Federal Reserve chairman Jerome Powell is talking tough and warning of more interest rate pain to come. At the same time, Fed officials are now admitting that their sized-up rate hikes won’t even be sufficient to tame the price inflation they have helped create.

Full Article →The price of silver hit a peak over $26.50 on March 8. It spent about a month and a half breaking down, and then the bottom fell out. It’s currently down from that peak almost 8 bucks. However, the opposite has been happening to silver’s scarcity…

Full Article →During my career, I’ve watched three speculative financial bubbles inflate, and two of them pop (the dot-com bubble, the 2007-08 housing bobble and today’s Everything Bubble). These bouts of “irrational exuberance,” to use Robert Shiller’s trenchant description, are remarkably similar.

Full Article →Fed Chair Powell’s Jackson Hole speech ended up being as hawkish (tighter monetary policy) as you could imagine. For a market that was simply gagging for even the remotest bit of dovish note, it was nowhere to be found and EVERYTHING barring the USD fell hard

Full Article →Who Will Forgive the Government’s Debt?

So much for “inflation reduction.” Just a few days after signing Green New Deal legislation, rebranded as the Inflation Reduction Act, President Joe Biden has moved to completely undo its core promise by pumping hundreds of billions of dollars into another new bailout package.

Full Article →IRS Targets the Middle Class

Video Report: What Exactly is the Huge IRS Funding Increase Being Used For? According to Whistleblower, Inflation Reduction Act’s IRS Funding Will Be Used to “Shake Down” Middle-Class

Full Article →Steep Decline in PMI Didn’t Move Gold Higher

The latest S&P Global Flash US Composite PMI doesn’t bode well for the U.S. economy. The headline Flash US PMI Composite Output Index declined from 47.7 in July to 45 in August, as the chart below shows. It was the second successive monthly decrease in total business activity.

Full Article →The latest Fed meeting may have hinted towards an easier monetary policy, whether that means a tempering or altogether cessation of interest rate hikes. While Fed officials did reiterate the dangers of high inflation, they also mentioned not wanting to slump the economy with excessive tightening.

Full Article →Is JPMorgan Joining Up with Gold Bugs?

People fighting for liberty, limited government, and honest money may have an unlikely ally according to Tom Luongo of the Gold, Goats N Guns blog. He recognizes a split in the monolithic powers running the world. Commercial banks may not be on board with the effort to establish a socialist world government.

Full Article →Gold Barely Reacts to July FOMC Minutes

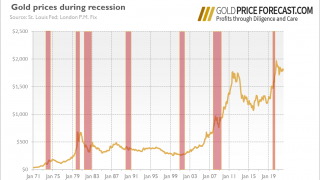

Although gold barely reacted to the July FOMC minutes, the Fed worries about an economic slowdown. That bodes well for the long-term outlook for gold. First, Fed officials continue to worry about inflation, believing it will remain elevated for some time…

Full Article →We are not living in the first society to move from a gold standard to a fiat standard, but extending this to a completely digital fiat standard is most likely the furthest that people’s concept of ‘money’ has ever been from precious metals…

Full Article →“The Most Overrated Silver Coin in the World”

Even as silver prices have begun to rally off their lows for the year, the white metal remains one of the best bargains in the investment universe. Few other assets are as cheap on a historical basis as silver is today. Just don’t talk about Silver Eagles…

Full Article →Whilst it looks next to certain that the US and Europe are in or about to be in a recession, opinion seems divided over whether Australia will follow suit. Much of that relies on the health of our biggest trading partner, China.

Full Article →Are We in a Recession or Not?

Does the Answer Even Matter? Debate over whether the U.S. is in a recession rages on. GDP numbers say we are. Others disagree. But for earnest retirement savers, no declaration is needed.

Full Article →Gold as an answer to present day trouble – it’s the only asset to claim geopolitical neutrality, and it’s not just Russia’s official sector that’s hoarding gold.

Full Article →Weaponized IRS = Off-Grid Investing Boom

The Orwellian-named Inflation Reduction Act passed both houses of Congress and is now on its way to the White House. The politicians responsible for multi-trillion-dollar federal deficits and an out of control Fed planning to “reduce” inflation by spending another $700 billion they don’t have…

Full Article →Over 60% Households Living Paycheck to Paycheck

Americans seem to be hanging on by a financial thread as number of higher earners living paycheck to paycheck has jumped. There may be a lot of citizens who have a job to go to each day, but it turns out the mere fact they have a job is no assurance of personal financial viability.

Full Article →The official consumer price index (CPI) gauge of inflation finally eased in July, slowing 60 basis points to an 8.5% annualized rate. Further upstream, the producer price index (PPI) also slowed from 11.3% to 9.8% year-over-year. Now, let me be clear: this is good news.

Full Article →US shares rallied again Friday night largely it seems off the back of a slightly softer PPI (Producer Price Index – i.e. inflation at the ‘factory door’). The market desperately looking for confirmation bias around an imminent Fed pivot got what they were looking for

Full Article →Does Gold Know a Recession Is Coming?

Recession has already occurred or is on its way.. Somebody should tell gold about it! Is a recession really coming? We already know that the yield curve inverted last month for the second time this year, but what are other indicators of looming economic troubles?

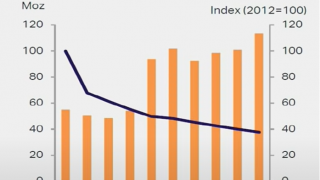

Full Article →Overall global solar panel production has been growing over the last 10 years while the actual amount of silver in each panel is set to increase. A number of major technological changes on the horizon are set to kick industrial silver demand into overdrive

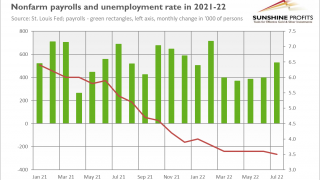

Full Article →Strong Jobs Shift Upper Hand from Gold to Fed

Strong Job Creation Shifts the Upper Hand from Gold to the Fed. The US economy generated almost 530,000 jobs in July. That’s good for monetary hawks but bad for gold bulls.

Full Article →In the wake of gold briefly passing the strong $1,800 resistance level, Equinox Partners’ Sean Fieler spoke about gold’s role in the coming financial crisis saying a sovereign debt crisis could catch some off-guard: ‘the kindling is set, and you just need one little spark to ignite the fire.’

Full Article →Gold has a unique appearance. It is also astonishingly heavy—much heavier than it has any right to be. Everyone should hold one in his hand (and own a few). But that’s not why many gold analysts today are saying you should buy gold.

Full Article →The federal criminal trial of JP Morgan executives Michael Nowak, Gregg Smith, and Jeffrey Ruffo began on July 8th. These senior bankers are accused of running a years-long scheme to manipulate precious metals prices through what is known as “spoofing.”

Full Article →US markets were shocked Friday when the NFP employment figures we discussed on Friday came in at literally more than double the expected headline print with 528,000 new jobs added in July and the unemployment rate dropping to 3.5% from 3.6% and wages rising to 5.2%.

Full Article →Gasoline prices have been dropping. As they do, some are suggesting the worst of inflation is behind us. Could June’s 9.1% headline inflation rate represent peak inflation? There’s been no shortage of concerning economic data for many months. And now we just learned the country is now in a “technical” recession.

Full Article →The Yield Curve Inverts. Time for Gold to Turn Back

Ever wondered what the yield curve’s favorite song is? Neither have I, but I bet in July it was Britney Spears’ hit, Oops, I Did It Again, as the yield curve inverted again last month, for the second time in 2022. It means that long-term rates fell below those on shorter-dated bonds.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.