Economics once again defied the will of politicians — this time in Minneapolis, Minnesota. The Minneapolis City Council wanted to help out Uber and Lyft drivers, so it passed an ordinance setting a minimum wage for drive-share drivers where companies such as Uber and Lyft must now pay their drivers a minimum of $1.40 per mile

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold price shatters $2,200 to set new record – what’s next after yet another all-time-high gold price?; lessons from Turkey’s financial crisis, and China’s dramatic influence on the gold market.

Full Article →You’ll often hear precious metals investors talk about the gold-silver ratio. So, what is it, and why does it matter? The gold-silver ratio tells you how many ounces of silver it takes to buy one ounce of gold given the current spot price of both metals. In other words, it tells you the price of gold in ounces of silver.

Full Article →By now, you likely are familiar with gold’s recent march well into record territory. Since the end of February, gold has appreciated 6.5% to more than $2,150 per ounce (as of March 21). Analysts say that one reason for gold’s recent upward trend has been talk of falling interest rates, which certainly makes sense.

Full Article →Happy Birthday to us as we celebrate our 10th anniversary since first publishing way back in 2014! It’s hard to believe it’s been ten years since we launched the site. It seems like both yesterday and forever ago. Judging by how much Mac and I have aged during the long process of building the site up, it sometimes feels we are Sisyphus of legend…

Full Article →Bitcoin Invalidated Its Breakout – Is Gold Next?

Gold price held up well yesterday. But will it be able to handle the USD Index’s breakout? The yellow metal moved back to the Dec. 2023 high and bounced from it, and today, it just did the same thing. Yesterday’s price action looked quite promising, as the verification of the breakout would indeed be a bullish thing.

Full Article →The Fed created the Bank Term Funding Program (BTFP) after the collapse of Silicon Valley Bank and Signature Bank last March. The program was set up so banks could easily access cash “to help assure banks have the ability to meet the needs of all their depositors.” The bailout was a sweetheart deal for banks

Full Article →Another week of sitting back and seeing how far analysts are willing to push today’s gold price predictions for the year. We were here last week at $2,080, and $2,150 is the latest pit stop in the race to $3,000. Right now, sky-high forecasts are abundant.

Full Article →Global silver demand in 2024 projected to be second highest on record – some analysts project a 20% price increase in silver this year. Through the first two weeks of March, gold surged into record territory, jumping roughly 6% to well over $2,100 per ounce. In the same period silver has risen even higher on a percentage basis, climbing nearly 12%

Full Article →Gold has garnered a lot of attention in the last few weeks with its record-setting run. Since the end of February, gold is up nearly 7 percent and set an all-time record of $2,195 an ounce along the way. This is really good news for silver. That wasn’t a typo. I meant silver. I’ve been arguing that silver is drastically underpriced for quite a while.

Full Article →Quarter Later: History Rhymes for Gold Stocks

Gold and gold miners moved higher yesterday, turned a few heads, and now they’re back down. What’s next? Yesterday might have seemed like a big deal, but… If you read my weekend Alert, you knew that seeing a double-top here was one of the possibilities that would NOT change the outlook. After all that’s how gold topped in 2011.

Full Article →The last few years have featured heavy doses of economic turmoil for most older Americans trying to save for their retirement. That turmoil includes persistent (possibly long term?) inflation, pandemic panic, and even the potential for a near-term recession. So let’s take a moment to cover a bit of good news.

Full Article →This is a preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers giving our predictions for gold and silver prices over the coming year. The talking heads are talking about recession, unemployment, and inflation, same as they’ve always done, though now perhaps with a bit more urgency.

Full Article →Price inflation is like the gum on the bottom of your shoe that you just can’t scrape off. Or maybe it’s like a movie theater floor after a big premiere. It’s sticky. And that’s a problem. The CPI data for February wasn’t anything to panic about. But nobody is throwing a party either.

