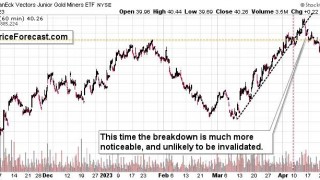

It was only two months ago – in April – when everyone and their brother were convinced that gold stocks are going to soar? They laughed at my warnings that this kind of sentiment is what accompanies tops, not buying opportunities…

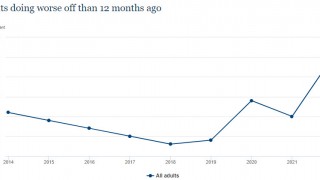

Full Article →All politicians, especially those in the Biden administration, are notoriously bad at anticipating the ripple effects of their “solutions” to problems like pandemics and inflation. Their response to emergencies has left us worse off.

Full Article →George Milling-Stanley, chief gold strategist at State Street Global Advisors, says gold has a real chance to smash its old price records before the end of the year. Now, gold has been above and below $2,000/oz. for more than a decade. Its initial foray into +$2,000 territory was supported by conditions nothing like where we are today…

Full Article →Fiscal hawks weren’t optimistic when Kevin McCarthy was elected Speaker of the U.S. House. The California Republican’s track record was dismal when it comes to spending restraint. Nearly 5 months into his term, it is now apparent McCarthy has no intention of holding the line against government expansion.

Full Article →Central Bank Digital Currency (CBDC, or in America let’s call it “FedCoin”) is a hot topic right now. Articles about it are everywhere, and Monetary Metals’ clients are asking about it. Gold is widely seen as a way to opt out. No doubt this is part of why the price of gold has held up so well.

Full Article →The Debt Ceiling Deal and the Price of Gold

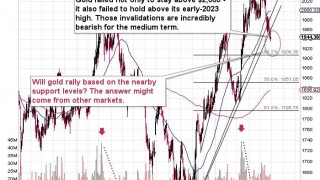

What are the consequences for the price of gold? Will gold go parabolic? Truth be told, though, there’s not that much to write because what we saw on the market on Friday took place in exact tune with what I wrote previously.

Full Article →According to Fidelity’s 2022 State of Retirement Planning Study, 71% of Americans say they are very concerned about the impact of inflation on their retirement savings plan. Nearly one-third admit they don’t know how to make sure their retirement savings keep up.

Full Article →President Joe Biden will meet with House Speaker Kevin McCarthy on Monday to hold high-stakes talks on the still-unresolved debt ceiling standoff. Both sides agree that the government will need to take on more debt in order to pay its bills.

Full Article →Recently we’ve documented a groundswell of popularity in gold as an investment. Google searches for how to buy gold recently hit a new record. Central bank gold buying, already fierce, is poised to grow even more. In short, there’s a “new global gold rush” underway:

Full Article →According to the latest Trustees report, approximately 66 million people receive some form of monetary Social Security benefits. The cost of Social Security programs have exceeded its income since 2021. So they’re underfunded (and falling behind).

Full Article →California-based Red Rock Secured, a finance company widely known for its commitment to customer satisfaction, is facing surprise civil charges this week. The Securities and Exchange Commission (SEC) alleges that Red Rock Secured have engaged in questionable practices over a span of five years.

Full Article →Central bank gold demand last year was undoubtedly one of the main takeaways in the market. That’s an accomplishment of sorts, since central bank gold demand has been one of the primary drivers of gold prices over the past decade.

Full Article →Investors don’t have to guess. Holding tangible assets with universal value and appeal is a better way to prepare against the coming changes. There will be a market and a price for commodities, real estate, and precious metals regardless of what money people might use.

Full Article →Ray Dalio doesn’t like the tensions building up between the U.S. and China. It’s a 2016-style flashback, intensifying quarrels with China over global trade. At the same time, 2016 was a while ago! We can no longer call the U.S.-China conflict a “trade war,” because there is a real and ugly war going on in Ukraine

Full Article →On Sunday, U.S. Treasury Secretary Janet Yellen warned that ‘financial and economic chaos will ensue’ if the U.S. government’s borrowing limit isn’t raised. If that wasn’t dramatic enough, she also said on ABC’s “This Week” that a default would bring about an ‘economic calamity.’

Full Article →It’s worth remembering that the Federal Reserve chair is an appointed, not an elected, position. Powell can survive a period of unpopularity more easily than any member of Congress. And that’s good news for him, because he’s going to be unpopular in the White House (and on Wall Street) for quite some time…

Full Article →Remember when the collapse of Silicon Valley Bank was the second-largest bank failure in U.S. history? Seems like just yesterday – which, in a figurative sense, it was. It’s been barely two months since Silicon Valley fell to earth and triggered a wave of anxiety over the banking system unseen since the 2008 financial crisis.

Full Article →Top in Stocks? Implications for Gold Miners and… Profits

The profits in the FCX increased once again, but junior miners didn’t decline despite the S&P 500’s downswing. Why would this be the case? In my analysis yesterday, I warned about the volatility that we might see this week, mainly due to Fed’s interest rate decision, but…

Full Article →Over the weekend, federal regulators seized First Republic and cut a deal with JP Morgan to assume most of the failed bank’s assets. This should come as no surprise to regular readers – I discussed the contagion spreading across the banking sector back in March. So this isn’t a surprise, but is it still worthy of concern?

Full Article →Demand for coins, rounds, and bars surged when the failure of Silicon Valley Bank awakened investors to the possibility of systemic problems among smaller and regional banks. Despite the massive spike in demand for bullion coins three years ago, the dysfunctional U.S. Mint has somehow managed to produce fewer coins.

Full Article →Monthly Reversal in Gold Price and Gold’s Outlook

In Friday’s analysis, I wrote that gold price was likely about to form a monthly reversal – and now it’s a fact. Will gold slide? Bullion.Directory precious metals analysis 01 […]

Full Article →As the US Federal Government and Federal Reserve head ever more into the abyss of destroying the value of the US dollar, there is an accelerating counter force emerging in the US that is the antithesis of this Federal Government and Federal Reserve madness. That is the Sound Money movement.

Full Article →Once Again $2000 is Ceiling for Price of Gold

The price of gold moved higher yesterday, but did it manage to rally back above $2,000? No! Despite USDX’s weakness, it didn’t. And this means that the odds for a bigger rally from here declined while the odds for a bigger decline increased.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: What to watch out for in the coming financial crisis, Citi thinks $30 silver is a lowball forecast, and how to solve the debt ceiling stand-off with a single platinum coin…

Full Article →What a Week in Gold Price! What an Invalidation!

Did last week’s market plunge below the $2,000 level provide the final confirmation? And why is this big news? I wrote in number of occasions that the gold price was unlikely to hold the breakout above the $2,000 level. Last week provided the final confirmation.

Full Article →There’s little dispute that the turmoil we saw upsetting the financial system a month ago has subsided. But have we really seen the last of it? A number of expert observers, including former Treasury Secretary Larry Summers, have been saying it’s a little too soon to give the “all clear” on the turbulence…

Full Article →Depending on the source you check, the U.S. debt ceiling has been lifted or modified approximately 102 times since its inception in 1917. By June of this year, that number is likely to increase by one, and that means the U.S. debt is poised to skyrocket after it happens. But what if things don’t go according to plan?

Full Article →Spend any time in the gold market and you will be bombarded with all kinds of theories about what drives gold and silver prices. It’s the money supply dummy! No, it’s “real” interest rates! No, no, it’s mine production! Then there are the non-theories…

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.