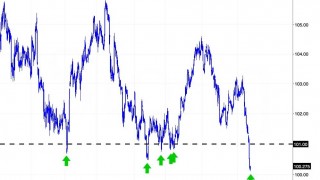

What Tricks Did These Investors Use to Make Money During Banking Crises? While the banking crisis was going on, there was a certain subset of investors that enjoyed record profits. You might ask, “Who?”

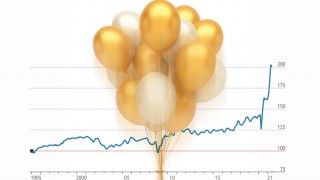

Full Article →Navigate the tumultuous seas of volatile markets with the ultimate financial lifeboat – gold. Discover its historic stability, the benefits of diversification, and how gold can help safeguard your investments against economic uncertainties. This guide is for savvy investors seeking a steady course in unpredictable financial waters.

Full Article →Unearth the power of precious metals in our comprehensive look at Gold vs. Silver Investments. Explore the key differences, market dynamics, and investment strategies that can illuminate your path to robust financial health. Let’s see which shines brighter for you!

Full Article →Discover five surprising facts about gold as an inflation hedge and how it could fortify your financial health. Learn from an experienced metals advisor why gold’s historical value, inverse relationship with the dollar, global acceptance, prominence in central banks’ reserves, and tangibility make it a secure investment choice in uncertain times.

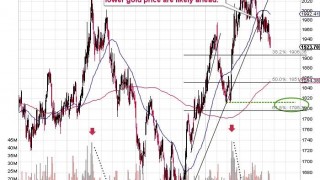

Full Article →Stay one step ahead of common gold investment pitfalls. Uncover the 7 warning signs of bad gold investments with this in-depth guide from an experienced metals expert. Learn how to spot overpriced collectibles, understand the value of tax-advantaged gold, avoid high premium traps, evade scams and more

Full Article →Embark on a journey to secure your wealth with our comprehensive guide to buying gold bars and coins online. Learn how to navigate the global marketplace, select reputable dealers, and safeguard your investment. Enter the exciting world of gold investing and shine brighter with our step-by-step guide!

Full Article →Discover why the world’s wealthiest are quietly amassing gold and how it could benefit your investment strategy. Explore the reasons for gold’s enduring appeal, and the methods by which the affluent invest in it – including the secret of Gold IRAs and learn why they’re a favorite among tax-savvy investors.

Full Article →Unearth the golden opportunities of a Gold IRA investment. Dive deep into tax benefits, inflation hedging, and geopolitical stability that could secure your financial future. From zero to hero, it’s time to solidify your retirement strategy with gold. Read more to embark on this golden journey!

Full Article →Discover 10 foolproof ways to diversify your portfolio with gold. From physical bullion to digital gold, this comprehensive guide offers tangible strategies for every type of investor. Unearth the golden key to wealth preservation and portfolio stability today!

Full Article →Discover the transformative power of gold investment on your financial health. From wealth preservation to tax benefits, learn how gold can revolutionize your financial discipline and bring peace of mind. Go for gold and watch your financial health flourish…

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.