to you?

Will it be worth that same premium when you come to sell? Our experience says no.

A quick test – if you are looking to buy proof coins from a dealer, phone them and say you have say 20 gold proof eagles you’re looking to sell. See what you’re offered and compare it to their sale price.

Do the math and ask yourself if you want to take that kind of hit on your account for the sake of owning some slightly more shiny coins held in a distant vault.

Beware “Collectibles” that are not collectible

Numismatic coins can make good investments outside of an IRA, but for the purposes of a gold IRA, remember all you’re really interested in is the weight of precious metals in your account.

As we’ve mentioned before dealer margins on regular bullion coins and rounds are pretty low especially if you shop around.

So some dealers, will take steps to increase their margins. They will sell fairly common bullion coins as being special for some reason – be it last of a design run, first of a design, or will imply a limited production of “only” 10,000 coins or some other must-buy reason.

They can make a very convincing argument and it’s easy to believe what these “experts” are saying if you’re new to precious metals investing.

And these coins WILL be suitable for your IRA, despite being collectible.

Why? Because they’re not collectible, or rare, or limited – or at least not in a sense that will give them a resale value over their basic intrinsic metal content.

But the dealer will have made a nice profit from you.

Home Storage Gold IRAs are NOT allowed

Gold in an IRA must remain with your custodian or trustee at an approved depository.

Gold in an IRA must remain with your custodian or trustee at an approved depository.

You can take a distribution from your IRA, however this will be taxable and may carry additional fees and penalties.

In recent years some IRA companies have started promoting “Home Storage”, “Check Book” IRAs or “LLC” IRAs as a loophole to this rule, where the IRA holder forms a Limited Liability Company. This LLC then buys gold coins (not bars, and so far only American Eagle coins are used in the scheme), which can be in turn be stored at the new LLC company HQ – which will typically be the IRA holder’s home.

However IRS Publication 590 specifies that for all IRAs, “The trustee or custodian must be a bank, a federally insured credit union, a savings and loan association, or an entity approved by the IRS to act as trustee or custodian.”

Again the IRS website states This rule [Gold in an IRA should be held at a bank etc] also applies to an indirect acquisition, such as having an IRA-owned Limited Liability Company (LLC) buy the bullion. [These] IRA investments… run the risk of disqualifying the IRA because of the prohibited transaction rules against self-dealing.

Therefore storing Gold IRA products in the IRA owner’s home or in a safe deposit box to which the IRA owner maintains a right of access is not within the letter or the spirit of the Internal Revenue Code – that is, the tax-advantaged IRA assets should be held outside the possession and personal control of the IRA owner until retirement or early distribution.

Some Home Storage IRA companies mention the Swanson v. Commissioner case in 1996, adding that the IRS and the Department of Labor have, through field service advisory letters, and DOL advisory opinion letters, consistently acknowledged the existence of the CheckBook IRA – however the Self-Storage IRA arrangement has not been approved or recognized by the Internal Revenue Service – formally or in a no-action letter issued by the IRS, Employee Plans Division. And now they’ve explicitly stated it is not allowable.

In short, don’t do it.

Finally remember the one rollover per year rule

As mentioned above, from January 1, 2015, you were only permitted to make one rollover from one IRA to another IRA in any 12-month period, regardless of the number of IRAs you own.

Gold Ira Approved Metals

The IRA-Approved Precious Metals List

Unfortunately, you can’t just add ANY old precious metals to your gold IRA. Investment grade metals for an IRA need to follow a set of strict criteria.

The bullion coins and bars that are accepted investments for a self-directed IRA are somewhat limited, but for good reason. Your long-term protection.

We list currently approved gold, silver, platinum and palladium metals below.

Precious metal IRAs may only contain bullion coins and bars from an ira approved precious metals selection. They must be COMEX/NYMEX accredited and must be sufficiently pure.

Bullion coins suitable for precious metal IRAs are valued on their precious metal content only. Slabbed / graded and numismatic or collectible coins (with the exception of American proof gold and proof silver Eagles) are not permitted.

IRA Approved Bullion Coins & Rounds

IRA approved coins and rounds must meet minimum fineness requirements and be manufactured by a NYMEX or COMEX-approved refiner/assayer or a national government mint and should be ISO9001 Certified.

IRA approved coins and rounds must meet minimum fineness requirements and be manufactured by a NYMEX or COMEX-approved refiner/assayer or a national government mint and should be ISO9001 Certified.

American Gold Eagle coins

U.S. Buffalo Bullion gold coins

Canadian Maple Leaf gold coins

Austrian Philharmonic gold coins

Australian Kangaroo/Nugget gold coins

Other examples of acceptable gold coins/rounds include:

Chinese Gold Panda coins

Gold Incuse Indian rounds

Gold Engelhard Prospector rounds

Perth Mint Lunar Series gold coins

American Silver Eagle coins

Austrian Vienna Philharmonic coins

Australian Kookaburra coins

Canadian Maple Leaf coins

Other examples of acceptable silver coins/rounds include:

UK Silver Britannia coins (*after 2013*)

Silver 1oz Dodgecoin Wolf medallions

Incuse Indian silver rounds

Sunshine Mint silver rounds

Candian Silver Arctic Fox coins

Australian Silver Kookaburra coins

OPM Silver Bullion rounds

American Platinum Eagle coins

Platinum Canadian Maple Leaf coins

Platinum Australian Koala coins

Other examples of acceptable platinum coins/rounds include:

Platinum Britannia coins

Platinum Australian Platypus coins

Canadian Maple Leaf Palladium coins

IRA Approved Bullion Bars

IRA approved bullion bars must meet minimum fineness requirements and be manufactured by a NYMEX or COMEX-approved refiner/assayer and should be ISO9001 Certified.

IRA approved bullion bars must meet minimum fineness requirements and be manufactured by a NYMEX or COMEX-approved refiner/assayer and should be ISO9001 Certified.

Gold bars .995+ fine that are accredited by COMEX/NYMEX / ISO9001 Certified

Examples of qualifying gold bars are:

Perth Mint .9999 fine bars

Credit Suisse .9999 fine bars

PAMP Suisse .9999 fine bars

Royal Canadian Mint .9999 fine bars

Ohio Precious Metals .9999 fine bars

Silver bars .999+ fine that are accredited by COMEX/NYMEX / ISO9001 Certified

Examples of qualifying silver bars are:

Royal Canadian Mint .9999 fine bars

Sunshine Mint .999+ fine bars

Ohio Precious Metals .999+ fine bars

Engelhard Hand Poured .999+ fine bars

Golden State Mint ISO9001 .999+ fine bars

Platinum bars .9995+ fine that are accredited by COMEX/NYMEX / ISO9001 Certified

Examples of qualifying platinum bars are:

Credit Suisse .9995 fine bars

Scotiabank .9995+ fine bars

Johnson Matthey .9995 fine bars

Palladium bars that are .9995+ fine that are accredited by COMEX/NYMEX / ISO9001 Certified

Examples of qualifying platinum bars are:

Pamp Suisse .9995+ fine bars

Credit Suisse .9995+ fine bars

Baird & Co. .9995+ fine bars

Gold Ira FAQ

With more investors looking to add physical gold in IRA’s we’ve produced a comprehensive set of gold retirement FAQ

Do you have Gold IRA questions? If you’ve asked it, we’ve answered it in our ultimate list of Frequently Asked Questions.

Covering every possible question a new investor may ask, with a further wealth of detailed information available in our free gold IRA guide.

Finally you can get the facts right about gold retirement accounts. We don’t sell gold or offer gold IRAs so our information is always unbiased and impartial – essential if you’re investing in your future.

What is a gold IRA?

Why would I want gold in my IRA?

What types of gold can I add to an IRA?

Can I add gold I already own?

Can I add other investment types to my gold IRA?

Can't I just add gold to my current retirement plan?

Can I take possession of the gold in my IRA?

Can I own more than one IRA or retirement account?

Can I transfer or rollover an existing retirement plan?

Where is my gold kept and is it secure?

How much does a gold IRA cost?

Is there a minimum amount I need to purchase?

Is there a maximum amount I can contribute?

What happens if I've contributed too much?

Is there a contribution deadline?

Can I withdraw gold from my IRA in an emergency?

Can I take a loan from my gold IRA?

Can I combine two or more retirement accounts?

Why is it important to choose the right dealer?

Why is it important to choose the right metals products?

Is there a best time to buy gold?

Gold Ira Companies

As gold’s popularity as a retirement investment grows, so does your choice of top rated gold IRA companies

We’re the world’s premier specialist precious metals dealer directory – so we list all the major and are working through all the smaller gold IRA Providers out there.

Every gold IRA company listed can be rated and reviewed by real customers, and visitors can order listings to show all gold IRA companies as rated from highest to lowest in a single click.

Find specific IRA providers or search all local gold IRA companies and major national listings with ease.

Consumer power and online ratings are keeping gold IRA providers on their A-game and it’s you the customer who benefits.

Competition is fierce and it’s clear the battle lies in customer service – in fact two of the three top rated companies in the Bullion Dealer Of The Year public vote, Augusta Precious Metals, and Birch Gold Group are both gold IRA specialists – well known for their quality of customer care, as are our current-top rated company in the category – Goldco.

Directory Listings: 20 Leading Gold IRA Companies

These are our top 20 gold IRA companies listed, at time of publication.

For all specialist Gold IRA companies listed in Bullion.Directory see our full directory category

Augusta Precious Metals

Read More

Birch Gold Group

Read More

Noble Gold

Read More

Lear Capital

Read More

SWP Cayman

Read More

Preserve Gold

Read More

GoldenCrest Metals

Read More

Money Metals Exchange

Read More

SD Bullion

Read More

APMEX

Read More

BGASC

Read More

Fisher Precious Metals

Read More

Priority Gold

Read More

Gainesville Coins

Read More

Colonial Metals Group

Read More

Selecting your gold IRA provider

As with any purchase involving a significant amount of money, it’s essential you carry out proper due diligence on your selected shortlist of gold IRA companies.

As an impartial directory we don’t like to recommend or advise to use any single company, but currently our top rated Gold IRA company is Goldco, and two of our past Bullion Dealer of the Year winners are Gold IRA specialists: Birch Gold Group and Augusta Precious Metals.

Whichever company you choose to use for your precious metals IRA investments, carry out at least the following basic checks and safeguards:

- Examine the gold IRA company’s profile, rating and reviews both here at Bullion.Directory and on our favorite 3rd party review site The Better Business Bureau. (To save time, many of our directory listings link to the corresponding BBB entry)

- Be wary of glowing company reviews on websites you don’t recognize, especially reviews that end “don’t buy from X, buy from Y”. There are multiple ongoing court cases concerning 100’s of fake review sites discovered to be under control of the companies being reviewed.

- Ensure the company lists a working phone number and physical company address on their site – the more methods you have to contact your chosen company the better.

- Check out the company listing on LinkedIn – most gold companies will have their own listing, or at least listings for their top employees and management. Do they seem an authority in their field?

- If the company is an LLC (Limited Liability Company) visit the website for the secretary of state or division of corporations of the company’s state – and do a search on the company. You may be surprised at what you find out.

- Finally, phone the gold IRA company up – speak to someone and get a feel for the company. Are you being given the hard-sell? Do they seem like the kind of people you’d hand over $50,000 to?

While none of the checks can 100% guarantee you’ll be in safe hands (several major US gold dealers have gone out of business in the past few years) at least you’re not going in blind and with any investment, knowledge is power.

And remember – when you’ve dealt with your chosen gold IRA company, please share your experiences on Bullion.Directory, good or bad – and help future investors make the correct decisions for their retirement choices.

An Alternative: The Silver IRA

Gold is not for everyone. Silver is a strong investment, considered by many as significantly undervalued, and with major industrial uses it’s not going away soon.

By combining or balancing silver and gold in an IRA it’s possible to reduce silver’s volatility giving a basket with excellent potential for growth.

A silver IRA gives the devil’s metal a chance to shine in your retirement planning portfolio

Often overlooked due to it’s more famous sibling, silver in an IRA can be an impressive performer.

Unlike gold, silver sees major industrial usage, so has a real value over simply being “precious”.

Add the fact that silver’s massively undervalued in 2015 and it’s no surprise that silver IRAs are seeing such a growth in demand.

Why add silver to your IRA?

![]() #1 Reason for Silver in an IRA: Silver is undervalued

#1 Reason for Silver in an IRA: Silver is undervalued

As mentioned at the top of the page, silver is undervalued. Any investor is always searching for commodities that can be bought below their true value, so just how undervalued IS silver?

We need to look at a trading ratio – the gold:silver ratio. Typically throughout history an ounce of gold has been worth a certain multiple of an ounce of silver – 15, the gold:silver ratio traditionally being 15:1.

