Diversify Your Portfolio with Gold – 10 Smart Options for a Golden Nest Egg

Bullion.Directory Quick-Read Guides and Articles

Bullion.Directory Quick-Read Guides and Articles

By Alice Walker

Investor Relations Manager at Bullion.Directory

As you navigate the financial waters in our current times of economic nervousness, you’ve probably come across the term “diversification”. Diversification isn’t just a buzzword – it’s a strategic move that can help you manage risk and maximize your returns.

But diversification isn’t just about having different stocks in your portfolio – it’s also about varying the types of assets you own. This is where the age-old asset, gold, comes into play.

Gold isn’t merely a shiny metal used for jewelry or coins. It’s an investment vehicle with a storied history and tangible value. It has served as a monetary standard and a symbol of wealth for millennia.

Today, gold is seen as a ‘safe haven’ asset that investors often turn to during times of economic uncertainty.

You might wonder, “How exactly DO I diversify my portfolio with gold?” Well, that’s exactly what we’re going to explore in this article.

Why Diversify With Gold?

Historically, gold has proven to be a reliable store of value. Unlike paper currency, coins, or other assets, gold has maintained its worth over time. While we no longer use the gold standard in the U.S. (it was officially abolished in 1971), the appeal of gold as an investment remains strong.

In the rollercoaster world of investing, gold is often seen as a stabilizing force.

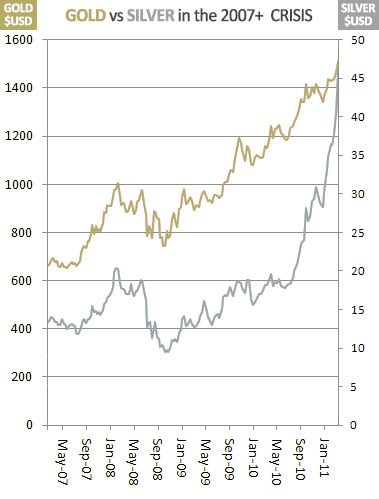

During the 2008 financial crisis, while many stocks were taking a nosedive, gold prices saw a significant increase. This is because gold tends to have an inverse relationship with the stock market, making it a valuable asset during economic downturns.

Similarly during the pandemic, gold reached all-time high prices as investors rushed to buy the safe-haven asset. Moreover, gold is considered a hedge against inflation, as its value often rises when the cost of living increases – given the current cost of living crisis, it’s not hard to see why so many investors are looking towards the yellow metal.

Now, how do we get this golden asset into your portfolio? Let’s explore ten foolproof ways to diversify your portfolio with gold.

1. Physical Gold Bullion

![]() If you’re a tangible asset lover like me, owning physical gold bullion – bars and coins, is not just a gratifying and deeply enjoyable experience, but it’s the only true way of owning gold.

If you’re a tangible asset lover like me, owning physical gold bullion – bars and coins, is not just a gratifying and deeply enjoyable experience, but it’s the only true way of owning gold.

There’s something immensely satisfying about holding a surprisingly heavy piece of wealth in your hand.

But it’s not just the feeling – physical gold has undeniable benefits.

Gold bars and coins are universally recognized worldwide, and their value is incredibly straightforward to determine based on weight and purity. They provide direct ownership (meaning you have the gold in your possession and don’t depend on any intermediary.)

And in terms of liquidity, gold is king. Almost anywhere in the world, there are buyers for gold. I have a friend who, whilst living abroad lost all his money and access to credit and debit cards – but he was able to quickly sell some gold coins he owned as insurance for just such eventualities – and he was able to sell them for the same price in that far off foreign market as he would’ve been able to back home in the US, or in any other country.

You can purchase gold bullion from various online dealers, mints, or local coin shops, and we list over 1600 of them in Bullion.Directory complete with user reviews and ratings. For some of the best, check the results of our annual Bullion Dealer of the Year public vote.

Do remember, owning physical gold comes with storage and insurance considerations. Be sure you’re ready to handle these aspects before diving in – be it an insurance rated home safe, or in a bank vault or depository.

2. Gold Exchange-Traded Funds (ETFs)

If you love the idea of investing in gold but aren’t thrilled about storage and insurance, gold ETFs might be your best bet. Gold ETFs are securities that track the price of gold.

