We’ve spent a lot of time discussing financial anxiety and planning for financial security past few years. Today, we’re going to shift gears. Instead, we’re going to discuss affluent Americans who are confident in their financial stability and believe their savings are secure enough to weather any economic storm.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Central banks could be planning modernize their gold reserves, Wheaton CEO’s gold and silver predictions, and BlackRock’s analysts on gold’s near-term prospects.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Five reasons gold and silver will rise this year; global central banks still top gold buyers; and forecasts for $3,000 gold and $50 silver in the near-term.

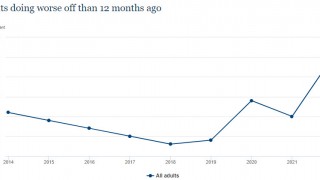

Full Article →All politicians, especially those in the Biden administration, are notoriously bad at anticipating the ripple effects of their “solutions” to problems like pandemics and inflation. Their response to emergencies has left us worse off.

Full Article →George Milling-Stanley, chief gold strategist at State Street Global Advisors, says gold has a real chance to smash its old price records before the end of the year. Now, gold has been above and below $2,000/oz. for more than a decade. Its initial foray into +$2,000 territory was supported by conditions nothing like where we are today…

Full Article →According to Fidelity’s 2022 State of Retirement Planning Study, 71% of Americans say they are very concerned about the impact of inflation on their retirement savings plan. Nearly one-third admit they don’t know how to make sure their retirement savings keep up.

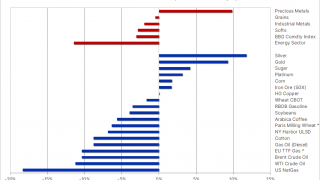

Full Article →Recently we’ve documented a groundswell of popularity in gold as an investment. Google searches for how to buy gold recently hit a new record. Central bank gold buying, already fierce, is poised to grow even more. In short, there’s a “new global gold rush” underway:

Full Article →According to the latest Trustees report, approximately 66 million people receive some form of monetary Social Security benefits. The cost of Social Security programs have exceeded its income since 2021. So they’re underfunded (and falling behind).

Full Article →Central bank gold demand last year was undoubtedly one of the main takeaways in the market. That’s an accomplishment of sorts, since central bank gold demand has been one of the primary drivers of gold prices over the past decade.

Full Article →Ray Dalio doesn’t like the tensions building up between the U.S. and China. It’s a 2016-style flashback, intensifying quarrels with China over global trade. At the same time, 2016 was a while ago! We can no longer call the U.S.-China conflict a “trade war,” because there is a real and ugly war going on in Ukraine

Full Article →It’s worth remembering that the Federal Reserve chair is an appointed, not an elected, position. Powell can survive a period of unpopularity more easily than any member of Congress. And that’s good news for him, because he’s going to be unpopular in the White House (and on Wall Street) for quite some time…

Full Article →Over the weekend, federal regulators seized First Republic and cut a deal with JP Morgan to assume most of the failed bank’s assets. This should come as no surprise to regular readers – I discussed the contagion spreading across the banking sector back in March. So this isn’t a surprise, but is it still worthy of concern?

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: What to watch out for in the coming financial crisis, Citi thinks $30 silver is a lowball forecast, and how to solve the debt ceiling stand-off with a single platinum coin…

Full Article →Depending on the source you check, the U.S. debt ceiling has been lifted or modified approximately 102 times since its inception in 1917. By June of this year, that number is likely to increase by one, and that means the U.S. debt is poised to skyrocket after it happens. But what if things don’t go according to plan?

Full Article →Steve Forbes demands a return to the gold standard, gold’s fair value is closer to $3,000 than its current price, and U.S. states aren’t waiting for a national gold standard – they’re busy authorizing their own.

Full Article →Owning physical gold and silver outside the banking system makes sense to me, not so much because I’m concerned about the imminent collapse of the global financial system. Because it’s smart protection. I have a fire extinguisher in my kitchen, but not because I think the oven is about to burst into flames.

Full Article →Markets are now pricing in a 1.5% cut in Fed funds rates in the next 15 months. It’s an interesting forecast on the markets’ part. Can the Fed really hold off so long? And when the Fed throws in the towel on the inflation fight and cuts rates, will the U.S. dollar have anything left in the tank anymore?

Full Article →After almost 15 years of Fed-fueled cheap money offered at near-zero rates that was leveraged into overinflated speculative bubbles, the lights are on, the crowd is dispersing – and the party might finally be over.

Full Article →A stable gold price over $2,000/oz means that something has gone wrong. Either the greenback crumbled further, or there is some kind of issue that isn’t going away and that is driving haven demand. So often investors see asset prices rising and, fearful of missing out on a new bull market, buy in and drive prices even higher.

Full Article →Over 95% of Silicon Valley Bank’s deposits are not insured by the FDIC (due to being over the $250,000 limit) That is over $160 billion in uninsured customer deposits. About half of all venture capital-funded startups in the U.S. are customers of SVB. That’s 65,000 startups.

Full Article →The magazine recently published a story about how the wealthy invest in gold that offered no real surprises but plenty of confirmation that the super-wealthy share the same economic concerns as most of us.

Full Article →Here’s the thing: the money you contribute to Social Security doesn’t go into an account in your name. Rather, it goes into a giant pool of money that’s used to pay benefits to those who’ve already retired. In fact, the Social Security trust that funds your benefit has been running a deficit for a while now.

Full Article →Despite the Fed’s best efforts thus far to raise rates and cool off inflation, I don’t expect relief any time soon. With that in mind, let’s look into the past to see what a longer period of inflation looks like. The best place to start in the U.S. is to take a brief look at an extraordinarily long period of inflation that took place from the 1970s

Full Article →500-Year-Old Law is Gold Investor’s BFF

I think about Gresham’s law a lot. Back in the day of the first Queen Elizabeth (1533-1603), her banker, Sir Thomas Gresham, made an observation about currency debasement: Bad money drives out the good. You see, back in the 16th century, money was still “sound”…

Full Article →Hidden In the Inflation Numbers: The Next Gold Price

The same people who told us inflation was “transitory” two years ago are still capable of being surprised when reality fails to meet their expectations. Even returning inflation to 2 percent won’t make absurd prices any lower – rather, prices will still rise, but at a slower pace.

Full Article →Bloomberg’s Gold Investment Advice Is Spot On

Do Bloomberg’s readers really need a primer on gold investment? Aren’t they all experienced economists and investors who know every asset inside and out? Judging by Bloomberg’s latest step-by-step gold investment guide, we’d say not.

Full Article →Gold Up 18% in Three Months – Will It Continue?

Low volatility plus a strong upward trend is a recipe for slow, steady price growth. You’re looking at an 18% increase in gold compared to a 5% increase in the S&P 500 – in just three months. That’s not enough for some people.

Full Article →We’re Just One Step Away from $5,700/oz Gold

MoneyWeek’s Dominic Frisby is an analyst to watch. His precious metals analyses are full of insights, and his latest observation on gold’s price is fascinating. Frisby shows off his decades of experience by reminiscing about gold’s price trajectory from the late 1990s to now.

Full Article →Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.