Today that ratio stands at 74:1, meaning you now need 74 ounces of silver to buy one ounce of gold, not 15. Bear in mind we’re seeing this unusually high ratio, even with gold’s price having fallen fairly hard the past couple of years.

But even ignoring price ratios, silver is literally a steal in dollar terms.

It is down from a high of nearly $50/oz in 2011 and is currently trading below it’s mining and refining cost at $14.

There is just so much potential upside in the metal, that it’s not surprising mints are selling out almost as quickly as they can produce.

And that’s just investment silver…

![]() #2 Reason for Silver in an IRA: Silver’s industrial demand is in deficit

#2 Reason for Silver in an IRA: Silver’s industrial demand is in deficit

What this means is more silver is consumed by the needs of industry than is produced. By produced, we mean ALL production, be that mining and recycling combined – and by consumed we mean gone, used – the silver is no more.

This has been the situation for over 50 years

Silver is used in multiple industries, particularly electronics and green energy – both of which could fairly be described as growth markets, so unless a wholly new way is invented to carry out 1000s of industrial and chemical processes, this deficit is set to continue.

![]() #3 Reason for Silver in an IRA: Silver is more rare than gold

#3 Reason for Silver in an IRA: Silver is more rare than gold

It almost makes no sense, given silver’s current low value and massive use in industry, but there is less available silver in the world than gold.

Adding up all mined, refined silver and known reserves Theodore Butler, silver analyst at Butler Research estimates that there are approximately 1 billion ounces of silver in global inventories, compared to 5 billion ounces of gold – a ratio of 5 to 1 in gold’s favor.

For clarity – there’s only 1oz of silver in existence for every 5oz of gold – and industry consumes millions of silver ounces a year.

Supply and demand forces guarantee a change in silver’s fortune, when the world realizes how seriously it has undervalued and under-protected this essential commodity.

What types of silver can I add to a Silver IRA?

The official IRA list says American Silver Eagle coins, Austrian Vienna Philharmonic coins, Australian Kookaburra coins and Canadian Maple Leaf coins can be added to an IRA.

The IRS’s relaxed guidelines states a number of requirements for silver IRA coins, which means other non-listed coins may be added if they meet these requirements, such as UK Silver Britannia coins (*after 2013*), Silver 1oz Dodgecoin Wolf medallions, Sunshine Mint silver rounds, Canadian Silver Arctic Fox coins, Australian Silver Kookaburra coins and OPM Silver Bullion rounds.

Bars need to meet minimum fineness requirements and be manufactured by a NYMEX or COMEX-approved refiner/assayer – and should be ISO9001 Certified. Silver bars that are .999+ fine and meet the NYMEX/COMES/ISO9001 criteria include Royal Canadian Mint .9999 fine bars, Sunshine Mint .999+ fine bars, Ohio Precious Metals .999+ fine bars, Engelhard Hand Poured .999+ fine bars and Golden State Mint ISO9001 .999+ fine bars.

AS WITH ANYTHING TO DO WITH THE IRS – CHECK CURRENT LEGISLATION BEFORE BUYING ANY METALS FOR YOUR SILVER IRA.

Note: This content on this page is taken from our PDF The Definitive Gold IRA Guide 2019

Gold IRA Overview: Why Gold and Why Now?

