Time to push the panic button on the JNUG ETF?

Bullion.Directory precious metals analysis 23 October, 2014

Bullion.Directory precious metals analysis 23 October, 2014

By Terry Kinder

Investor, Technical Analyst

Time to push the panic button on the JNUG ETF? Image: pixabay

The madness began several months ago when I noticed a pattern, what appeared to be an underlying cycle in the price of the JNUG ETF.

The JNUG ETF, like other prices, can be teased apart into sine waves representing the lengths of various lengths that when added back together form the price lines we see on the charts. Image: pixabay

This obsession has taken me on a journey that lead to encounters with the works of J.M. Hurst, W.D. Gann, Edward R. Dewey, Martin Armstrong and the Foundation for the Study of Cycles. Each step of the journey led me to become more convinced that there are cycles that affect everything around us from history to prices and much more. Often, our failure to see these cycles or understand them isn’t an indication that they don’t exist, but instead points to our lack of understanding about them.

Despite all of the research on the JNUG ETF, the countless hours creating, printing and pouring over charts, it can be difficult to fight the fear that comes when things don’t go as expected.

Fear is corrosive, it can eat away at your insides, consume your dreams and steal your hope for the future. Certainly when my JNUG ETF position sat with a better than 30% loss earlier in the day I was fighting with fear. Image: pixabay

I must not fear. Fear is the mind-killer. Fear is the little-death that brings total obliteration. I will face my fear. I will permit it to pass over me and through me. And when it has gone past I will turn the inner eye to see its path. Where the fear has gone there will be nothing. Only I will remain.

Frank Herbert (Source)

If you are distressed by anything external, the pain is not due to the thing itself, but to your estimate of it; and this you have the power to revoke at any moment.

Marcus Aurelius (Source)

Never be afraid to try something new. Remember that a lone amateur built the Ark. A large group of professionals built the Titanic.

Author Unknown (Source)

Fear is corrosive, it can eat away at your insides, consume your dreams and steal your hope for the future. I used to be horribly afraid of heights, to the point where I was afraid to even climb a ladder.

While being an Army Parachutist helped me overcome my fear of heights it doesn’t mean there aren’t moments of fear, today’s further plunge in price of the JNUG ETF being just one example. Image: pixabay

Don’t get me wrong, fear can be a good thing and can keep you alert and alive. For example, you don’t want to parachute out of a plane with someone who isn’t afraid to jump. A person with no fear is dangerous. You need a little fear to focus your attention and make you more aware of your surroundings. But, you don’t want to be so ruled by fear that you are afraid to try new things. You don’t want to be too afraid of what other people will think or say. I like the quote above that talks about the Ark. You shouldn’t be afraid to try new things or worry too much about what the professionals think. What works for you in life and investing may not be what works for somebody else. Your technique may not fit in with what the “experts” say is correct, but if it works for you consistently and is based on study, knowledge and experience, then you should not change just because someone says you are wrong.

That brings us back to my investment in the JNUG ETF. My approach has probably been wrong in many ways. Hindsight being 20/20, I should have waited for price to drop further to begin investing. Instead, I ended up trying to catch a falling knife, grabbing a little too soon and holding the investment far longer than the professionals would deem smart. I don’t like looking stupid or losing money any more than anyone else does. I am often my harshest critic, and it isn’t likely that anyone can offer up a critique that hasn’t been run in my head before. But, the process of being self-aware, willing to look at my own weaknesses, and the strength and weaknesses of my own ideas, and those of others is a tremendous help when it comes to investing. It was that process of looking at my JNUG ETF investment idea over and over again for months that got me through today when I was staring at a better than 30% loss and wondering if it was a stupid idea to begin with. Investing in the JNUG ETF wasn’t and isn’t a stupid idea and I’m going to show you why with a few charts.

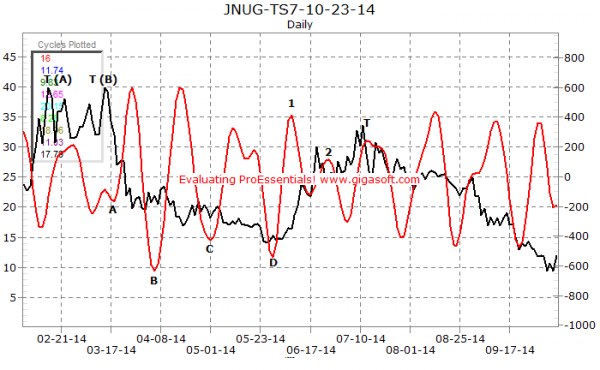

JNUG ETF Cycles Charts

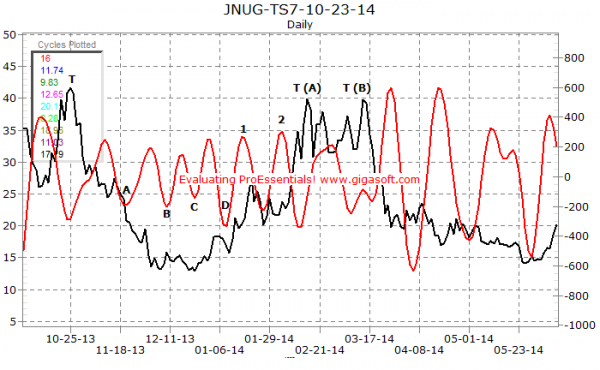

As you can see in the JNUG ETF cycle chart above the JNUG ETF price first topped around 10-25-13. The JNUG price then dropped in 4 waves – A, B, C, and D before rising to a new top after 1 and 2.

In this second JNUG ETF cycle chart I have had to make some compromises with the wave labels because of the two “tops” labeled T (A) and T (B).

The second JNUG ETF cycle chart above highlights one of the imperfections of cycle analysis. At T (A) and T (B) we see two “tops”. The top labeled B is the actual top, while the “top” labeled A if the first peak in price that conforms to the larger cycle. These two “tops” forced a compromise of sorts on this JNUG ETF cycle chart. In essence the cycle count for the next top was started from the actual top labeled B while the peak in price labeled A was used for the previous count. It is an imperfect compromise, but it allows for a chart that is more or less consistent and can still be used to determine future low and high prices. Again, as in the first JNUG ETF cycle chart, the price drops in waves A, B, C, and D after topping at T (B) and rises at 1 and 2 before peaking at T again.

This JNUG ETF cycle chart is one of the main reasons I continued to hold my JNUG stock today, despite the overall position being down by over 30% at one point during the day.

In the last of the JNUG ETF cycle charts you may have noticed that the down part of the cycle has lengthened quite a bit, almost to the point of needing to add an E wave down. It will probably take until tomorrow to know for sure if the E label needs to be added or not, but it doesn’t change the up labels. You may have also noticed that the wave up labeled 2 is just the tiniest little bump up. Because wave 2 is so tiny, I’m anticipating that it’s likely that the high price at the point labeled T may not be as high as the $36.00 achieved at the previous top back in July. Here are some other possible (not sure if they are very probable) outcomes because of the very tiny wave 2:

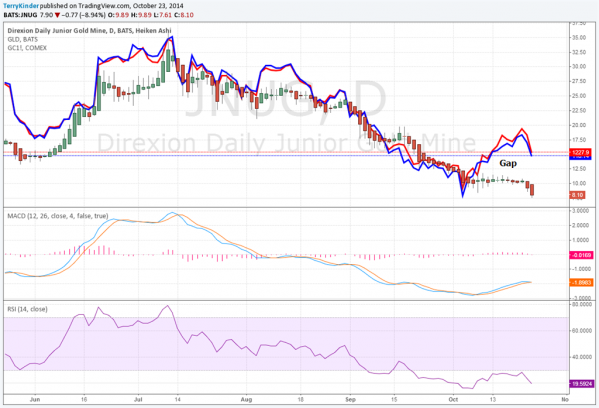

There are, of course, lots of other possibilities, but those are a few of them. I’m not necessarily looking for any exceptions to occur, but am open to the possibility that the next peak in price won’t be picture perfect. This last JNUG ETF cycle chart is one of the main reasons why I decided not to sell any shares of JNUG earlier in the day when it was way down. If this cycle is anything like the previous ones, then it is near the point where it should bottom and start to turn back up. The fact that the price dropped from $8.67 yesterday, gapped down to open at $8.37, fell as low as $7.61 and ended the day above $9.00, despite a weak performance for the gold price, gives me hope that today just may have been a turning point. On the JNUG ETF cycle chart above you may have noticed I labeled the last visible price “The point where hope, greed and fear meet.” That is exactly what that price represented, the intersection between hope, greed and fear, and hope, perhaps with a little bit of greed, won the day today.

