As 2014 winds to a close, the U.S. Dollar is near a critical level that could influence the direction of precious metals prices in 2015.

Bullion.Directory precious metals analysis 30 December, 2014

Bullion.Directory precious metals analysis 30 December, 2014

By Terry Kinder

Investor, Technical Analyst

U.S. Dollar: Since May of this year, the dollar has exploded higher. Image: pixabay

U.S. Dollar: Since May the U.S. Dollar has been on a tear, rising from under $79.00 to over $90.00 before drifting slightly lower recently.

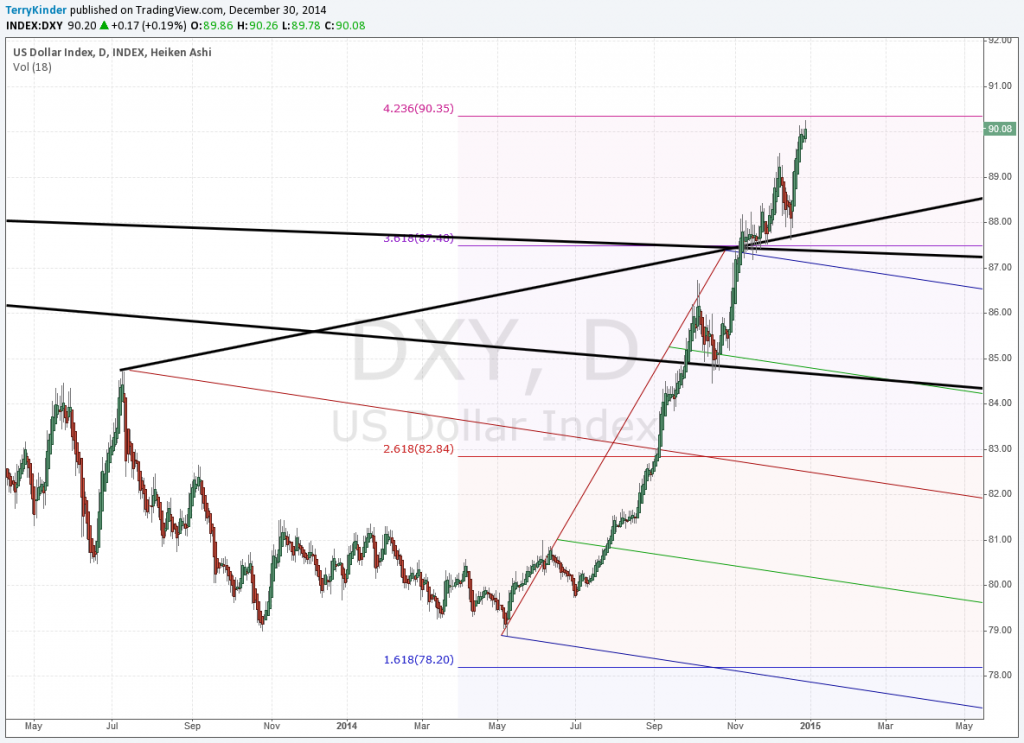

Since May, the U.S. Dollar has been on a tear, rising from under $79.00 to over $90.00 before drifting slightly lower recently. In the chart of the U.S. Dollar above, you can see just how steep and sharp the rise in the dollar has been. Also note that the dollar is quite near the 4.236 Fibonacci Retracement Level, or $90.35. Should the U.S. Dollar manage to pierce and hold above $90.35, then the most likely outcome would be the continuation of the dollar trend higher, perhaps to $92.00 or even above $96.00. Needless to say, continued dollar strength, if it can be sustained over time, would be expected to exert downward pressure on the price of precious metals.

A Longer View of the U.S. Dollar Price Trend:

As seen in the U.S. Dollar chart above, the dollar has clearly broken its long-term downtrend which dates all the way back to 1985. Each day that passes without the U.S. Dollar price falling back down to or below the long-term trend line makes it more likely that the uptrend will continue.

A Medium-Term Look at the U.S. Dollar Price Trend:

The U.S. Dollar bottomed at $70.69 back in 2008 and the DXY remained below a resistance line drawn from late 2005 for almost 9 years. That price resistance line was broken through in November of this year.

Clearly, the dollar is in an uptrend. Should the DXY be able to reach and hold above $90.35, then it appears likely the dollar will make a run at $92.00, or even above $96.00. With a higher U.S. Dollar, normally, we would expect precious metals to be pressured lower, although that isn’t always the case.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.