Every time gold moves back up, the same question emerges – was that THE bottom? The key thing for gold is the massive weekly reversal that formed over two weeks ago, and we saw another weekly reversal last week. The implications are very bearish for the weeks to come…

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the economy. Stories include: A decade of gold in review, forecasters call for $2,200 gold in 2024 and physical gold bullion is coming to a retail store near you. With a decade of Your News to Know), we felt like doing an overview of the stories that stood out the most.

Full Article →Outlook 2024: Gold Set to Make History

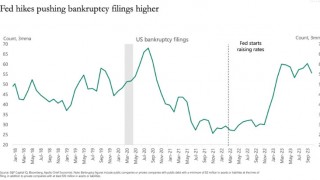

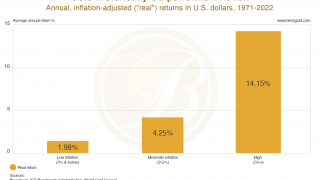

The gold market is poised to make history in 2024. It enters the New Year within striking distance of new all-time highs. How high will gold go? Much depends on how low interest rates and the U.S. dollar go. The Federal Reserve ended its rate hiking campaign last fall. It is expected to pivot toward monetary easing later this year…

Full Article →The American Dream vs. Bidenomics… This Is Getting Ugly

Back when inflation was heating up to historic levels in July 2022, President Biden tried to downplay inflation as “unacceptably high” but “not as bad as it looks.” The truth was actually pretty dire back then, as an increasing percentage of Americans were struggling to afford putting food on their tables. In fact, they still are right now.

Full Article →Against the backdrop of high inflation rates and geopolitical uncertainty, states are increasingly enacting measures that encourage saving in precious metals and even using gold and silver as money. With five bills signed into law in 2023, sound money reforms are gaining momentum across the United States.

Full Article →There is a phrase you will hear a lot over the coming decade: Artificial Intelligence (AI). Not that you haven’t heard it already. But thanks to multiple major breakthroughs in 2017, like how language is used across different AI development efforts, innovation has accelerated at a breakneck pace. And there’s no sign of it slowing down.

Full Article →Why Gold and Silver Just Surged

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Reflecting on recent gold price changes, China’s obsession with safe-haven gold and could central banks break last year’s gold buying record?

Full Article →Demand for copper has been rising at bullion dealers. The number of products available has also risen dramatically in recent years. Mints and refiners are responding to increased demand with a wide variety of new copper rounds and bars with some interesting designs. The number of questions we get from clients has been rising, along with the interest.

Full Article →Central Banker Reveals Why They Are “All In” on Gold

The pace at which the world’s central banks have been accumulating gold has been nothing short of relentless. Central banks bought more gold in 2022 than in any other year up to that point: 1,078 metric tons. And given the pace at which central banks are continuing to buy gold this year, it’s very possible 2023 will see a new record total

Full Article →Bidenomics is Bankrupting the Nation

Back in July, we reported on the Bidenomic “pay cut” of $5,600 per year that every American has suffered during Biden’s term. Unfortunately, the failures of Biden’s economic policies are starting to pile up. They’re almost impossible to ignore already. The media won’t be able to put a positive spin on it for much longer…

Full Article →We know it’s been an unfortunate year for fiscal management in the United States. The year has seen a contentious debt-ceiling standoff resolved in just the nick of time; a reduction in the nation’s credit rating for only the second time ever; and a budget stalemate leading to the removal of a House speaker from his job for the first time in history.

Full Article →Important Analogy for the Markets – Including Gold

Some say that war never changes, and in some aspects, that’s true. But markets’ reactions to war are also remarkably similar. What I’m going to start today’s analysis with is not something you’ll read in many places. Usually, analysts are either following just the technicals or just the fundamental aspects of a given market. But the true edge comes from…

Full Article →What Happens to Gold Price When it Finally Rebounds?

After testing new highs, gold is likely to move far, up or down. Previously, I wrote that the price of gold was about to decline after its massive reversal and that’s exactly what happened. The decline is now likely to continue, but there’s a good chance that we’ll see at least a small rebound from $2,000 or slightly higher levels.

