JNUG ETF: The Pain, in the Main, is Mostly in my Brain (Oh, and in my Wallet too)

Bullion.Directory precious metals analysis 14 November, 2014

Bullion.Directory precious metals analysis 14 November, 2014

By Terry Kinder

Investor, Technical Analyst

If you haven’t read the other investor’s diaries in this series, the link to them will appear at the end of this article. I became interested in the Direxion Daily Bull Gold Miners Index 3X JNUG ETF after reading about it, if memory serves, over at The Daily Gold. This coincided with a moment where I became very fascinated with price cycles in stocks and other instruments.

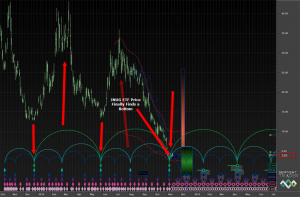

In the process of studying cycles a running across some interesting software to help identify underlying price cycles, I noticed that the JNUG ETF was undergoing fairly regular price cycles, at least for the short history of its existence. So, the idea of investing in it based on its price cycles was born.

I did what I believed to be very thorough research on the JNUG ETF, its price cycles, and began to prepare for making an investment in it. Well, as Mike Tyson once said –

Everybody has a plan until they get punched in the mouth.

My plan was picture perfect, right up until the time that the JNUG ETF punched me square in the mouth. Then it was just the JNUG ETF landing punches and my brokerage account bleeding money. Part of the problem was that the plan was flawed. I intended to hold the JNUG ETF for a more extended period of time when the ETF is designed to be traded on a daily basis as Christopher Lemieux pointed out to me.

I got a little too emotionally committed to the investment idea and held onto the JNUG ETF for longer than I should have. Yes, I did finally let go of the investment, but not before it had done pretty significant damage to the balance in my brokerage account. I’m not going to reveal the percentage yet. I will, just not yet.

So, looking back, here are a few of the mistakes I made investing in the JNUG ETF:

1. Position size was too big. Should have invested a smaller amount of money to start, especially since the idea was not tested and proven.

2. Made the assumption that the past cycles would look like the present cycle, especially in terms of how far the price would move. I wasn’t entirely wrong about the cycle, but my timing and interpretation of when to enter the trade was off. I later started using the Sentient Trader which applies Hurst Cycle Analysis to stocks, and saw much more clearly where the JNUG ETF was in its cycle.

3. Did not properly consider the amount of time to hold the JNUG ETF. My original idea that I might have to hold it for 2 months was a complete mismatch with the design of JNUG to be traded daily. So, I have changed my strategy, and will trade JNUG for short periods, a day or two at the outside as it cycles higher. In fact, I have already been in and out of JNUG this week successfully.

4. Hung on to the position for too long, not seeing or wanting to see that it clearly was not moving in the direction or manner I had originally anticipated. Once the JNUG ETF punched me in the mouth my game plan and a good portion of my money went out the window.

5. Did not follow the advice I received to get out of the JNUG ETF sooner. Should have simply admitted that I was mistaken and re-evaluated the situation immediately when the position went against me.

6. Did not fully consider some of the trading tools I might need in order to navigate the trade. It turned out what I thought was going to be fairly simple was much more complicated than I had originally thought. Through trial and error discovered some additional tools including Sentient Trader and another nice tool over at TradingView that lets me see where important pivot points are which is essential to trade the JNUG ETF correctly in the very short time periods required.

I’m sure there are more things that could be added to the list of mistakes, but that is plenty. Given everything that went wrong, it could have been worse. On the positive side, it taught me a lot. The punch in the face hurt, but next time I will be much more prepared to fight back when things don’t work as planned.

It’s good to have a plan. It’s even better to have a strategy and mindset that gives you the confidence to deal with a situation you weren’t expecting.

Links to other investor’s diaries in this series:

Part 1

Part 2

Part 3

Part 4

Part 5

Part 6

Part 7

Part 9

![]() This license allows for redistribution of this article, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to Bullion.Directory, linking to the original article.

This license allows for redistribution of this article, commercial and non-commercial, as long as it is passed along unchanged and in whole, with credit to Bullion.Directory, linking to the original article.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply