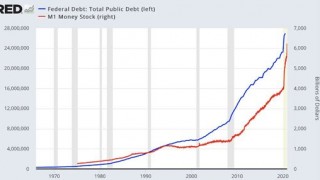

In a year that was marred by a global pandemic and a wave of economic restrictions that crippled many small businesses, financial markets proved to be resilient. Of course, that resilience owes in no small part to the unprecedented outpouring of stimulus from Congress and the Federal Reserve – and more stimulus is on the way.

Full Article →Released today, the Sound Money Index is the first index of its kind and uses 12 different criteria to determine which states maintain the most pro- and anti-sound money policies in the nation.

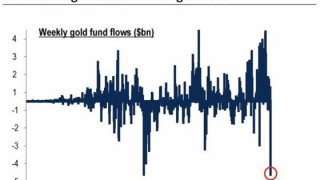

Full Article →Alarming Developments in GLD ETF…

The world’s largest gold exchange traded fund (ETF) seems to be having a lot of trouble when it comes to accounting. There’s little good reason to put any trust in GLD’s parade of CFOs or in shady HSBC bankers.

Full Article →This week I’m speaking with Vergel Villasoto, a Director at Silver Bullion Pte Ltd one of Singapore’s top precious metals dealers. Vergel has been working in the precious metals & bullion industry for several years, with additional hands on experience in the financial services line working both in private equity and commodities trading.

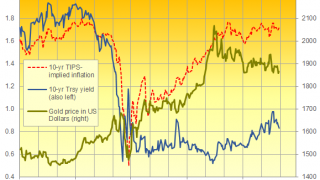

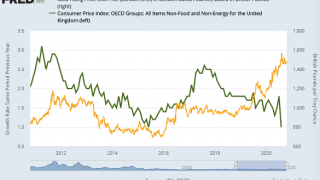

Full Article →Fed Recommits to Misleading Public About Inflation

Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline? On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future. Fed officials also vowed to keep pumping cash into financial markets.

Full Article →Danger Ahead as Markets Detach from Fundamentals

Americans may start the New Year without certainty as to who will be sworn in as president on Inauguration Day. President Donald Trump and his supporters can’t find courts willing to consider their evidence of widespread voter fraud. Trump is not likely to concede.

Full Article →Gold Slips on US Vaccination Start

GOLD PRICES fell even against a weak US Dollar on Monday as Asian and European stock markets rose amid widening hopes for a vaccine-led economic recovery while the UK and EU agreed to a last-gasp extension to Brexit trade talks.

Full Article →What Happens When Confidence Falls Apart?

While we may never know how deep and wide the political elites’ effort to gain control over our government goes, it appears to be vast. Although it’s still unknown whether fraud altered the overall election outcome, the evidence of fraud is real.

Full Article →Many investors see gold and silver ETF outflows as negative signs. But I view it as a Mr. Market’s last big effort to “shake the tree,” causing as many people as possible to fall off the galloping bull and head for cover.

Full Article →Globalists Poised for a “Great Reset” – Any Role for Gold?

Although the apparent results of the 2020 election are still being contested, members of the global ruling elite are already looking forward to a post-Trump era in American politics – and a post-vaccine world economy.

Full Article →Confidence Erodes in U.S. Institutions… Is the Dollar Next?

The U.S. election system, once sacrosanct, is losing the trust of half the country. Which half will depend on the outcome of Donald Trump’s efforts in the courts to demonstrate widespread fraud.

Full Article →There is little doubt that when we return to safer pastures, gold’s attractions will be reduced…[but] what we are seeing at the moment is a market in which some participants can’t decide whether now is the time to get out, or whether there is more upside ahead.

Full Article →Pro-Gold Fed Nominee Blocked

It was only after he entered politics that President Donald Trump began to fully grasp the bias, dishonesty, and fakeness that runs throughout the so-called mainstream media – but gold bugs and sound money advocates have long known to distrust the reporting of establishment news sources.

