We take a look at GLD charts for clues about the shape of things to come

Bullion.Directory precious metals analysis 25 February, 2015

Bullion.Directory precious metals analysis 25 February, 2015

By Terry Kinder

Investor, Technical Analyst

In Gold Triangles, Fib Spirals, Pivot Points we looked at some unusual chart patterns to get a better idea about the future gold price. If you haven’t read it yet, take a look at it, especially the part about triangles as it will help gain a better understanding of one of the charts to be presented here. We aren’t going to rehash the Pythagorean Theorem or the more esoteric elements here.

With that as preface, let’s begin with the charts.

GLD triangles

GLD looks to be forming a bottom in the week of 30 March 2015 to week of 6 April 2015 time frame. Expected price is around $111.32. Note: This technique is somewhat experimental so it is not recommended that you use it as the basis for any trading decisions. As you’ll see later, this coincides fairly closely in price with another chart.

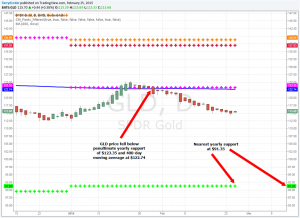

GLD daily chart featuring yearly pivots

On the GLD daily chart which features the yearly pivots, GLD has fallen below its penultimate yearly support pivot of $123.35 and also the 400-day moving average at $122.74. The nearest yearly pivot is $91.35. While I’m not necessarily expecting the price to go to the ultimate pivot, it’s good to know where that support is.

GLD daily chart featuring weekly and yearly pivots

On the GLD daily chart featuring weekly and monthly pivots, GLD fell below support (now resistance) at $118.72. However, it should have good support between $111.99 and $112.10. Note that this level is quite close to the $111.32 indicated from the triangle chart at the beginning of this post.

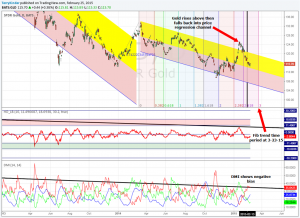

GLD Fib trend time

In this Fib trend time chart the last period charted ends on 23 March 2015 and could indicate a possible change in direction of price

Our final chart shows Fib trend time for GLD. This is a similar chart to that featured in GLD Deviation Ends Friday the 13th where we made the case that the GLD price would fall back into its price regression channel before Friday the 13th. This, indeed, did happen.

A couple of other noteworthy features of this chart are:

1) The final fib trend time shown on the chart ends 23 March 2015. This is fairly close to the time frame of 30 March 2015 to 6 April 2015 periods mentioned for a potential pivot low in GLD;

2) DMI shows a negative bias. This bias is close to as high as it has been this year. This may not be extremely important as this is a daily chart, but interesting nevertheless.

Conclusion

GLD appears to be following a similar path to that we outlined previously with regards to gold. However, while gold looks to bottom in early May, GLD could bottom closer to late March or early April.

Expect GLD to bottom somewhere near the end of March or beginning of April. Target price is approximately $111.32 to $112.10.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.