Rarely do markets move straight up or straight down. The stock market has, however, essentially moved straight up since the March 2020 mini-crash. As the market moves higher, an increasing number of “analysts” are calling for even higher equity prices.

Full Article →As NFTs (Non-Fungible Tokens) rapidly become mainstream investments it’s starting to seem like there’s nothing that cannot be made into a cryptographic unit and sold to ravenously excited Bitcoin millionaires.

Full Article →What Biden’s Infrastructure Push Means For Silver

The federal government is spending and redistributing newly created cash so rapidly, it’s becoming difficult to keep track of which trillions are going where. This week, President Joe Biden will pitch a $3 trillion “green” infrastructure package. That’s on top of the $1.9 trillion economic “relief” bill he recently signed into law.

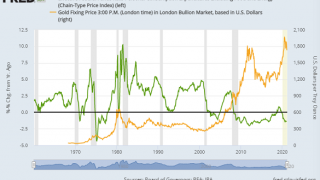

Full Article →There has been considerable discussion in recent weeks about the prospect and threat of rising inflation. This inflationary scare comes at a time when the government is unleashing massive stimulus measures to bailout states, businesses, and consumers – all in the name of combatting the pandemic.

Full Article →An economic framework called Modern Monetary Theory (MMT) governs the financial world today, but fails to account for the consequences of its practices. In fact, MMT is leading us to an extremely dangerous financial situation that could blow up at any time.

Full Article →GOLD PRICES popped higher but silver struggled to follow Thursday lunchtime in London after new US data said the world’s largest economy grew a little faster than previously estimated at the end of 2020 but only thanks to a slowdown in price inflation.

Full Article →Spotlight on Ghana Gold

Speaking with Stephen Yeboah, policy analyst, researcher and strategic communicator on commodities in Africa. Stephen is CEO of Commodity Monitor, the Ghanaian-based commodity trading, logistics and research company that’s leading the drive towards mercury-free mining in Ghana and other West African countries.

Full Article →The Globalist Push for Central Bank Digital Currency is Ramping Up…

On Monday, Federal Reserve Chairman Jerome Powell spoke at a virtual “Innovation Summit” hosted by the Bank for International Settlements, the central bank for central banks around the world. Powell aimed his remarks specifically at digital currencies.

Full Article →The Fed’s Open Markets Committee met last week and left policy unchanged – at least for the moment. No one expected central banking officials to make rate adjustments last week with equity prices rubbing up against all-time highs and the economic recovery narrative still dominant.

Full Article →Goodbye Economic Growth, Now It’s Over

The Bank of France has raised its growth forecast to 5.5% for 2021. A crazy figure when the first quarter already starts in the red with the curfew and the closure of restaurants, hotels, ski resorts, etc. It would take 7-8% over the next three quarters to reach this forecast… Let’s get serious again.

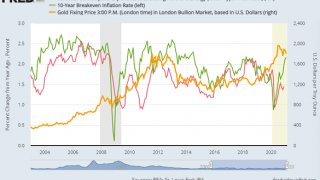

Full Article →GOLD PRICES struggled to show any change for the week so far Thursday afternoon in London, erasing yesterday’s $30 pop as government bonds resumed their plunge, driving longer-term interest rates higher despite the US Federal Reserve vowing to continue its zero-rate and massive QE policies in the face of surging inflation expectations.

Full Article →Silver Setting Up for a BIG Move Following Fed

Precious metals markets traded into an important technical juncture ahead of Wednesday’s Federal Reserve policy announcement. Bank of America analysts stated that this week’s meeting is “one of the most critical events for the Fed in some time.”

Full Article →The last year has been extraordinary. There have been COVID lockdowns, a disputed presidential election, and multi-trillion-dollar federal deficits and bailouts. The Federal Reserve has injected more money into markets than ever before.

