Some say that war never changes, and in some aspects, that’s true. But markets’ reactions to war are also remarkably similar. What I’m going to start today’s analysis with is not something you’ll read in many places. Usually, analysts are either following just the technicals or just the fundamental aspects of a given market. But the true edge comes from…

Full Article →What Happens to Gold Price When it Finally Rebounds?

After testing new highs, gold is likely to move far, up or down. Previously, I wrote that the price of gold was about to decline after its massive reversal and that’s exactly what happened. The decline is now likely to continue, but there’s a good chance that we’ll see at least a small rebound from $2,000 or slightly higher levels.

Full Article →Sound Money Scholarship Awards $13,500 to 9 Outstanding Students

“The overwhelming interest in the 2023 Sound Money Scholarship was deeply heartening. At a time not only of high inflation and bank instability but also when states are advancing dozens of sound money bills, this fundamentally important issue is reaching an inflection point”

Full Article →Gold Price at New Highs? Sellers Say NO.

The huge rally in gold and the monstrous decline that followed provided a sign of epic proportions. Gold price’s huge-volume reversal is the last thing that anyone even remotely interested in the precious metals market should ignore. The Gold price was just soaring to new highs like there was no tomorrow, and then it happened.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold passes $2,100 to post a new all-time high, the only two solutions to the global debt crisis aren’t applicable, and a recent government study returns some very rough inflation data.

Full Article →Despite President Biden’s insistence that the U.S. is experiencing the “greatest economic recovery ever,” the evidence suggests otherwise. In fact, the U.S. economy could be heading for one of the most painful periods of economic turmoil of the last 15 years. And it’s all thanks to the disastrous policies known as “Bidenomics.”

Full Article →A minority of citizens say American dream “still holds true” as half of Americans earn less than $3,400 per month. As inflation soared in 2022 and the Federal Reserve set about the task of reining price pressures in with a singular, surgical focus on raising interest rates, sentiment among consumers struggled in the face of those headwinds…

Full Article →Don’t Buy at the Top. Analyze.

The USD Index is soaring today, so let’s start today’s free analysis with this market. You can probably already tell that it’s likely that today’s (0.6+) rally is the start of something bigger and not just a one-day event. Let’s check why – starting with my previous comments on this market as they remain up-to-date…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold’s downside doesn’t sound so bad these days, where we are on the 1970s track, and gold demand surging as Indian buying returns to pre-pandemic levels.

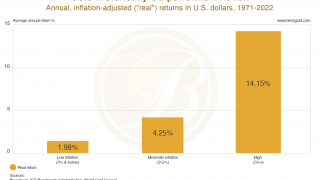

Full Article →Americans might be well served to contemplate how safe cash really is. Money market funds aren’t going to keep pace with inflation over the long run. Nor are they immune from credit risk, which could manifest at any time. Bullion investors would like to see some of this capital pour into the gold and silver markets.

Full Article →Stocks and Silver Have Something to Say about Gold

Silver just shot up, and given what the stock market is doing, it makes perfect sense. Namely, it’s most likely the final part of the rally in them both, and the same is the case for gold and mining stocks. Starting with the stock market, it’s still the case that the shares are following their early-2022 path.

Full Article →Are Americans being unduly gloomy, and unreasonable in their unwillingness to accept the beneficial reality they’re actually living? Or are they entirely justified in their pessimism over what they see as an economy growing increasingly less responsive?

Full Article →A Recent Typo in Our Footer Menu May Have Caused Offense, and For That I Can Only Apologize! As part of our recent site refresh we (and by we, I mean ‘I’) made a small typo in the menu item titled “Discounts” by omitting a vowel. This omission may have caused offense for the 2 days it was live and for that I’m sorry.

Full Article →As markets reopen following the Thanksgiving holiday, investors are feeling thankful that interest rates are no longer rising. Stocks, bonds, and precious metals have all gained ground in recent days as long-term rates have come down. Meanwhile, expectations for the Federal Reserve to cut its benchmark short-term rate in 2024 have risen.

