Those who are looking to get rich quick can try their luck at lotteries, casinos, or highly leveraged derivatives markets. Most who do will, predictably, end up getting poorer. A sound investing strategy won’t necessarily bring you jackpot gains, but it will protect you from disastrous losses while…

Full Article →Looking at every recession since December 1969, the economist David Rosenberg has calculated that, on average, the Leading Economic Index starts to decline 13 months before a recession begins and falls 4.6 percent before the recession begins. By that metric, we’re even deeper into the danger zone than

Full Article →A Little Decline Here, a Small Rally There… It’s Happening.

The USD Index is on the rise, and the precious metals sector is declining. Big things can have small beginnings, though, and that’s normal. In yesterday’s analysis, I focused on what’s currently most important from the medium- and short-term point of view on… pretty much all markets

Full Article →Last week, the Fed launched a new payment processing system dubbed “FedNow.” Officials say FedNow will allow individuals and businesses to initiate instant funds transfers between banks. Critics warn FedNow could be a prelude to central bank digital currency (CBDC) that threatens financial privacy and freedom.

Full Article →By now, there’s a good chance you’ve heard of central bank digital currencies (CBDCs). In the U.S., they’ve come to be known popularly as “digital dollars.” Basically, CBDCs are the digital versions of the same official currencies issued by central banks around the world…

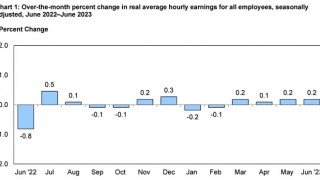

Full Article →Following the government’s panicked response to the Covid pandemic, the resulting economic devastation and two-plus years of historic inflation thus far… There is finally some good news! According to data released from the Bureau of Labor Statistics (BLS), wages are finally outpacing inflation… Or are they?

Full Article →This week, Your News to Know rounds up the latest top news stories involving gold and the overall economy. Stories include: The trend of central bank gold repatriation, analyzing gold’s headwinds, and man from Kentucky finds 700 Civil War era coins almost in his backyard.

Full Article →One of the most common questions we get from clients is whether they should buy either gold OR silver. Anyone researching an investment in bullion can find good arguments for owning either metal. One of the best ways to evaluate the prospects of one metal versus the other is by looking at the gold/silver ratio.

Full Article →When you’re planning for retirement, one of the many decisions you’ll have to make is whether to contribute “pre-tax” or “after-tax” dollars. Each has its advantages, and here’s a general summary of maximizing your savings using a 401(k) plan…

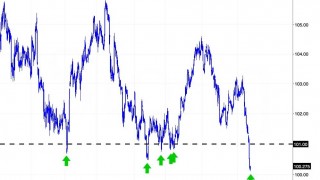

Full Article →USDX Hits New Lows, Is Gold Asleep?

And so, it happened – against the odds and rising real rates, the USDX is at a new yearly low. But is gold at a new yearly high?… The decline in the USDX was truly significant. Things are (still) very exciting on the USD Index front. Yes, it’s declining, and yes, it’s excitingly… Bullish.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Russia announces gold-backed BRICS, Larry Lepard predicts total fiat failure by 2030 and Zoltan Pozsar’s take on the new monetary world order.

Full Article →2023 is barely half finished. Yet already we know America’s flirtation with debt default will most certainly prove to be one of the biggest news stories of the year. The way events unfolded still may be a fresh memory for some.

Full Article →The speed at which a bank can be deemed insolvent has increased dramatically with improvements in communication and technology, which prompts businesses, institutions, and wealthy individuals to rethink ways to safely store their cash.

Full Article →Ready for MORE Profits in Gold Miners?

So, yeah, gold, silver, and mining stocks declined yesterday. This did not surprise you, as I’ve been emphasizing multiple reasons due to which this was the likely outcome. But I admit the power with which juniors declined yesterday amazed me even more than I thought it would. And I get rarely surprised by the markets.

