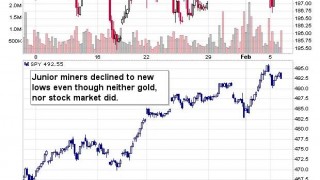

What a beautiful and profitable breakdown in junior miners! And that’s not all! This part of the bigger decline is just starting, so junior miners still have some room to fall. Gold, silver, and the S&P 500 futures are calm in today’s pre-market trading, but don’t let that fool you – the market is about to slide once again.

Full Article →A Banking Crisis Is Quietly Brewing

The Federal Reserve’s most recent policy statement came with a curious omission. Fed officials removed language from previous statements that proclaimed “the U.S. banking system is sound and resilient.”

That begs the question: Is the banking system no longer sound and resilient?

Global Currency Shift as Dollar Cannibalizes Itself

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Global de-dollarization as a major driver of gold prices, gold demand statistics for 2023, and how silver is becoming more industrial by the day. A safer safe haven: The U.S. dollar is losing ground to gold…

Full Article →Analysts Ponder Metal’s Strength During Rate Surge

The prospect of interest rates reversing direction and declining after nearly two years of a steady surge upward has a lot of people brimming with excitement. Among them are those with a strong affection for gold, who know it and other precious metals can respond well during periods of monetary policy that tend to weaken the dollar.

Full Article →Gold Price Forecast for February 2024

Forecasting gold prices is not difficult if you focus on the right things. The key is knowing what. Many people are interested in commodity prices, but few know in order to predict the prices of gold, it’s great to actually analyze mining stock values. But you knew, and were not caught by gold’s fake intraday and overnight rallies in the previous days.

Full Article →“Tax Relief Act” Exposed: Something’s Ominous…

As it stands right now, it appears like Biden’s entire first term will have been plagued by varying degrees of unacceptable price inflation. No matter how the corporate media spins it, he just can’t seem to lead the country out of this persistent economic trend. The rate of price inflation is easing, but core inflation remains at a pace not seen since the early 1990s.

Full Article →The 4 Financial Scams to Watch Out For in 2024

In 2023, fraudulent activities inflicted over $7 billion in losses to American consumers within the first nine months, up 5% from the year before. Financial scammers are quick to adopt new technologies to steal money from their targets. Thanks to the rapid growth of artificial intelligence tools, criminals can now perfectly copy your loved one’s voice

Full Article →Soaring Gold Price, Soaring Expectations

Gold price futures jumped higher today – was the current gold price forecast affected? In short, not really. As I explained previously, it’s much better to focus on how the market is likely to interpret whatever is coming its way, and we know this thanks to technical chart analysis.

Full Article →Analysts Say Gold About To Have A Massive Bull Run

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: CPM Group says 2024 and 2025 will be even better for gold, why silver stayed dormant in 2023, and gold is getting pricey in Egypt…

Full Article →Now I’m not a particularly superstitious person, nor am I religious, but just having THAT number center stage on our home page feels weird. I know that 1666 listings, should be no different than 1665 or 1667, and yet this is a number that’s giving me a bit of pause. And stuff like this impacts gold.

Full Article →Governor Greg Abbott Delivers Vote of No Confidence

Texas Governor Greg Abbott gave up on the Biden administration doing much to secure his state’s border with Mexico. As an estimated 6 million people, including large numbers of fighting age men, have been pouring illegally into border states over the past 3 years, Abbot has started using the Texas national guard and state police to put up barriers.

Full Article →Business Defaults Soar in Adverse Rate Environment

This week, we’re going to use our binoculars to get a closer look at the corporate debt cliff that’s starting to form…and also try to ascertain to what degree companies – and investors – can count on a change in the rate environment to lower the risks of slipping over the edge.

Full Article →We Regret to Inform You, Janet Yellen is at it Again.

We regret to inform you, Janet Yellen is at it again. This time, it appears like she’s campaigning for another Biden term by highlighting his economic “success.” After all, he probably needs all the campaign help he can get. Yellen’s “strategy” isn’t all that novel. She seems to be starting by leveraging Biden’s infrastructure spending but…

Full Article →Nearly Everyone Falls For These Two Savings Traps

While quite a few personal finance pundits have suggested that savers can expect a 12% annual return, when you incorporate the impact of volatility and inflation, 7% is a more accurate historical estimate for an aggressive investor and 5% would be more realistic for a more conservative saver.