Full Article →You might be thinking something’s different, and you’d be right – we’ve changed our logo! Our ‘tri-metal’ cube design had been in use since 2016 and despite a change from the site’s original (very) yellow color scheme to a more subtle gold one in 2019 we’ve been using the trusty cube for much of the directory’s 10-year – and counting – life.

Full Article →With all of the unanswered questions floating around in today’s economy (like “When will the recession start?), one thing is fairly certain – Today’s economic uncertainty is likely to stick around for a while. With that in mind, at some point you might wonder if you’ve saved enough to enjoy a comfortable and stress-free retirement in the face of that uncertainty…

Full Article →Silver production is failing to keep up with rising demand. But you wouldn’t know it by looking at the silver price. Phillips Baker, CEO of Hecla Mining and Chairman of the Silver Institute, the metal’s most prominent industry trade group, recently made a presentation at the London Bullion Market Association Global Precious Metals conference in Spain…

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold as sentiment-driven as ever, $34 silver soon, and U.S. Mint’s gold sales have already outpaced last year’s figures. The U.S. federal government is indebted by over $33 trillion, and it matters…

Full Article →Let’s drill down on the spending that’s helped fuel the economy. It might interest you to know that real wage growth (earnings after inflation and taxes) has declined in each of the last three months. So, from where have Americans been getting the money for all the spending that sends GDP growth ever higher?

Full Article →A Precious Gift from Precious Metals Sector

What a powerful bearish confirmation! Not only did our profits increase yesterday, but we got this precious gift, too! What gift, you ask? The powerful bearish confirmation, of course! Did you see the… Rally in gold? The yellow precious metals moved higher by $12.50 yesterday. It happened on low volume, indicating that it was just a breather, but still…

Full Article →Savvy investors are always on the lookout for the next big thing – a dominant theme that drives headlines and creates profit opportunities in markets. The problem is that by the time everyone is talking about it, it’s often too late to invest – at least at attractive prices. The big investment story-line of 2023 has been artificial intelligence.

Full Article →Dollar Weakness Could See Gold Surge to $2500

Experts forecast a shaky dollar will send gold to $2,500 next year. This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold forecasts ahead of the election, Powell feints as U.S. economy crumbles, and Kuwait bolsters its place on the list of gold consumers.

Full Article →Coming right out of the gate in January, the federal debt ran up against the debt ceiling, which at the time was $31.4 trillion. A months-long and highly combative back and forth ensued between Democrats and Republicans…one that wasn’t finally resolved until the very beginning of June and just a few days before “X Date,” when the government would have had no choice but…

Full Article →Why US Heading Into Another Great Depression

First it was the COVID economic panic that started in March of 2020. Then it was Biden’s disastrous mishandling of the military withdrawal from Afghanistan in 2021. Almost immediately following that disaster, the Biden administration went on a multi-trillion-dollar deficit spending spree that dramatically worsened inflation. Not long after, Biden led …

Full Article →If you want to build a house that can withstand the test of time, you can’t have a weak foundation. So you have to build a solid foundation. The same idea holds true for your financial “house.” Your retirement savings plan has to be built on a strong foundation. Don’t spend money you don’t have – Live within your means!

Full Article →Central Banks Making HUGE Gold Moves

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Central bank gold buying on track to shatter last year’s record, a different take on gold’s price and who wants a gold token instead of physical gold? 2023 may set another new record for central bank gold buying

Full Article →Consumer Financial Crunch Worsens

According to a Harris poll conducted for Bloomberg News, a whole lot of middle-class Americans are worried about the economy. In fact, the number who say they are worried about the economy has grown over the past year, even though inflation has steadily declined at the same time. 44% of middle-class Americans are “stressed” about the economy

Full Article →Gold Price Forecast for November 2023

Gold didn’t just invalidate the move above $2,000. It moved even lower – that’s how we know the invalidation is real. And so are its consequences. After gold’s suspicious rally, we see a very real decline. And the decline in silver and mining stocks is even bigger.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.