Prior to the crash of 2008, a typical American would be perfectly happy in adding stocks, bonds and certificates to their retirement account. The markets were buoyant and paper assets were performing strongly, growing that all important retirement nest egg. Indeed, that same typical American wouldn’t consider adding anything more unusual to their retirement account, than shares in a few blue-chip companies – and in most cases their account custodians wouldn’t have allowed them to anyway. But they were in a tiny minority. If you asked Joe Normal if he had gold in his IRA he’d look at you like you were a crazy. He had stocks, shares, mutual funds and certificates like everyone else. Why would anyone want to self-direct their retirement fund anyway? Why rock the boat? Paper assets were where it was at and everyone was an expert in a rising market. That is, until the crash came. The big-name experts were horrified. “Nobody saw this coming”. Except this wasn’t strictly true. There had been a handful of vocal commentators and financial advisors warning of an impending implosion. A similar group of “crazies” to those mad, bad and dangerous to know folks who’d been adding gold and silver to their IRAs. Which is funny, because those crazy experts were advising anyone who’d listen to get out of paper assets, get out of real estate – and to buy gold and silver. So how did “the crazies” fare? While the markets crashed and burned, Gold saw massive growth. A $33k gold IRA taken out in 2001 would have been worth $175,155 by 2013, while a paper-backed account would have struggled to $42,570 as the markets began a slow recovery. Bear in mind that thanks to inflation, by 2013 you’d have needed $43,432 to achieve the same spending power as the original $33k in 2001 – meaning the stock-market investment would have made an overall loss. A loss, versus a 430% profit with gold Why? Because gold typically acts as hedge against market volatility. The ultra-rich have been using gold to protect their wealth for generations, it’s just nobody told the little man. Well nobody except those much-derided contrarian analysts. Those that listened, and those with financial advisors worth paying for, took the opportunity to buy precious metals while they were still priced low. Indeed, gold had effectively been shunned by the regular investor, sitting unloved in the low $300s for years, making gold a true bargain-basement investment. When the mainstream media picked up on this, people began to flock to this exciting, rising commodity – and it’s price rose more and more rapidly. Gold became THE investment. Companies sprang up touting it’s sparkle to new investors and as the price rose to ever dizzying heights, fortunes were made overnight. It was a literal gold rush – and those once-crazy owners of self-directed gold IRAs? Those who were first in? They did exceptionally well. Gold did exactly what gold does best. It hedges risk and protects wealth. Those investors who’d been last to the party, those who saw others making fortunes and threw the whole farm into gold hoping to strike it rich – got hurt. Early investors would still be in substantial profit, but the last in? They saw a loss causing them to curse gold and all it stands for. And so gold began another period in the wilderness, unloved and once again mocked, with a price bumping along neither going up, nor down… Which brings us to present day. Those unsustainable loans and leveraged trades that were blamed for the 2008 crisis? All time high. Billions of dollars in gold are being bought every day. Mints and refineries across the world are working 24-7 to meet demand. And somehow, all this time, despite growing warnings the masses are still jumping into stocks, still buying at record highs… It doesn’t take a genius to see what’s about to happen. Or to see the wise and the wealthy positioning themselves for the inevitable. Thankfully this time round there are a lot more crazies adding gold to their self-directed IRAs. Hopefully you’ll join them. If not, don’t say we didn’t warn you.  Originally Posted in the BD Blog, January 24, 2018

Originally Posted in the BD Blog, January 24, 2018

By Alison Macdonald

Commercial Editor at Bullion.Directory

After all the banks and those professional investors we pay so handsomely were running everything nicely – and it’s always much easier to sit back and let someone else take control.

After all the banks and those professional investors we pay so handsomely were running everything nicely – and it’s always much easier to sit back and let someone else take control. Overnight, trillions of dollars were wiped off the financial markets and millions of Americans saw over half the value in their 401(k) or IRA vanish into thin air.

Overnight, trillions of dollars were wiped off the financial markets and millions of Americans saw over half the value in their 401(k) or IRA vanish into thin air.

If they’d been planning on retiring in the next few years, their lifetime of hard work would have been vaporised by forces outside their control.

You see they’d been advising people to buy gold when they saw what the markets were doing, when they saw what are now acknowledged to be unsustainable levels of borrowing and watched dangerous bubbles spreading across multiple markets at the same time.

You see they’d been advising people to buy gold when they saw what the markets were doing, when they saw what are now acknowledged to be unsustainable levels of borrowing and watched dangerous bubbles spreading across multiple markets at the same time.

As the crisis broke institutional investors were first to run for “safe-haven” assets like gold, creating demand that caused gold prices to rise.

But even gold can’t protect against greed and bad advice, which saw far too many retail investors clamber into the now vigorous gold market, creating unsustainable conditions leading to a bubble forming – and an inevitable correction. Gold meanwhile is just sitting there, still out of favor, it’s price still relatively static – and if you consider that silver and gold are barely trading for what it costs to mine and refine them, you’d perhaps even see them as a bargain…

Gold meanwhile is just sitting there, still out of favor, it’s price still relatively static – and if you consider that silver and gold are barely trading for what it costs to mine and refine them, you’d perhaps even see them as a bargain…

You wouldn’t be alone.

Once again the ultra-wealthy, those contrarians and a number of big investment funds with an eye to the future are very quietly buying as much gold as they can.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.