Full Article →US National Insolvency Draws Closer

Bullion investors are naturally concerned about unsound monetary and fiscal policy. Many of them buy precious metals, in part, because they recognize the federal government is out of control when it comes to borrowing and spending. This makes the most recent betrayal by the Republicans in the House of Representatives relevant to our readers.

Full Article →A Little Good News on Inflation Doesn’t Cover the Bad

After 3 years of relentless (sometimes historic) inflation, it’s about time some good news made its way through the economic carnage. Some categories of goods have finally moved into deflationary pricing. That is, a handful of items are starting actually decline in price. Better late than never, even though all consumer price inflation isn’t deflationary just yet.

Full Article →The Gold Yield Movement Advances

I launched this business with a simple thesis. Interest will draw gold into the market; without interest, gold disappears into private hoards. The obvious reason is that people want a return. Without a return, they put their gold away and seek to avoid risk. A return provides an incentive to bring out the gold. Everyone wants to make a profit.

Full Article →A large bipartisan contingent of Wisconsin legislators have reintroduced legislation seeking to end Wisconsin’s outdated practice taxing purchases of gold and silver. Assembly Bill 29 and Senate Bill 33, primarily sponsored by Rep. Shae Sortwell and Sen. Duey Strobel (R – Saukville), respectively, would align Wisconsin with the policies of 43 other U.S. states.

Full Article →Two Undeniable Gold Trends Coming In 2024

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Are the comparisons with 2008-2011 in gold holding up? The World Gold Council’s 2024 outlook for gold and China’s gold-buying streak extends to 14 months…

Full Article →Bitcoin Is No Substitute for Gold

Some proponents still market the crypto asset as “digital gold.” That combined with the dramatic rally in bitcoin prices over the past year means there are plenty of interested investors. There are good reasons to own bitcoin, but they are not the same reasons to own physical gold…

Full Article →Bidenomics Impacts Retirement Accounts

Bidenomics might have a number of fans at 1600 Pennsylvania Avenue. But among regular Americans? The data suggests, “Not so much.” Officials at the White House aren’t using the term as often as they once did. They seem to be concerned about evidence that it’s been landing with something of a dull thud lately…

Full Article →The Bidenomics Job Creation Myth

The White House is busy leveraging the media to tout the headline 216,000 jobs that were added in December. That was a whole lot more than the 170,000 economists predicted. The administration is eager to tell you this is a strong finish to 2023’s spectacular job growth. Bidenomics is winning! Lets look more closely at the propaganda…

Full Article →A Pause is a Pause, Nothing Else

Why did the miners’ decline pause? Might this be a bottom? In short, it might, but it’s highly unlikely that this is indeed a bottom. Yesterday’s pause is natural given the support that miners are encountering and given the situation in the USD Index. Let’s start with the latter…

Full Article →The Reckoning in Pension Funds Draws Closer

The outlook for pension systems is growing increasingly dire. Promises made to retirees have been generous and they can only be kept if prices for all kinds of assets move consistently higher. The trouble is that the past three years don’t look like the first twenty years of the century…

Full Article →The Stock Market is in Trouble

Something’s brewing and it doesn’t take a genius to see the signals and read between the lines… The three major stock indices, S+P 500, Dow Jones, and NASDAQ composite have had late afternoon declines five out of the last six trading days. The Dow Jones made a new all-time high on January 2, 2024 but the S+P 500 and NASDAQ Composite did not follow

Full Article →Rallies? Nope. These Are Breakdown Verifications

Some rallies – being breathers within declines – are not bullish. And that’s what we see in gold and silver today. Before moving to the precious metals sector, let’s take a look at the currency markets as what’s happening there is one of the key building blocks for the situation in the gold, silver and miners.

Full Article →Central-Bank Forecasting: A Legacy of Inflation?

Here in the United States, the annual inflation rate – as measured by the headline consumer price index (CPI) – reached above 9% in June 2022. At the time, it was the fastest annual inflation rate in nearly 41 years. Since then, the inflation rate has steadily subsided, coming in slightly north of 3% in November. Significantly better, to be sure… but still an issue

Full Article →There is an untold story in American monetary history. Some are reluctant even to discuss it. I’m referring to the U.S. Secret Service’s very own role in the destruction of sound money in America. As federal government central planners began circulating unbacked paper proxies, they formed a Gestapo-like police agency to enforce the scheme.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.