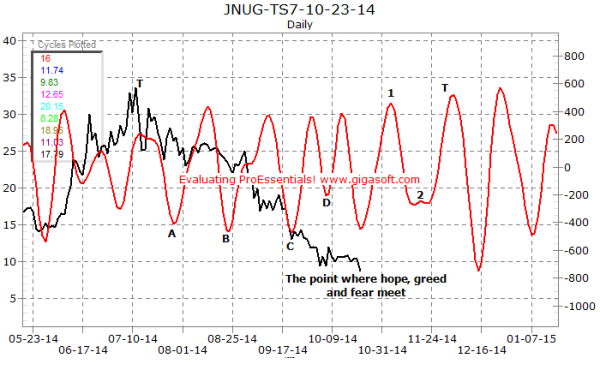

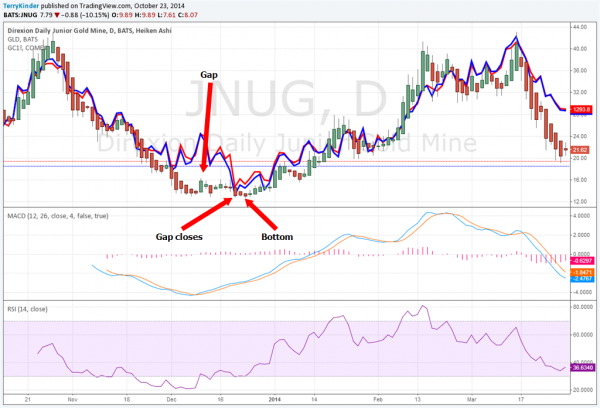

So, if the last JNUG ETF cycle chart presented was one of the reasons I held on to my position today, that implies there was at least one other reason why I didn’t sell. Another important reason I decided to wait and see what happened today was because of the closing gap between the gold price as represented by GLD and COMEX continuous gold and the JNUG ETF price. Below are two previous cases of a gap opening between JNUG and the gold price and then closing right as the JNUG price bottomed.

The JNUG ETF and the gold price have formed a pattern of opening a gap and then closing it very near the JNUG ETF price bottom.

The most recent gap between the gold and JNUG ETF prices appears to be closing. Could the JNUG ETF price be near the bottom?

The final chart above shows the current gap between the gold and JNUG ETF prices. It appears that the gap is narrowing, but it is not yet certain that the JNUG ETF price has bottomed.

Today was, to say the least, an interesting day to be invested in the JNUG ETF. It was a day where hope, fear and greed intersected. In the end, hope won out based on prior study and analysis of the price cycles and patterns of the JNUG ETF.

Sometimes you have to be a little crazy to be an investor. It helps to have a little method to our madness plus some madness in your method.

Links to other investor’s diaries in this series:

Part 1

Part 2

Part 3

Part 4

Part 5

Part 7

Part 8

Part 9

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Hi Terry!,

Well, its 2016.. and I just read your article. lol

Say, do you discuss the cycle analysis anywhere else? I would like to discuss a few questions. thanks..

Brian

Terry, a year and a half later, things with Gold are bullish, how are you looking now? What’s the longest period you’d stay in a position during a gold bull run? Would it be disastrous to hold a position and just ignore the volatility?

The first step is to understand how these instruments operate. They do not historically track the underlying benchmark over long duration. Leveraged ETFs are designed for alpha day trading. Even if you look on Direxion’s website, ETFs are split as short-term trading (leverage) and long-term investing (non-leveraged).

