After the crazy year we’ve just had, one good question to ponder for a moment is: What does the U.S. economy look like as we head into next year? To answer that, this article will examine three sectors by looking at economic activity (including Wall Street), the inflation situation, and of course physical gold. So brace yourself…

Full Article →Who’s Pulling Santa’s Sleigh: Bulls or Bears?

Santa Claus is coming to town! What will he give gold: a gift or a rod? Like most of 2021, gold has been rubbing against $1,800 this week but did not have the strength to permanently rise above this level thus, we could say that gold was rather naughty this year and doesn’t deserve gifts from Santa.

Full Article →Powell Sends Gold Over $1800 – But only Briefly

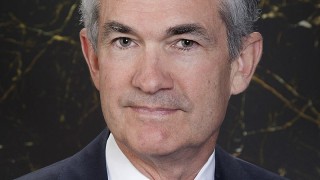

Finally, Powell admitted higher inflation risks and gold jumped above $1,800. Before anyone noticed, however, it plummeted below the key level again. Who are you Mr Powell? A reptilian or a human? A dove or a hawk?

Full Article →Shock And Awe Inflation

The Producer Price Index (PPI) is a measure of inflation expectations by industry producers. Most investors keep an eye on the Consumer Price Index (CPI). However, the CPI gauge is not only incomplete, it is, as U.S. Global’s Frank Holmes likes to say, “backward looking”

Full Article →Inflation and Gold: What Gives?

The Different Theories on What Moves Gold and Silver Prices: In the last Supply and Demand update, we discussed some different theories which attempt to explain what causes the gold and silver prices to move. We mentioned the:

Full Article →New Inflation Numbers Prompt Questions About Economic Future

In this brief video, Devlyn Steele, Augusta’s on-staff Harvard-trained economist crunches some of the numbers relating to inflation. Last week, new inflation numbers came out and there’s a lot of discussion about whether the numbers are reliable…

Full Article →Not Only Gold Lacks Energy – We ALL Do Now!

First a pandemic, then inflation, and now an energy crisis. Should you buy gold when preparing for the winter? Brace yourselves, winter is coming! Not only does gold lack energy to fuel its rally right now, but people from all over the world lack it to fuel their operations and to heat their houses…

Full Article →The Cost of Biden’s Plan is Probably More Than They Say

Through the Build Back Better Act (BBB), President Biden suggests he’s decided to close out his political career by trying to create a legacy of governmental progressivism the likes of which we’ve not seen up to this point in America.

Full Article →Fed Accelerates Tapering But Gold Shows Resilience

The Fed begins to get up steam and has finally turned its hawkish mode on. Was it something the gold bulls wanted to hear? The Fed’s full capitulation and unconditional surrender of the doves!

Full Article →Inflation Beast Roars – Gold Only Modestly Up

The inflation beast is growing stronger. Unfortunately for gold bulls, we cannot say the same about the yellow metal. Is sacrifice going on tomorrow? November readings clearly falsify central banks’ narrative about transitory inflation (which was already partially abandoned) and confirm my claim that inflation will stay longer

Full Article →Bond King Gundlach Bullish on Gold Long-Term

DoubleLine CEO Jeffrey Gundlach, who is perhaps best known as the “Bond King” for his legendary forays into the bond market, recently spoke about the current state of the markets and a preview of the new year. Gundlach’s primary forecast for gold is that it’s set to become a long-term hold despite a relatively quiet year.

Full Article →Lies, Damn Lies, and Government Inflation Statistics

Consumer prices are rising at the fastest pace in 40 years. The official report for November showed an increase of 0.8% versus October (9.6% annualized) and 6.8% over the past twelve months. What’s more, the month-over-month increases show inflation accelerating.

Full Article →Transitory is Out: Inflation is IN

One thing is certain, inflation is no longer officially “transitory.” For months, Federal Reserve Chairman Jerome Powell kept telling the public that rising inflation was transitory, and would soon subside. It hasn’t, and isn’t likely to in the near future either.

Full Article →Gold and Silver Stand Out as Inflation Ruins the Economic Picture

A recent survey of institutional asset managers revealed that 40% of those that don’t own gold presently plan to buy it within the next three years. The survey also found that 40% of those that do own gold right now expect to buy more of it within the same time period.