Full Article →n a historic move, the New Jersey Assembly has unanimously voted to eliminate the sales tax on physical gold and silver. Assembly Bill A5294 exempts precious metals purchases over $1,000 from state sales taxes, aligning New Jersey with the majority of states that have already ended this regressive tax.

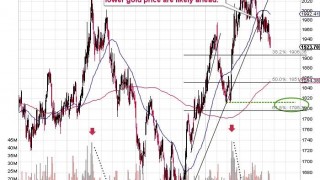

Full Article →Gold Price Forecast for July 2023

The month is over. The week is over. Some things changed, some things didn’t. What can one predict for gold price in July 2023? While it might appear that not much happened in gold last month, in reality, it declined by over $50 – and that’s no small feat.

Full Article →Time to batten down the hatches, folks. That warning comes from HSBC Asset Management earlier this week. It could be a long recession, too. It’s not that surprising, once you take the highlights of HSBC’s into account. Even worse, chief strategist Joseph Little added a bit of context…

Full Article →If you can see beyond the mainstream media’s attempted glossing over of Biden’s failures, one topic stands out: Historic inflation since June 2021. Of course, Biden doesn’t deserve all the blame for inflation heating up. Powell’s Fed practically ignored it until the “inflation train” had already left the station.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: John Williams on why inflation is worse than presented, Poland wants more gold, and Korea introduces gold ATMs.

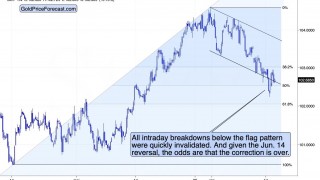

Full Article →Gold Can’t Slide Indefinitely, Can It?

Gold price “was supposed to” hold above $2k, but it looks ready to break below $1,900. At what price can we see a turnaround? Let’s investigate gold’s chart to find out…

Full Article →Last week was another big week in what has become perhaps the most prominent cycle of inflation and interest-rate movements since the historic era of the “Great Inflation” 40-odd years ago…

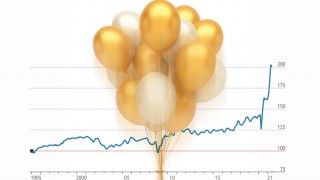

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Five-figure gold in the long-term, the silver supply picture is worse than we know, and prices force Turkish couples to turn to imitation gold for their traditional wedding celebrations.

Full Article →It’s Not Necessarily All About Gold Price…

Boring day for precious metals, but brace yourself for some major stocks action! I’ll be honest – there’s not much going on today, at least for the precious metals market. Things are pretty interesting for stocks, though…

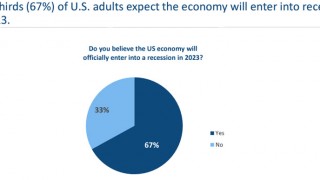

Full Article →U.S. manufacturing index contracts for seventh straight month. Are we headed for a recession? That appears to be among the most pressing economic questions of the day. And there doesn’t seem to be a consensus opinion one way or another.

Full Article →We’ve spent a lot of time discussing financial anxiety and planning for financial security past few years. Today, we’re going to shift gears. Instead, we’re going to discuss affluent Americans who are confident in their financial stability and believe their savings are secure enough to weather any economic storm.

Full Article →Now THAT Was the Game-changer for the Price of Gold!

In a game-changing turn of events, yesterday’s FOMC meeting shattered hopes of a quick, dovish U-turn as the Fed announced the possibility of raising rates twice this year. Yesterday’s FOMC and the following press conference were groundbreaking.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Central banks could be planning modernize their gold reserves, Wheaton CEO’s gold and silver predictions, and BlackRock’s analysts on gold’s near-term prospects.

Full Article →Last Saturday, President Biden signed into law a bill that suspends the debt ceiling through January 1, 2025. With that gesture, the federal government avoided defaulting on its obligations for the first time in history. So, crisis averted, yes? For now, absolutely.

Full Article →