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the economy. Stories include: Gold notches another all-time high over $2,180, analysts are acknowledging that gold’s surging price confuses them and understanding bitcoin vs. gold comparisons.

Full Article →One of the more curious mysteries of the Biden years is the disconnect between what looks like solid economic data and how Americans actually are feeling about the economy. The government’s headline unemployment rate may be the most notable example of the data at issue.

Full Article →Can you borrow your way to prosperity? American consumers are certainly giving it the old college try. Consumer debt surged once again in January, rising by $19.5 billion, according to the latest data from the Federal Reserve. On an annual basis, consumer debt rose by 4.7 percent to a record $5.04 trillion. The jump was double the projection.

Full Article →Central banks took up where they left off in 2023, adding more gold to their stockpiles to kick off the new year. Globally, central banks increased their gold reserves by a net 39 tons in January, according to the latest data compiled by the World Gold Council. There were no notable sellers in January.

Full Article →Gold Price Forecast for March 2024

Forecasting gold prices is not easy, but right now it seems that we have quite many factors aligned. The market buys on rumors and sells on facts – even if they are positive. But if the facts are negative… Then the market sells substantially, and the price declines significantly. For now, the market continues to exaggerate its reaction…

Full Article →The United States enjoys the privilege of issuing the world’s reserve currency. But it increasingly uses that privilege as a hammer to shape foreign policy. Could Americans end up feeling the blows from that hammer? Economist and the author of Currency Wars Jim Rickards thinks that’s already happening.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold sets new all-time-high closing price as analysts wonder what’s next, are our national gold reserves finally coming into question? and silver as a symbol of Poland’s strength. This week’s moves will be in the limelight…

Full Article →Silver demand is expected to hit 1.2 billion ounces this year. That would rank as the second-highest annual silver demand on record. Record industrial demand for silver is expected to drive overall silver offtake this year, according to an article in the latest edition of the Silver Institute’s Silver News.

Full Article →Household debt in America now stands at a record $17.5 million. Economist says rising debt delinquencies could turn mild downturn into a major recession. When you hear the term “economic uncertainty,” what comes to mind? If you’re like many people, you probably think of things such as…

Full Article →Hey Fed! You’re Part of the Spending Problem!

During a recent interview aired on 60 Minutes, the Fed chairman said it was time to have an “adult conversation” about the national debt and conceded that the U.S. government is on “an unsustainable fiscal path.” Powell said, “We’re effectively borrowing from future generations,” and that it is time for us to put a priority on “fiscal sustainability.

Full Article →Gold & Stocks Might Be Doing Something Critical Here

Miners declined as expected, but today’s action is so far in gold and stocks. Both will impact miners. Let’s start with gold. From the daily point of view, we just saw another move toward the 61.8% Fibonacci retracement based on the recent decline. This level was not touched, let alone broken. Today’s intraday high wasn’t above the Friday’s intraday high.

Full Article →What’s Gold Doing? Exactly What It’s Supposed to…

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Ronald Stoeferle explains why gold has been an outperforming asset worldwide, how the U.S. will rein in budget deficits with your money and are European silver investors finally getting a break?

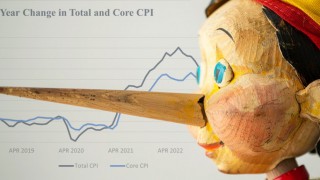

Full Article →Yet More Reasons to Question CPI Data

According to the latest Consumer Price Index (CPI) data, prices rose by 3.1 percent over the last year. Based on my own experience at my local shopping center, that seems low. And it may well be. There are reasons to doubt the accuracy of CPI data. According to a recent report released by the Bureau of Labor Statistics (BLS) weak response rates…

Full Article →Top Investment Banks Forecast Rising Gold in 2024 and Beyond

Leading investment banks forecast gold heading well into record territory, with Citi stating De-dollarization could be key to $3,000 gold in 2025. Those familiar with the movement of precious metals prices likely are familiar with gold’s historical interest-rate sensitivity and how changes in rates can impact prices…

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.