When you buy shares of a gold ETF, you’re purchasing a fund that holds gold as its primary asset.

Here’s an analogy: imagine owning a picture of a gold bar versus owning the actual gold bar…

With a gold ETF, you have the picture. You don’t own the physical gold, but your investment moves with the price of gold. This method provides a relatively low-cost and straightforward way to add gold to your portfolio without worrying about physical storage.

3. Gold Mining Stocks

![]() Gold mining stocks are another method to get your feet wet in the gold industry. These stocks represent companies that mine for gold. When gold prices increase, these companies tend to become more profitable, and their stock price can surge.

Gold mining stocks are another method to get your feet wet in the gold industry. These stocks represent companies that mine for gold. When gold prices increase, these companies tend to become more profitable, and their stock price can surge.

But it’s not all sunshine and rainbows. Investing in gold mining stocks also means you’re exposed to the risks associated with the company – operational mishaps, management performance, and regulatory changes, among others. Perhaps a mine that has cost the company millions to develop,strikes out and the gold deposits are nowhere near the anticipated levels.

Perhaps a mine in a foreign country gets taken over by the local government, or is subject to sanctions or some other issue far outside your control. This happens, and can happen more than you would realize.

It’s like owning shares in any other business – the success of your investment hinges on the success of the company.

4. Gold Mutual Funds

If you’re not interested in researching individual gold mining stocks, gold mutual funds may be your golden ticket. These funds pool money from various investors to buy a diversified portfolio of gold-related assets.

Gold mutual funds can include everything from physical gold to shares in gold mining companies, giving you broad exposure to the gold market without having to manage individual investments.

It’s a hands-off way to invest in gold and can be a great starting point for new gold investors. It’s something many of my clients buy alongside their physical bullion and can further diversify a diversifier.

5. Gold Certificates

Let’s talk about gold certificates and look at another analogy. A gold certificate is like having a title deed to a house, but instead of a house, it’s gold.

You own a certain amount of gold, but you don’t physically store it. This method was more common back when the U.S. was on the gold standard, but there are still places where you can buy gold certificates.

Just make sure you’re dealing with a trustworthy source.

6. Gold Options and Futures

If you’re an advanced investor looking for a more complex way to invest in gold, consider gold options and futures.

Options give you the right to buy or sell gold at a specific price within a set timeframe. Futures are contracts obligating you to buy or sell gold at a predetermined price on a specific future date.

These methods can offer significant returns if you correctly predict how gold prices will move. However, they come with substantial risk and require a deep understanding of the gold market and investment strategies, especially with any form of leveraged investment.

Consider this path only if you’re comfortable with potentially high-stakes trading and with the possibility of losing more than you staked.

7. Gold Jewelry and Numismatic Coins

![]() I will no doubt annoy a lot of investors when I equate gold jewelry with numismatics, but I firmly believe that unless you buy an exceptional piece of jewelry or an exceptionally rare numismatic coin, they are both little more than pretty collectibles that happen to be made from gold.

I will no doubt annoy a lot of investors when I equate gold jewelry with numismatics, but I firmly believe that unless you buy an exceptional piece of jewelry or an exceptionally rare numismatic coin, they are both little more than pretty collectibles that happen to be made from gold.

For those who appreciate history and craftsmanship, investing in gold jewelry or numismatic coins can be an enriching endeavor. It can also be a good way to throw away 50% of your money (or more) when you leave the store.

Numismatic coins are collectible coins, whose value is based not only on their intrinsic gold content but also their rarity, condition, and historical significance. Many coins in the market are called numismatic, but a huge majority of these should really be classified as collectibles as opposed to true rarities. Collectibles are typically bullion coins made in somewhat limited numbers, but as any actual numismatist will yell you, that does not make them a numismatic and can simply be a way for the bullion dealer to make a better markup.

Likewise, investment gold jewelry can appreciate in value far beyond it’s melt-weight based on its craftsmanship, design, and antiquity, but of the two I think you have less chance of hitting a big win with jewelry, than you do with numismatics. In most western countries the markup on even the most basic of gold jewelry can be 200-500% over it’s gold weight. Designer boutiques will sell their gold at even greater premiums.