Full Article →Since the pandemic began a year ago, the term “new normal” has become part of the American lexicon. Not “new” as in better or improved. But rather “new” as in contrast to the way things used to be. Much of the mainstream discussion argues that returning to the “old” normal isn’t likely to happen. Things like pre-pandemic employment, closer-to-normal price inflation, and less economic uncertainty just aren’t on the map.

Full Article →GOLD erased the last of this week’s earlier 2.4% rally in London trade Friday, moving back to $1705 per ounce as silver held 1.3% firmer and platinum prices showed a 4.6% weekly gain.

Full Article →GOLD PRICES traded near 1-week highs after rising and then slipping $10 from $1740 per ounce in London trade Thursday, and bullion reached the highest so far in March for Euro investors as longer-term interest rates retreated further from this month’s spike after the European Central Bank vowed to raise the pace of its government bond purchases to ensure “favourable financing conditions”.

Full Article →No less an establishment thinker than former U.S. Treasury Secretary, Lawrence Summers, opines, “I think there’s a real possibility that within the year, we’re going to be dealing with the most serious incipient inflation problem we have faced in the last forty years.”

Full Article →DMCC: Perfecting Dubai Good Delivery

Mapping Dubai’s Journey Towards a Golden Future: Dubai’s reputation as a major gold-trading hub has been harmed recently in what has at times seemed to be a concerted attack on the Emirate by a small group of well-connected individuals and a protectionist agenda…

Full Article →In a recent interview, Digix co-founder and COO Shaun Djie spoke about the comparisons between gold and bitcoin, the metal’s role in the monetary system and what investors can expect in short-term economic conditions.

Full Article →Supporters of the World Economic Forum’s all-encompassing Great Reset agenda are eyeing BIG changes for the global monetary system. Plans that might once have been dismissed as pure speculation or conspiracy theories are now being openly pushed by people who occupy the highest levels of power.

Full Article →It is an extraordinarily dangerous time for bullion banks to continue selling silver they don’t have. Their play is to destroy sentiment and shake investors out of the market. Thus far, at least on the physical front, this effort appears to be backfiring.

Full Article →IRAs Bridge the Social Security Income Gap

We’ve reported many reasons why you should not rely solely on Social Security to fund your golden years. Those reasons are in addition to the official advice that Social Security is only designed to replace about 40 percent of your pre-retirement income. Which naturally might get a retirement saver to think: “What about the other 60 percent?”

Full Article →GOLD PRICES slipped back below $1800 per ounce Wednesday as longer-term interest rates rose further on government bonds, hitting new multi-month and multi-year highs for rich Western economies’ borrowing costs as new US President Joe Biden pushes for $1.9 trillion in Covid relief and stimulus.

Full Article →FRESH outflows from gold-backed ETFs failed to stop the metal holding above what traders called the “psychological $1800 level” in Asian and London trade Tuesday, defying yet more investment liquidation as longer-term interest rates reach multi-year highs

Full Article →Gold Price to $2,000 in 2021: BoA Analysts

Bank of America sets a 2021 gold price target of $2,000, why silver could jumpstart the next precious metals bull cycle, and thefts of catalytic converters from cars are on the rise, driven by high prices in platinum and palladium.

Full Article →Yellen Forces Fed to Begin Downsizing from $7.5 Trillion

The Fed attempts to maintain control of various rates (including inflation, unemployment and long-term interest rates) through its monetary policy decisions. In the past, poor choices arguably led to both the dot-com bubble and the Great Recession. But that’s old news.

Full Article →What IS The Real Purpose of Money?

“Money is a matter of functions four: a medium, a measure, a standard and a store.” Or at least so says an old rhyme once used in economics books. And let’s face it, three of these functions are clear. A medium of exchange is what people use to pay for goods.

Full Article →Backwardation + Evidence of Silver Supply Squeeze

In recent months, the numbers of people standing for delivery of the metal on their futures contracts has spiked. If that trend continues in March, which is the next delivery month, it may be a bigger “Come to Jesus” moment than the shorts had in March of 2020.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.