On 2023-08-18, the expected price range for the Gold Continuous Futures was projected to have a low of 1,915.34 and a high of 1,946.65. This forecast was based partially on the previous day’s data, where the opening price was 1,923.00, the highest point reached was 1,933.50, the lowest point was 1,914.20, and the closing price was 1,920.60.

Full Article →On 2023-08-17, the expected price range for the Gold Continuous Futures was projected to have a low of 1,922.62 and a high of 1,951.59. This forecast was based partially on the previous day’s data, where the opening price was 1,932.80, the highest point reached was 1,938.20, the lowest point was 1,921.70, and the closing price was 1,923.00.

Full Article →With all eyes on BRICS as it prepares for a meeting at the end of August that could see new members joining, the question is looming in the back of future-minded investors: will BRICS develop its own currency in a bid to challenge the U.S. dollar as the world standard?

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: U.S. credit rating and de-dollarization, China boosts official gold reserves for 9th consecutive month, and South Africa’s gold mines are under heavy stress.

Full Article →Can Gold and Silver Ever Return to Circulation?

There aren’t many bullion investors who haven’t thought about using their stash to buy groceries one day. Most of them bought metal in the first place because they know something important about history. Fiat currencies eventually die at the hands of irresponsible leaders, and it can happen fast.

Full Article →On 2023-08-14, the expected price range for the Gold Continuous Futures was projected to have a low of 1,937.51 and a high of 1,974.75. This forecast was based partially on the previous day’s data, where the opening price was 1,944.50, the highest point reached was 1,953.60, the lowest point was 1,944.00, and the closing price was 1,945.70

Full Article →Fitch Cuts America’s Credit Rating

When we get near the end of 2023 and news outlets begin rolling out their “year-in-review” retrospectives, there’s one story that’s sure to be featured prominently: the saga of the debt-ceiling standoff, including how close America came to defaulting on its federal debt for the first time in history.

Full Article →On 2023-08-10, the expected price range for the Gold Continuous Futures was projected to have a low of 1,945.49 and a high of 1,983.10. This forecast was based partially on the previous day’s data, where the opening price was 1,959.60, the highest point reached was 1,966.10, the lowest point was 1,947.20, and the closing price was 1,949.30.

Full Article →Mismanaged U.S. Mint Doubles Production

Poor planning practices at the U.S. Mint, including an apparent refusal to stockpile extra silver blanks during periods of market slack (such as now), have caused a steady erosion in the market share of this once extremely popular U.S. silver coin.

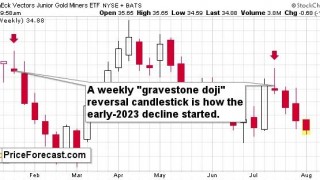

Full Article →2023 is a Down Year for Silver and GDXJ

Did you notice that for the HUI Index, GDXJ, and silver, 2023 is already a down year? In today’s analysis, I’ll dig into the former. Remember how I wrote in mid-July that after the weekly reversal, junior mining stocks were likely to move lower…

Full Article →On 2023-08-08, the expected price range for the Gold Continuous Futures was projected to have a low of 1,955.25 and a high of 1,999.57. This forecast was based partially on the previous day’s data, where the opening price was 1,978.60, the highest point reached was 1,980.20, the lowest point was 1,966.10, and the closing price was 1,971.40.

Full Article →On 2023-08-07, the expected price range for the Gold Continuous Futures was projected to have a low of 1,949.00 and a high of 1,994.79. This forecast was based partially on the previous day’s data, where the opening price was 1,971.10, the highest point reached was 1,984.20, the lowest point was 1,954.50, and the closing price was 1,978.20.

Full Article →Inflation is by no means finished. But it does seem to be dissipating. And as this chapter of inflation draws to a close, so, too, will one of the fastest cycles of interest-rate increases in four decades draw to a close, as well.

Full Article →Gold Price Forecast for August 2023

Making gold price predictions is not an easy feat, but every now and then, we get blessed with a clear signal. And we saw one in July 2023. It’s visible on the monthly chart that features not only the key parts of the precious metals sector but also one of the key gold price’s drivers – the USD Index.

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Understanding why gold’s price rises despite higher interest rates, the trouble with “tokenized gold” and platinum might be the diversification asset you need.