Full Article →GOLD PRICES fell within $5 per ounce of a 4-month low in London trade Thursday, retreating to $1853 even as world stock markets fell together with long-term interest rates and commodity prices amid tighter anti-Covid restrictions plus a surprise jump in US jobless benefit claims.

Full Article →What Will Biden Mean For Retirement Plans?

When it comes to Social Security, taxes, and especially 401(k) plans in general, it goes without saying that Joe Biden has very different plans than President Trump.

Full Article →GOLD PRICES on Wednesday gave back most of yesterday’s bounce from a $100 plunge, retreating to $1865 per ounce as interest rates on government bonds rose again with both global stock markets and commodity prices following Monday’s headline news of a Covid-19 vaccine.

Full Article →GOLD PRICES regained almost a third of yesterday’s $100 plunge in Asian trade Tuesday before easing back to $1880 per ounce in London as global financial markets stabilized from the apparent shock of pharma-giant Pfizer announcing successful trials of a Covid-19 vaccine.

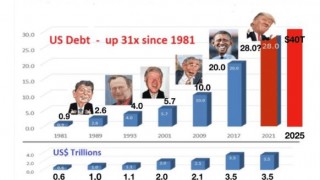

Full Article →The election campaign has been ugly but totally avoided the monumental problem facing the American people. Clearly neither of them wanted to tell the voters that he will take over the running of a totally bankrupt country that is likely to collapse economically, financially and morally in the next four years.

Full Article →Gold Climbs Following Election Results, Then Retreats

Gold prices closed Friday at a 7-week high above $1,950/oz… But with news today of a vaccine breakthrough, gold has fallen back below its breakout point. It is now retesting support in the $1,865 range and could consolidate for a few more weeks

Full Article →After The Election… Inflation!

If Congress, the Senate, and the President can’t come to terms on another fiscal stimulus package, then the burden will fall squarely on the shoulders of the Federal Reserve to ramp up new monetary stimulus schemes.

Full Article →The Moment Of Truth Is Here

If results are contested, the fiscal and monetary response would be the same; more stimulus, more debt, and more money creation. There is no uncertainty with regards to these policies and, long term, they will be key drivers in the precious metals markets.

Full Article →A New World Monetary Order Is Coming

Under a monetary order where electronic digits representing currency can be created out of thin air in unlimited quantities, the best hedge is the opposite – tangible, scarce, untraceable wealth held off the financial grid.

Full Article →Election May Impact Near-Term Action in Gold & Silver

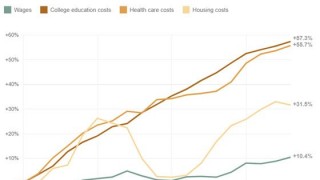

Metals broke out earlier in the year because there has likely never been so many fundamental reasons to buy gold and silver. We’ve seen economic turmoil, political strife, social unrest, a $3 trillion federal deficit, and a dollar weakened by fiscal and monetary stimulus – all happening at once.

Full Article →Today I’m speaking with a good friend Mr. Kedar Modi, the serial Entrepreneur with over 9 years in-depth experience in physical, scrap metal trading business.

Full Article →Sure, it sounds flashy when people talk about buying gold, but the reality is that a lot of our investors are simply buying gold as another way to store money rather than stockpiling their savings in the banks.

Full Article →GOLD PRICES rose against a falling US Dollar in London trade Wednesday, reaching 1-week highs above $1920 per ounce as global stock markets fell amid fresh Covid-19 lockdowns and restrictions across Europe, plus continued rumors and counter-rumors over US politicians agreeing a new stimulus package ahead of 3 November’s White House.

Full Article →Three Unstoppable Forces Set to Drive Silver Prices

The threat of economically crippling lockdowns, the promise of unending monetary stimulus, and the uncertainty of game-changing political outcomes – this is the “new normal” for investors.

Full Article →America’s Political and Financial Institutions Are Broken

America’s key institutions are broken. More people wake up daily to that reality. They are preparing for the moment this realization dawns on Americans at large, which explains why the markets for physical bullion are so active.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.