Saying that I have an acquaintance who inherited a collection of vintage gold jewelry, which turned out to be a treasure trove when appraised and included a couple pieces from a well-known Russian jeweler. Rather than a $30,000 value based on its weight in gold, the collection was worth north of $4 million.

But this is the exception – not the rule.

8. Digital Gold

First they called Bitcoin the new gold, then they used the blockchain to sell gold – welcome to the 21st century, where gold can now be digitized.

Yes, digital gold is a new way to invest in precious metals. Companies offering digital gold allow you to buy, sell, or hold gold in a digital format, with custody and title details all stored in a variation of the blockchain.

In the best cases, your gold token will be backed 1:1 with a given weight in gold and track the spot price of gold. In less good cases your gold token will only be partially backed by gold and in some cases not backed by gold at all, and simply track the price of gold, or be priced on uptake of some patented utility.

In theory many of these tokens work like physical gold ownership minus the hassles of storage and insurance. – and transactions can be near instantaneous.

I say in theory however, because of 30 gold-backed tokens I was following 3 years ago, only 4 still exist today.

9. Gold IRA (Individual Retirement Account)

![]() Planning for retirement? A Gold IRA can be an excellent part of your strategy – and in some ways is like the first option, owning physical gold bullion – but on steroids.

Planning for retirement? A Gold IRA can be an excellent part of your strategy – and in some ways is like the first option, owning physical gold bullion – but on steroids.

A Gold IRA is a specific type of individual retirement account that allows you to own physical gold within the account. I say on steroids, because THIS investment is tax-advantaged with the IRS letting you buy gold up-front with pre-tax dollars with a traditional IRA, or to not pay tax on disposal of the gold with a Roth IRA.

While the rules for a Gold IRA are as you would expect fairly complex given the involvement of the IRS, it can offer a tangible and stable asset as part of your retirement planning wrapped up in a highly tax-advantaged bow. It can also be as hands-off or hands-on as you like, when you deal with a Gold IRA Specialist. (See our top-rated gold ira companies here)

This is the one form of investment I recommend to any of the clients looking to buy physical gold!

10. Diversifying Within the Gold Space

Finally, let’s talk about diversifying within your gold investments. As we’ve seen, there are many ways to invest in gold, each with its pros and cons.

Just as you wouldn’t put all your money in a single stock, it’s prudent not to put it all your golden hopes and dreams in one type of gold investment.

Diversifying within the gold space can offer additional protection against market volatility. For many a combination of Physical gold, much of which is held in a tax-advantaged gold IRA, and some mutual funds will be a good mixture.

After those three the option become a combination of trading, gambling and collecting, which while right for some is definitely not suitable for all.

How Much Gold Should be in Your Portfolio

So, what’s the golden number? How much of your portfolio should be in gold? As you’d expect there’s no one-size-fits-all answer.

Some financial advisors suggest a 5-10% allocation to gold, while others might recommend a higher percentage and a few who I expect will regret their advice in a couple of years time say no to gold altogether.

In truth it depends on your individual circumstances, including your financial goals, risk tolerance, and overall investment strategy. Personally, I aim for about a 10% allocation to gold and other precious metals – and when things are looking very overheated in other markets, or if geopolitical risks are high, I’ll increase my allocation to be between 20-30%.

This figure provides a balance between benefiting from gold’s stability without overexposing my portfolio to any one asset. It also gives me easy access to a cash-like asset to help buy up post-crash bargains, such as stocks and real estate when the inevitable crash comes. And it will.

How to Diversify Your Portfolio with Gold – Conclusion

Gold, with its enduring value and stabilizing properties, can play a significant role in your diversified portfolio. It’s a tangible, finite resource that can provide protection against market fluctuations, inflation, and economic uncertainty.

Are you ready to bring a golden shine to your portfolio? If you’re thinking about making gold a part of your investment strategy and could use some guidance, don’t hesitate to get in touch with any of the specialist bullion dealers in our directory.

Our recent Bullion Dealer of the Year public vote, saw over 36,000 votes cast for 72 shortlisted companies taken from our 1600+ listings.

Any one of them will be able to offer exceptional service and help at low premiums.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply