Despite the Fed’s best efforts thus far to raise rates and cool off inflation, I don’t expect relief any time soon. With that in mind, let’s look into the past to see what a longer period of inflation looks like. The best place to start in the U.S. is to take a brief look at an extraordinarily long period of inflation that took place from the 1970s

Full Article →The Rally in Gold – Did it Just End?

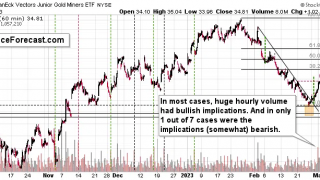

Let’s start today’s analysis with a very short-term chart (hourly candlesticks) featuring the GDXJ ETF – a proxy for junior mining stocks. These miners have been the most volatile part of the precious metals sector – at least, it’s the more popular part.

Full Article →Every year we take a step back from our regular business of paying interest on gold and silver to our clients to give our thoughts on the likely direction of gold and silver prices for the coming year. We provide this in-depth analysis, for free, in our annual Gold Outlook Report.

Full Article →Contrary to popular misconceptions perpetuated by the Fed, the root causes of inflation aren’t tied to employment or economic growth. Inflation occurs when the currency supply expands too rapidly as confidence in the ability of U.S. dollars to retain their value falls.

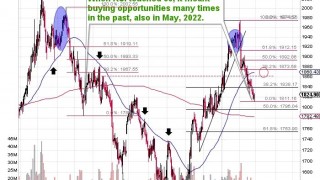

Full Article →How High Can the Gold Price Rally in March?

Fear and greed are common on the market, and due to them, people tend to follow specific patterns over and over again, regardless of the exact economic surroundings and also pretty much regardless of the time when it’s all taking place…

Full Article →500-Year-Old Law is Gold Investor’s BFF

I think about Gresham’s law a lot. Back in the day of the first Queen Elizabeth (1533-1603), her banker, Sir Thomas Gresham, made an observation about currency debasement: Bad money drives out the good. You see, back in the 16th century, money was still “sound”…

Full Article →Gold Price Is ALMOST Ready to Rally

Enough is enough. No market can decline without correcting every now and then. And both gold and the USDX point to an upcoming reversal. Let’s start with gold. Looking at its price from a short-term point of view, we see that it…

Full Article →Even the Gold Price Has to Breathe!

Long weekends are often a chance for the markets to cool off recent emotionality and focus on the main trend. And the trend in gold is back! Gold moved sharply higher during Friday intraday trading, and…

Full Article →Hidden In the Inflation Numbers: The Next Gold Price

The same people who told us inflation was “transitory” two years ago are still capable of being surprised when reality fails to meet their expectations. Even returning inflation to 2 percent won’t make absurd prices any lower – rather, prices will still rise, but at a slower pace.

Full Article →White House Actions Raise Risks to Economy

It would now be no surprise to many if a big city went dark tomorrow. It seems the unthinkable is becoming more and more thinkable as time goes. This raises questions for investors who want to protect themselves from rising risk factors.

Full Article →New Enthusiasm for Old Investment Strategy?

Activity among central banks, state legislators and younger savers could suggest bright future for metals with central bank 2022 gold purchases now highest on record. In fact for well more than a decade, central banks have been relentlessly stocking up on gold.

Full Article →‘Demand Destruction’: What It Means for You and Me

If you listen to financial pundits talking about the Federal Reserve and the current state of the markets you might hear this term mentioned: “Demand destruction.” What is it? And what does it mean for you and me?

Full Article →Danger – Choose Your Bullion Dealer Carefully

Regal Assets, a somewhat prominent gold and silver dealer in southern California, is in serious trouble based on news released last week. Tyler Gallagher, the firm’s high-flying owner, has reportedly vanished…

Full Article →Gold Outlook 2023 Brief

This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market players, dynamics, fallacies, and drivers of markets, and finally, give our predictions for gold and silver prices over the coming year.

Full Article →Bloomberg’s Gold Investment Advice Is Spot On

Do Bloomberg’s readers really need a primer on gold investment? Aren’t they all experienced economists and investors who know every asset inside and out? Judging by Bloomberg’s latest step-by-step gold investment guide, we’d say not.

Full Article →Fishy Jobs Report Boosts Dollar

January’s jobs report was ‘stunningly good,’ according to CNBC promoting traders to buy up U.S. dollars and short gold and silver. The official unemployment rate fell to 3.4%, the lowest since 1969. Skeptics say something smells fishy.

Full Article →Social Security on Brink of Collapse

Once again, the federal government has reached its statutorily determined debt limit – now an unbelievable $31.4 trillion. There can be no more spending until that limit is either raised or suspended and the United States may default on its obligations for the first time in history

Full Article →Gold Market Not Buying Powell’s ‘Disinflation’

According to Fed chairman Jerome Powell, disinflation is now taking hold. Yes, the very same person who had to walk back his ridiculous pronouncements in 2021 and 2022 that inflation was “transitory” now wants us to believe inflation is steadily declining

Full Article →Gold Up 18% in Three Months – Will It Continue?

Low volatility plus a strong upward trend is a recipe for slow, steady price growth. You’re looking at an 18% increase in gold compared to a 5% increase in the S&P 500 – in just three months. That’s not enough for some people.

Full Article →Markets Not Accounting for Ukraine Escalation

The U.S. has provided Ukraine nearly $100 billion in weapons, cash, and humanitarian assistance. The sanctions imposed on Russia may be even tougher now than during the Cold War. Despite these things, investors in the U.S. don’t seem to be paying much attention to rising geopolitical risks

Full Article →Debt Ceiling Crisis Reveals Precarious Economy

The ongoing battle over the debt ceiling is likely to continue for some time this year. According to Treasury Secretary Janet Yellen, the government can use accounting tricks to keep the government running and meet principal obligations until around early June.

Full Article →We’re Just One Step Away from $5,700/oz Gold

MoneyWeek’s Dominic Frisby is an analyst to watch. His precious metals analyses are full of insights, and his latest observation on gold’s price is fascinating. Frisby shows off his decades of experience by reminiscing about gold’s price trajectory from the late 1990s to now.

Full Article →What Would Early Biden Departure Mean For Markets?

Joe Biden entered the Oval Office with relatively low approval ratings. The botched withdrawal from Afghanistan, an economy in decline, rising consumer prices, and potential scandals simmering in the background haven’t helped his approval ratings over the past two years.

Full Article →Will Silver Leave Gold Behind in 2023?

Not only are there sound fundamental reasons why silver can outperform gold during metals-favorable climates, but there have been several notable periods during which silver has done just that.

Full Article →Revealed: The Secret Reason Governments Love Inflation

When people spend beyond their means, they increase the likelihood that they will suffer severe financial consequences – including foreclosure and bankruptcy. But when the U.S. government spends beyond its income, that doesn’t happen.

Full Article →Shock: Raging Inflation Still Robbing Americans

It’s official: Inflation is easing up from the historic pace it reached back in June 2022. The latest report from December 2022 has it running at “only” 6.5%. But even that is still running hotter than any month since the early 1990s.

Full Article →Why Are Analysts Predicting Higher Gold Prices?

Strange as it might sound for a year when gold posted a new all-time high, many thought 2022 was a “tepid” or “disappointing” year for gold’s price. That makes the price gains so far in 2023 all the more promising…

Full Article →Elite’s Masterplan Revealed

The bureaucratic assault on the First Amendment is part of a larger movement to end personal liberty. The ultimate goal may be to assume financial control over the populace through implementation of a central bank digital currency

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.