Since May 2021, inflation persistently above the Fed’s 2% target has devoured our purchasing power, day by day. Making the cost of living impossible to predict and planning for the future increasingly uncertain. After a short period of cooling off, inflation is heating up again on multiple fronts. One rather unexpected price surge will make budgeting a challenge…

Full Article →The Biggest Con Job in Banking: The Savings Account

Savings accounts today offer the highest yields in 15 years. Even so, they may not be the best way to protect your savings from inflation. When the Fed raises interest rates to curb inflation, ripple effects spread across the economy. Some of the impacts are negative (especially if you owe a lot of money), but others are positive for savers…

Full Article →They say that time flies when you’re having fun. Or apparently if you’re baking under a ridiculously hot desert sun in the middle of summer, with marginally effective air conditioning. It’s hard to believe we’ve been based in Dubai for 18 months already, it seems like just yesterday Mac and I stepped out of the doors at DXB to a bewilderingly humid heat

Full Article →Attacks on Rule of Law Point to Need for Off-Grid Money

The assault on individual rights is accelerating, and investors would be wise to think about the assets they hold in a world where the rule of law is failing. Last week, New Mexico Governor Michelle Lujan Grisham banned citizens from carrying firearms in Albuquerque, neither bothered nor slowed by recent U.S. Supreme Court affirmations of the 2nd Amendment.

Full Article →Insider Gold Buying Reaches New Record Level

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Global gold holdings rise to highest level since 2012, a one-way flood of gold from West to East and are we missing out on platinum’s comeback?

Full Article →Central Banks Decide It’s Time for Their Metals to Come Home

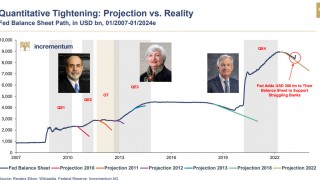

It remains to be seen if, in fact, interest rates start declining next year after what has been a year and a half of the fastest rate-tightening cycle in 40 years. But expectations are growing that Federal Reserve officials will be making a more dovish tilt in their application of monetary policy beginning at some point in 2024

Full Article →Threat of New Economic Lockdowns Grows

A late summer rise in COVID cases is triggering calls by control freaks across the globe for reimposing mandates and restrictions on the public. Civil liberties advocates are warning that crippling new economic lockdowns could be coming down the pike. Public health officials are talking up widespread masking yet again

Full Article →Here’s Why Everyone Will Need Gold Soon

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Investment firm sounds off on gold investment in a commodities era, gold standard and why we might have been here before, and did you notice gold hit another ATH in the Japanese yen?

Full Article →2023 Deficit Surge: A Concerning “New Normal”?

The day before signing the Fiscal Responsibility Act into law, President Biden said, “We’re cutting spending and bringing deficits down.” In the merely three months since the Fiscal Responsibility Act became law, the gross national debt already has risen by another nearly $1.5 trillion, suggesting that perhaps this promise remains elusive

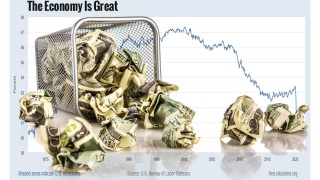

Full Article →Bidenomics Has Failed In The Worst Way Possible

Corporate media headlines like Biden’s Economy Is the Best Ever or The Bidenomics Success Story leave one big question unanswered… Who is better off? (Lest we forget, “the economy” isn’t a citizen.) Are you better off than you were thirty months, two and a half years ago?

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold’s price holding up even though interest rates keep rising, the real story of inflation, and gold remains a key asset for the new global economy.

Full Article →Must-Know Facts About Precious Metals Insurance

Making an investment in physical gold and silver is easy. Insuring these new valuables stored at home is more difficult. It may be outright impossible in larger amounts. The standard homeowner’s insurance policy provides little, if any, coverage for precious metal coins, rounds, and bars…

Full Article →Recession Canceled? Not According to These Analysts

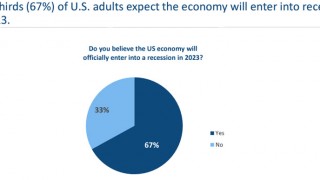

You know how it goes. Inflation comes barreling out of the gate. The Fed starts pushing rates upward. At some point, the cost of money ultimately gets so high that the economy starts to break. Next, consumers stop spending, stores and manufacturers have less business, and workers get laid off. Last stop: recession.

Full Article →At the beginning of the pandemic panic, American households hunkered down, slashed spending and deposited their stimmie checks. Ever since, thanks to a combination of high inflation and “revenge spending,” consumer spending exploded to what Wolf Richter calls “drunken sailors partying hard” levels.

Full Article →The U.S. dollar has enjoyed global reserve currency status for nearly a century now. If BRICS nations have their way, that privileged status won’t last much longer. The weakness of the U.S. dollar is top of mind for all BRICS countries, and plenty outside of BRICS too.

Full Article →2024 Gold Bull: Projections of Stronger Gold Next Year

Can anyone dispute that this has been one of the more challenging cycles of chronic inflation and higher interest rates in our history? For the past 2½ years, year-over-year inflation has remained stubbornly above the Federal Reserve’s 2% target, at one point reaching north of 9% – it’s highest rate in more than 40 years

Full Article →With all eyes on BRICS as it prepares for a meeting at the end of August that could see new members joining, the question is looming in the back of future-minded investors: will BRICS develop its own currency in a bid to challenge the U.S. dollar as the world standard?

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: U.S. credit rating and de-dollarization, China boosts official gold reserves for 9th consecutive month, and South Africa’s gold mines are under heavy stress.

Full Article →Can Gold and Silver Ever Return to Circulation?

There aren’t many bullion investors who haven’t thought about using their stash to buy groceries one day. Most of them bought metal in the first place because they know something important about history. Fiat currencies eventually die at the hands of irresponsible leaders, and it can happen fast.

Full Article →Fitch Cuts America’s Credit Rating

When we get near the end of 2023 and news outlets begin rolling out their “year-in-review” retrospectives, there’s one story that’s sure to be featured prominently: the saga of the debt-ceiling standoff, including how close America came to defaulting on its federal debt for the first time in history.

Full Article →Mismanaged U.S. Mint Doubles Production

Poor planning practices at the U.S. Mint, including an apparent refusal to stockpile extra silver blanks during periods of market slack (such as now), have caused a steady erosion in the market share of this once extremely popular U.S. silver coin.

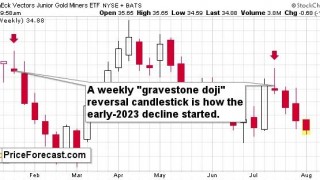

Full Article →2023 is a Down Year for Silver and GDXJ

Did you notice that for the HUI Index, GDXJ, and silver, 2023 is already a down year? In today’s analysis, I’ll dig into the former. Remember how I wrote in mid-July that after the weekly reversal, junior mining stocks were likely to move lower…

Full Article →Inflation is by no means finished. But it does seem to be dissipating. And as this chapter of inflation draws to a close, so, too, will one of the fastest cycles of interest-rate increases in four decades draw to a close, as well.

Full Article →Gold Price Forecast for August 2023

Making gold price predictions is not an easy feat, but every now and then, we get blessed with a clear signal. And we saw one in July 2023. It’s visible on the monthly chart that features not only the key parts of the precious metals sector but also one of the key gold price’s drivers – the USD Index.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Understanding why gold’s price rises despite higher interest rates, the trouble with “tokenized gold” and platinum might be the diversification asset you need.

Full Article →Those who are looking to get rich quick can try their luck at lotteries, casinos, or highly leveraged derivatives markets. Most who do will, predictably, end up getting poorer. A sound investing strategy won’t necessarily bring you jackpot gains, but it will protect you from disastrous losses while…

Full Article →Looking at every recession since December 1969, the economist David Rosenberg has calculated that, on average, the Leading Economic Index starts to decline 13 months before a recession begins and falls 4.6 percent before the recession begins. By that metric, we’re even deeper into the danger zone than

Full Article →A Little Decline Here, a Small Rally There… It’s Happening.

The USD Index is on the rise, and the precious metals sector is declining. Big things can have small beginnings, though, and that’s normal. In yesterday’s analysis, I focused on what’s currently most important from the medium- and short-term point of view on… pretty much all markets

Full Article →