Recently, we’ve spent time examining the phenomenon – probably not too strong a word – of gold staying strong in spite of interest rates that have not merely risen, but soared. From March 2022 through July 2023, the Federal Reserve hiked America’s benchmark interest rate, the federal funds rate, 11 times, a total of 525 basis points.

Full Article →The American Dream Is Dead, And THIS Is What Killed It

The total amount of publicly held debt in the United States is nearing $34 trillion. The historic and unsustainable pace that it has piled up over the last decade is insane. In addition, GDP can’t keep up with the pace that debt keeps piling up. Expressed officially as the ratio of Public Debt to GDP, that sits at a record 120% – and it’s still rising.

Full Article →US to ‘Save’ Social Security (By Raiding Savings)

It’s a well-known fact by now that the Social Security Trust Fund is in big trouble. It’s also a fact that without a reasonable solution by 2034, retirees will face a serious reduction (20-25%) to their monthly Social Security benefit. The last time the trust fund was depleted like this was back in 1982.

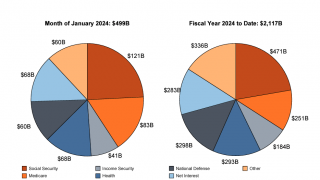

Full Article →US Government Runs Another Deficit Despite Record Revenue

The federal government’s budget deficit was “only” $21.93 billion in January. That was a significant improvement over the $129 billion shortfall recorded in December. The smaller deficit was primarily due to increased government receipts thanks to a big drop in tax refunds. But the Biden administration is still spending like a drunken sailor.

Full Article →The Incoming Gold Shortage Nobody Is Talking About

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: How a slight rebalancing to savings could shake the gold market, more bullish forecasts for gold and gold’s movement other currencies hints at its future trajectory. Will there be enough gold to go around?

Full Article →Russia Turns to Gold to Raise Cash and Skirt Sanctions

Russia has reportedly used gold to evade currency restrictions put in place as part of economic sanctions levied in the wake of the invasion of Ukraine. Under the sanction regime, Russian banks are prohibited from importing dollars or euros into the country, enforced by locking Russia out of the SWIFT network

Full Article →Powell Scolds Biden “The Debt is Unsustainable”

There really is no way to sugarcoat the current debt trend. It’s already insane (and it’s going to get worse) Following is even more data that further confirms the fact that the total debt load for the American economy is unsustainable. The debt also appears to have caught the attention of central bankers (in a meaningful way this time).

Full Article →Egypt Turns to Silver to Hedge Against Inflation

With gold prices skyrocketing in their local currency, Egyptians are turning to silver to protect their savings from skyrocketing inflation. According to a Reuters report, surging prices and a weakening currency have driven the price of gold to record high levels. In order to protect their wealth, many are turning to silver as a more affordable alternative.

Full Article →Commercial Real Estate Woes Challenge Banking System

In March 2023, the world became reacquainted with a measure of the anxiety felt during the financial crisis, when the global banking system destabilized. Last spring, in a span of less than eight weeks, four regional U.S. banks closed when fast-rising interest rates sharply reduced the value of the U.S. Treasury securities into which they’d heavily invested…

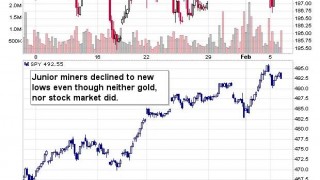

Full Article →Junior Miners Just Broke New Lows – Will Gold Follow?

What a beautiful and profitable breakdown in junior miners! And that’s not all! This part of the bigger decline is just starting, so junior miners still have some room to fall. Gold, silver, and the S&P 500 futures are calm in today’s pre-market trading, but don’t let that fool you – the market is about to slide once again.

Full Article →A Banking Crisis Is Quietly Brewing

The Federal Reserve’s most recent policy statement came with a curious omission. Fed officials removed language from previous statements that proclaimed “the U.S. banking system is sound and resilient.”

That begs the question: Is the banking system no longer sound and resilient?

Global Currency Shift as Dollar Cannibalizes Itself

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Global de-dollarization as a major driver of gold prices, gold demand statistics for 2023, and how silver is becoming more industrial by the day. A safer safe haven: The U.S. dollar is losing ground to gold…

Full Article →Analysts Ponder Metal’s Strength During Rate Surge

The prospect of interest rates reversing direction and declining after nearly two years of a steady surge upward has a lot of people brimming with excitement. Among them are those with a strong affection for gold, who know it and other precious metals can respond well during periods of monetary policy that tend to weaken the dollar.