Full Article →Those who are looking to get rich quick can try their luck at lotteries, casinos, or highly leveraged derivatives markets. Most who do will, predictably, end up getting poorer. A sound investing strategy won’t necessarily bring you jackpot gains, but it will protect you from disastrous losses while…

Full Article →On 2023-07-27, the expected price range for the Gold Continuous Futures was projected to have a low of 1,952.79 and a high of 1,986.44. This forecast was based partially on the previous day’s data, where the opening price was 1,966.60, the highest point reached was 1,979.90, the lowest point was 1,963.20, and the closing price was 1,972.50

Full Article →On 2023-07-27, the expected price range for the Gold Continuous Futures was projected to have a low of 1,952.79 and a high of 1,986.44. This forecast was based partially on the previous day’s data, where the opening price was 1,966.60, the highest point reached was 1,979.90, the lowest point was 1,963.20, and the closing price was 1,972.50

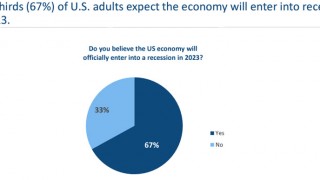

Full Article →Looking at every recession since December 1969, the economist David Rosenberg has calculated that, on average, the Leading Economic Index starts to decline 13 months before a recession begins and falls 4.6 percent before the recession begins. By that metric, we’re even deeper into the danger zone than

Full Article →On 2023-07-26, the expected price range for the Gold Continuous Futures was projected to have a low of 1,948.21 and a high of 1,981.21. This forecast was based partially on the previous day’s data, where the opening price was 1,956.10, the highest point reached was 1,967.70, the lowest point was 1,951.60, and the closing price was 1,966.80.

Full Article →A Little Decline Here, a Small Rally There… It’s Happening.

The USD Index is on the rise, and the precious metals sector is declining. Big things can have small beginnings, though, and that’s normal. In yesterday’s analysis, I focused on what’s currently most important from the medium- and short-term point of view on… pretty much all markets

Full Article →On 2023-07-25, the expected price range for the Gold Continuous Futures was projected to have a low of 1,947.35 and a high of 1,979.63. This forecast was based partially on the previous day’s data, where the opening price was 1,963.00, the highest point reached was 1,969.80, the lowest point was 1,954.60, and the closing price was 1,956.00

Full Article →Last week, the Fed launched a new payment processing system dubbed “FedNow.” Officials say FedNow will allow individuals and businesses to initiate instant funds transfers between banks. Critics warn FedNow could be a prelude to central bank digital currency (CBDC) that threatens financial privacy and freedom.

Full Article →On 2023-07-24, the expected price range for the Gold Continuous Futures was projected to have a low of 1,952.12 and a high of 1,987.26. This forecast was based partially on the previous day’s data, where the opening price was 1,963.60, the highest point reached was 1,964.80, the lowest point was 1,962.20, and the closing price was 1,963.00.

Full Article →By now, there’s a good chance you’ve heard of central bank digital currencies (CBDCs). In the U.S., they’ve come to be known popularly as “digital dollars.” Basically, CBDCs are the digital versions of the same official currencies issued by central banks around the world…

Full Article →On 2023-07-21, the expected price range for the Gold Continuous Futures was projected to have a low of 1,963.75 and a high of 1,999.57. This forecast was based partially on the previous day’s data, where the opening price was 1,980.30, the highest point reached was 1,989.80, the lowest point was 1,967.70, and the closing price was 1,974.20.

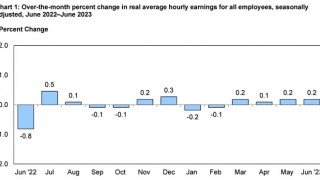

Full Article →Following the government’s panicked response to the Covid pandemic, the resulting economic devastation and two-plus years of historic inflation thus far… There is finally some good news! According to data released from the Bureau of Labor Statistics (BLS), wages are finally outpacing inflation… Or are they?

Full Article →This week, Your News to Know rounds up the latest top news stories involving gold and the overall economy. Stories include: The trend of central bank gold repatriation, analyzing gold’s headwinds, and man from Kentucky finds 700 Civil War era coins almost in his backyard.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.