Full Article →Sound Money Scholarship Awards $13,500 to 9 Outstanding Students

“The overwhelming interest in the 2023 Sound Money Scholarship was deeply heartening. At a time not only of high inflation and bank instability but also when states are advancing dozens of sound money bills, this fundamentally important issue is reaching an inflection point”

Full Article →Gold Price at New Highs? Sellers Say NO.

The huge rally in gold and the monstrous decline that followed provided a sign of epic proportions. Gold price’s huge-volume reversal is the last thing that anyone even remotely interested in the precious metals market should ignore. The Gold price was just soaring to new highs like there was no tomorrow, and then it happened.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold passes $2,100 to post a new all-time high, the only two solutions to the global debt crisis aren’t applicable, and a recent government study returns some very rough inflation data.

Full Article →Despite President Biden’s insistence that the U.S. is experiencing the “greatest economic recovery ever,” the evidence suggests otherwise. In fact, the U.S. economy could be heading for one of the most painful periods of economic turmoil of the last 15 years. And it’s all thanks to the disastrous policies known as “Bidenomics.”

Full Article →A minority of citizens say American dream “still holds true” as half of Americans earn less than $3,400 per month. As inflation soared in 2022 and the Federal Reserve set about the task of reining price pressures in with a singular, surgical focus on raising interest rates, sentiment among consumers struggled in the face of those headwinds…

Full Article →Don’t Buy at the Top. Analyze.

The USD Index is soaring today, so let’s start today’s free analysis with this market. You can probably already tell that it’s likely that today’s (0.6+) rally is the start of something bigger and not just a one-day event. Let’s check why – starting with my previous comments on this market as they remain up-to-date…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold’s downside doesn’t sound so bad these days, where we are on the 1970s track, and gold demand surging as Indian buying returns to pre-pandemic levels.

Full Article →Americans might be well served to contemplate how safe cash really is. Money market funds aren’t going to keep pace with inflation over the long run. Nor are they immune from credit risk, which could manifest at any time. Bullion investors would like to see some of this capital pour into the gold and silver markets.

Full Article →Stocks and Silver Have Something to Say about Gold

Silver just shot up, and given what the stock market is doing, it makes perfect sense. Namely, it’s most likely the final part of the rally in them both, and the same is the case for gold and mining stocks. Starting with the stock market, it’s still the case that the shares are following their early-2022 path.

Full Article →Are Americans being unduly gloomy, and unreasonable in their unwillingness to accept the beneficial reality they’re actually living? Or are they entirely justified in their pessimism over what they see as an economy growing increasingly less responsive?

Full Article →As markets reopen following the Thanksgiving holiday, investors are feeling thankful that interest rates are no longer rising. Stocks, bonds, and precious metals have all gained ground in recent days as long-term rates have come down. Meanwhile, expectations for the Federal Reserve to cut its benchmark short-term rate in 2024 have risen.

Full Article →With all of the unanswered questions floating around in today’s economy (like “When will the recession start?), one thing is fairly certain – Today’s economic uncertainty is likely to stick around for a while. With that in mind, at some point you might wonder if you’ve saved enough to enjoy a comfortable and stress-free retirement in the face of that uncertainty…

Full Article →Silver production is failing to keep up with rising demand. But you wouldn’t know it by looking at the silver price. Phillips Baker, CEO of Hecla Mining and Chairman of the Silver Institute, the metal’s most prominent industry trade group, recently made a presentation at the London Bullion Market Association Global Precious Metals conference in Spain…

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold as sentiment-driven as ever, $34 silver soon, and U.S. Mint’s gold sales have already outpaced last year’s figures. The U.S. federal government is indebted by over $33 trillion, and it matters…

Full Article →Let’s drill down on the spending that’s helped fuel the economy. It might interest you to know that real wage growth (earnings after inflation and taxes) has declined in each of the last three months. So, from where have Americans been getting the money for all the spending that sends GDP growth ever higher?

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.