Full Article →Gold Price Forecast for February 2024

Forecasting gold prices is not difficult if you focus on the right things. The key is knowing what. Many people are interested in commodity prices, but few know in order to predict the prices of gold, it’s great to actually analyze mining stock values. But you knew, and were not caught by gold’s fake intraday and overnight rallies in the previous days.

Full Article →“Tax Relief Act” Exposed: Something’s Ominous…

As it stands right now, it appears like Biden’s entire first term will have been plagued by varying degrees of unacceptable price inflation. No matter how the corporate media spins it, he just can’t seem to lead the country out of this persistent economic trend. The rate of price inflation is easing, but core inflation remains at a pace not seen since the early 1990s.

Full Article →The 4 Financial Scams to Watch Out For in 2024

In 2023, fraudulent activities inflicted over $7 billion in losses to American consumers within the first nine months, up 5% from the year before. Financial scammers are quick to adopt new technologies to steal money from their targets. Thanks to the rapid growth of artificial intelligence tools, criminals can now perfectly copy your loved one’s voice

Full Article →Soaring Gold Price, Soaring Expectations

Gold price futures jumped higher today – was the current gold price forecast affected? In short, not really. As I explained previously, it’s much better to focus on how the market is likely to interpret whatever is coming its way, and we know this thanks to technical chart analysis.

Full Article →Analysts Say Gold About To Have A Massive Bull Run

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: CPM Group says 2024 and 2025 will be even better for gold, why silver stayed dormant in 2023, and gold is getting pricey in Egypt…

Full Article →Now I’m not a particularly superstitious person, nor am I religious, but just having THAT number center stage on our home page feels weird. I know that 1666 listings, should be no different than 1665 or 1667, and yet this is a number that’s giving me a bit of pause. And stuff like this impacts gold.

Full Article →Governor Greg Abbott Delivers Vote of No Confidence

Texas Governor Greg Abbott gave up on the Biden administration doing much to secure his state’s border with Mexico. As an estimated 6 million people, including large numbers of fighting age men, have been pouring illegally into border states over the past 3 years, Abbot has started using the Texas national guard and state police to put up barriers.

Full Article →Business Defaults Soar in Adverse Rate Environment

This week, we’re going to use our binoculars to get a closer look at the corporate debt cliff that’s starting to form…and also try to ascertain to what degree companies – and investors – can count on a change in the rate environment to lower the risks of slipping over the edge.

Full Article →We Regret to Inform You, Janet Yellen is at it Again.

We regret to inform you, Janet Yellen is at it again. This time, it appears like she’s campaigning for another Biden term by highlighting his economic “success.” After all, he probably needs all the campaign help he can get. Yellen’s “strategy” isn’t all that novel. She seems to be starting by leveraging Biden’s infrastructure spending but…

Full Article →Nearly Everyone Falls For These Two Savings Traps

While quite a few personal finance pundits have suggested that savers can expect a 12% annual return, when you incorporate the impact of volatility and inflation, 7% is a more accurate historical estimate for an aggressive investor and 5% would be more realistic for a more conservative saver.

Full Article →US National Insolvency Draws Closer

Bullion investors are naturally concerned about unsound monetary and fiscal policy. Many of them buy precious metals, in part, because they recognize the federal government is out of control when it comes to borrowing and spending. This makes the most recent betrayal by the Republicans in the House of Representatives relevant to our readers.

Full Article →A Little Good News on Inflation Doesn’t Cover the Bad

After 3 years of relentless (sometimes historic) inflation, it’s about time some good news made its way through the economic carnage. Some categories of goods have finally moved into deflationary pricing. That is, a handful of items are starting actually decline in price. Better late than never, even though all consumer price inflation isn’t deflationary just yet.

Full Article →The Gold Yield Movement Advances

I launched this business with a simple thesis. Interest will draw gold into the market; without interest, gold disappears into private hoards. The obvious reason is that people want a return. Without a return, they put their gold away and seek to avoid risk. A return provides an incentive to bring out the gold. Everyone wants to make a profit.

Full Article →A large bipartisan contingent of Wisconsin legislators have reintroduced legislation seeking to end Wisconsin’s outdated practice taxing purchases of gold and silver. Assembly Bill 29 and Senate Bill 33, primarily sponsored by Rep. Shae Sortwell and Sen. Duey Strobel (R – Saukville), respectively, would align Wisconsin with the policies of 43 other U.S. states.

Full Article →Two Undeniable Gold Trends Coming In 2024

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Are the comparisons with 2008-2011 in gold holding up? The World Gold Council’s 2024 outlook for gold and China’s gold-buying streak extends to 14 months…

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.