Full Article →Gold Stuck Between High Inflation and Strong Dollar

I have good and bad news. The good is that the price of gold rose 2% in November. The bad – is that the price of gold rose 2% in November. It depends on the perspective we adopt. Given all the hawkish signals sent by the Fed and all the talk about tapering of quantitative easing a small increase is an admirable achievement…

Full Article →Take This Job and Shove It!

The Great Resignation Continues… Record numbers of Americans are quitting their jobs, which is putting a major strain on our economy and infrastructure. As one economist puts it, we’ve really met a once-in-a-generation ‘take this job and shove it’ moment.

Full Article →Social Security ‘Sticker Shock’ Coming…

Mainstream media has been making a big deal about Social Security’s cost-of-living-adjustment (COLA) for next year. “Biggest jump since 1983,” according to at least one source. While it’s a fact that the 5.9% COLA is substantial when compared to prior years, once inflation is factored in, beneficiaries will experience “sticker shock.”

Full Article →Gold Holding Up as Cryptos Hammered

As Bitcoin made new all-time highs in recent weeks, an increasing number of investors referred to it as the “new gold.” Cryptos are a far cry from hard money, however, and recent price action may be indicative of why.

Full Article →Crypto Scams Explode Across America

Investing in cryptocurrency definitely means taking on risks. There’s an inherent volatility in this new asset class. Every time Elon Musk tweets, the crypto marks might surge or plummet 20%. Further, there’s a definite flavor of the Wild West in cryptocurrency exchanges, an aura of reckless enthusiasm cloaked in mystique.

Full Article →Weak November Payrolls Won’t Help Gold

November employment report was mixed. Unfortunately for gold, however, it won’t stop the Fed’s hawkish agenda. The nonfarm payrolls number is much lower than both October’s figure and the market expectations – so, it’s a huge blow to those optimistic about the US economy.

Full Article →Changes to Price Discovery If the Futures Market Fails

The U.S. dollar and precious metals futures have one thing in common. The value of the greenback and a contract for future delivery of metal are completely dependent on confidence. When, or if, that disappears, neither will be worth the paper they aren’t printed on.

Full Article →Home Storage Gold IRA Sees Couple Fined $300,000 in Back-Taxes

Investing in gold and silver offers the feeling of security so many Americans seek, especially in uncertain times. Allocation to precious metals in an IRA is a clear-cut choice for many. But a gold IRA investment may quickly become a decidedly suboptimal investment for those willing to cut corners.

Full Article →Fed Chairman Retires Laughable “Transitory Inflation” Line

In recent days, the Fed announced it would not only begin – but possibly step up – its tapering of monthly bond purchases, and global markets have not liked what they heard with stock indices falling last week and again this week, despite some brief recovery rallies.

Full Article →Top Analysts Make Huge “Christmas Predictions” for Gold

Daniel Fisher, CEO of UK bullion retailer Physical Gold, discussed the recent surge in gold demand and why gifting gold isn’t just an Asian phenomenon. He said that this is the second holiday season with off-the-charts demand. Last November’s sales were up 2,000% compared to 2019, and Fisher thinks history is repeating itself…

Full Article →Will the Anointed Experts Get It Wrong Again?

Investors fear government health officials will order new lockdowns to try to contain it.Never mind that previous lockdowns don’t appear to have worked. Some of the most draconian were imposed by Michigan governor Gretchen Whitmer. Her state now records the nation’s highest seven-day rate of infections.

Full Article →This Retirement Savings Loophole Is Closing Fast…

Congress Passes Backdoor Tax Hike by Removing a Popular Savings Loophole: Sometimes Congress doesn’t need to pass tax legislation directly. Sometimes it tries to tax retirement savers indirectly. That’s a polite way of saying, picking our pockets…

Full Article →Bloomberg Analysis: Gold To Outperform Stocks Next Year

While several analysts have upgraded their gold forecasts, Goldman’s are among the more bullish ones. The bank’s head of energy research Damien Courvalin said that gold is set to move far past its current price, bolstering previous calls for clients to consider the metal’s upside.

Full Article →What’s In Your Loan?

El Salvador has a scheme to borrow dollars to use bitcoin as a means to make more dollars. Those dollars will (they hope) be forked over by savers who will buy from them at a million bucks. Presumably, these new speculators will buy at a million bucks because they hope to sell at two million.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.