Unless one has experience successfully day trading with the proper money management in place, there is no need to even consider such products.

Do you still own JNUG today? Can you do another analysis on it today! Dec 8 ,2014. Thanks. Jack

The only thing I can safely say is that JNUG doesn’t have much further to fall. In other words, at $3.05, it’s getting nearer and nearer to zero. Now I don’t think it goes to zero, but its price has dipped far lower than I ever dreamed it would.

There are a lot of factors at play here. If the U.S. Dollar continues to move higher, then gold may move lower, and I would expect that to push the price of JNUG lower. Should the dollar pause, or move lower, then the opposite may happen and JNUG could end up moving higher.

One of the problems you face with JNUG is the fact that it is an ETF. A choppy market with prices oscillating up and down may be as bad, or worse, than a market which if steady, or steadily declining. JNUG is designed to move 3x relative to the GDX, but I have seen it temporarily move much greater than 3x or much less than 3x. In other words, its highly unpredictable.

You could choose to invest in NUGT instead which isn’t as levered as JNUG. It’s still risky, I have seen it move in far greater percentage terms than JNUG, and also far less. In general, the expectation would be that it would move in smaller percentage terms than JNUG, so you could buy NUGT, still have some leverage, and hopefully (again, hopefully) not see quite as volatile price moves as JNUG.

Honestly, I have not done well with JNUG. Have lost quite a bit of what I invested in it. I have been in and out of it a few times and got a small amount of the loss back. In the end I decided to spread my investment out and reduce risk through position sizing which is something he talks about in more detail in the link below…

https://www.youtube.com/watch?v=QjFRVPWpEuY

What I’m doing now is risking no more than 1-2% on any single trade. So, for example, in a $100,000.00 portfolio I would not risk losing more than $1,000.00 – $2,000.00 with any single trade.

Van Tharp has a good simulation game dealing with position sizing. You have to register in order to download the program…

http://www.vantharp.com/regform.asp

Ideally, with position sizing you would not only try to not risk a loss over 1-2%, but would also make sure that the overall size of any investment in your portfolio is also very small. For instance, you still assume a lot of risk if you have 25% of your overall portfolio dedicated to a single stock, even though your stop loss is set so you only risk 1-2%. But, if the market drops sharply your stop loss could be blown right through. This happened to me recently with an oil-related ETF. My loss wasn’t too bad, but only because I was paying attention and not depending on the stop loss to do all of the work.

To answer your question, I do have a very small amount invested in JNUG. I set a very wide stop loss so the price could drop to a record low and I still won’t get stopped out. I do believe that JNUG (along with the mining stocks) will recover at some point. Right now I’m just trying to have some skin in the game and trying not to get taken out of my positions should the price of gold fall. However, should the dollar continue to rise sharply and / or gold fall sharply, it’s possible that all of my positions could potentially turn into losses. But, my losses (unless the stops get blown out) should be 1-2% per stock, so they will be limited.

While you can make big gains with JNUG/NUGT or with short mining ETFs such as JDST/DUST, you’re exposing yourself to a lot of risk if you stay in them for more than a day at a time. I have had some great days with them just day trading and using things such as Bollinger Bands andpivots to trade in and out. You can do pretty well doing that, but I have also had days where the short and long ETFs are both making (or losing) money, so it can be confusing and dangerous to trade those ETFs.

At this point, I have opted to use position sizing to limit my risk, and hopefully be able to withstand any declines in gold and mining stocks with the idea that, at some point, I will be able to catch a good move to the upside. I’m in the middle of this now, so whether or not this proves to be a good idea or not won’t be known into the future. A lot of smart people still think gold will go to $1,000.00 or perhaps below. In that case, I could very well see most of the stocks I have right now hit their stop loss and end up losing money.

I’m thinking that, perhaps, gold doesn’t go down to $1,000.00 and works its way higher over the next few months. If that turns out to be the case, I could make a decent profit. Time will tell.

Just note that none of this constitutes investment advice. This is not a solicitation or recommendation to buy or sell stock. You should do your own due diligence and consult with a licensed professional investment adviser before making any investment decisions. All decisions whether to invest or not or your own.