My bold price prediction on the JNUG ETF was wrong. Now what?

Bullion.Directory precious metals analysis 24 October, 2014

Bullion.Directory precious metals analysis 24 October, 2014

By Terry Kinder

Investor, Technical Analyst

To avoid criticism say nothing, do nothing, be nothing.

Aristotle (Source)

Well, I was wrong. While my investment in the JNUG ETF has been going the wrong way, I have learned some important lessons that can be applied in the future. Image: pixabay

The motive behind criticism often determines its validity. Those who care criticize where necessary. Those who envy criticize the moment they think that they have found a weak spot.

Criss Jami (Source)

JNUG ETF Investment: What Went Wrong:

1. I did not anticipate how far the JNUG ETF price would fall. My original strategy was to buy JNUG on the way down in three equal purchases at $13.50, $12.50, and $11.50. The lowest JNUG price had dipped as I was creating my strategy was $12.80 back in December 2013.

2. I did not anticipate the amount of time the down part of the cycle would last. I knew in advance that the down cycles were getting longer and the up cycles were shorter, but I did not think the down cycle would last as long as it has.

3. The investment thesis for the JNUG ETF was based on cycles. I had been studying the price cycles and action of the JNUG ETF for several months in anticipation of buying near the bottom of the cycle. However, I did not focus enough on the large and powerful trend that is threatening to push mining stocks, as represented by the HUI, down to levels not seen since 2008. The overarching trend in the mining stocks in no way invalidates the underlying cycles, but it does create a downward trend that both swamps those cycles and will continue to pull prices down until it is broken.

4. Since I didn’t anticipate how far the JNUG ETF price would drop I also did not consider just how far the investment would draw down the funds put towards it. Overall, I have made an outsize bet with the belief that the risk/reward ratio is in my favor. This may prove to be wrong.

JNUG ETF Investment: What I Would do Different Next Time (Yes, There Will be a Next Time):

1. One thing I would do differently, and hopefully better, the next time (and there will be a next time since this trade is very cyclical) is to have a better understanding of the underlying cycles. Given the tools I started with I did okay. I went from using my own eyes to see patterns, to using a program to pull information out on a few of the cycles. The program I used wasn’t quite adequate to the task and it didn’t provide an overarching view of the cycles. You’ll see in a bit that without a clearer picture of the underlying cycles, I purchased the JNUG ETF at too high a price. I pretty much caught the downside of all of the cycles. Fortunately, this mistake should not prove to be fatal. I should come out of the investment ahead, but likely not at the level I had originally anticipated.

2. Hand in glove with the point above, I would probably scale into the position differently. I’m actually not a big fan of scaling in (or dollar cost averaging, or whatever you want to call it). I would prefer to buy as close to the bottom as possible. It isn’t something that is easy to do, but I believe I have acquired some tools through this first round of investing in the JNUG ETF that will help me buy closer in to the bottom than I did this time. Having a better understanding of what the cycles are and how they interact with each other, plus an awareness of the importance of general market psychology surrounding the miners, should allow me to be a better investor next time in the JNUG ETF.

3. The next time I will consider the position sizing of my investment in the JNUG ETF a little more carefully. It may or may not turn out to be much different in sizing, but the sizing will be carefully considered in light of the risk-to-reward ratio and also in light of opportunity cost investing in the JNUG ETF relative to other less volatile options.

4. Another change in approach for next time which fits in especially with points 2 and 3 above is to minimize the time in the JNUG ETF investment. I have been told that an ETF is not necessarily the appropriate vehicle to hold for a very long period of time. My impression is that these ETFs are basically being flipped during very short periods of time, more like hours or days rather than weeks. This makes sense, but the flip side is that sometimes the unconventional and unexpected move wins the day – think Hannibal

The Valid Parts of my JNUG ETF Investment Thesis:

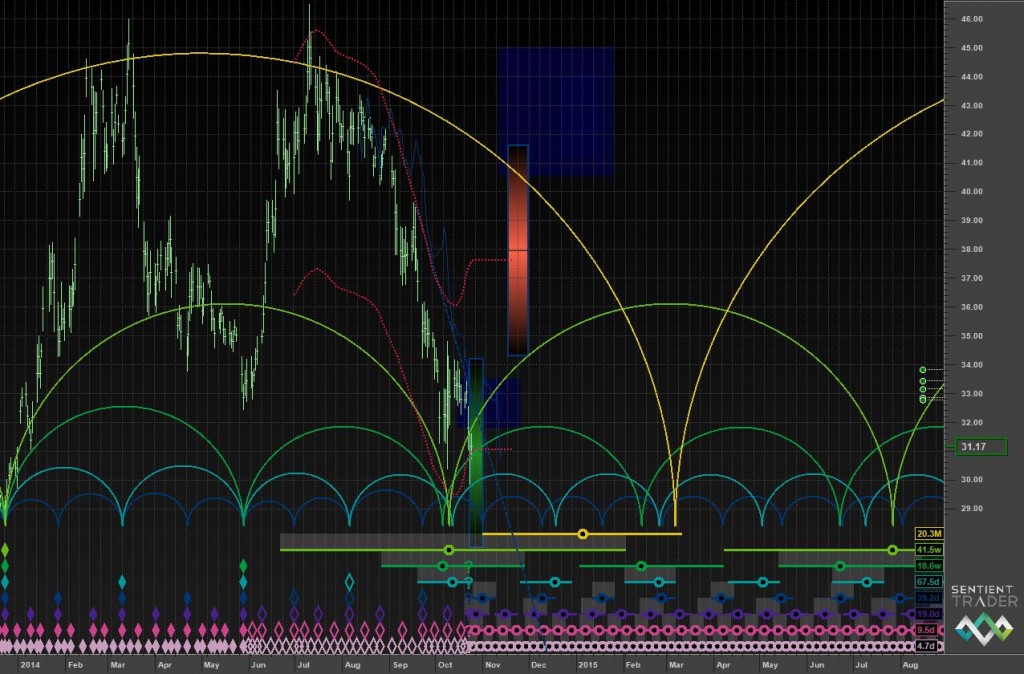

It’s pretty simple what is valid about my JNUG ETF investment thesis, it’s the idea that there are underlying cycles that move the price, and that those cycles can be used to help determine the future direction, momentum and price range of the JNUG ETF. To demonstrate this below is a screenshot of the GDXJ showing the cycles discovered through the Sentient Trader program. I’ve chosen to show the cycles chart for the GDXJ for a couple of reasons: 1) The JNUG ETF tracks the GDXJ price, only with leverage, so it makes more sense to show the GDXJ price since the JNUG ETF price is being driven by GDXJ rather than the other way around; and 2) The GDXJ has traded longer than the JNUG ETF so there is more cycle information available for GDXJ versus the JNUG ETF.

While I was correct on the overall idea of the JNUG ETF being very cyclical, my timing was poor. As you can see the visible cycles were all moving lower at the same time and my investment ended up being on the wrong side of this movement. Pictured above is the cycle chart for GDXJ. I chose to show the chart for GDXJ rather than the JNUG ETF because it determines the JNUG price and also because it has a longer price history as well as more available cycle information. Image: Sentient Trader

It’s easy to attack and destroy an act of creation. It’s a lot more difficult to perform one.

Chuck Palahniuk (Source)

Remember: when people tell you something’s wrong or doesn’t work for them, they are almost always right. When they tell you exactly what they think is wrong and how to fix it, they are almost always wrong.

Neil Gaman (Source)

“Our critics make us strong!

Our fears make us bold!

Our haters make us wise!

Our foes make us active!

Our obstacles make us passionate!

Our losses make us wealthy!

Our disappointments make us appointed!

Our unseen treasures give us a

known peace!Whatever is designed against us will work for us!”

Israelmore Ayivor (Source)

Conclusion:

So far, my investment in the JNUG ETF has been a pretty wild ride. If I had to do it all over again I would:

1. Do so with a better understanding of the underlying cycles.

2. Use the knowledge gained about the underlying cycles to purchase closer to the bottom.

3. Would consider other factors including overall market psychology more carefully.

4. Re-evaluate the position size of the investment in relation to my overall portfolio of investments.

Stay tuned to the next JNUG ETF investor’s diary to what I decided to do and how the overall investment is doing.

Links to other investor’s diaries in this series:

Part 1

Part 2

Part 3

Part 4

Part 5

Part 6

Part 8

Part 9

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply