Rapidly increasing industrial and military demand for silver is depleting global inventories, and the rate may well accelerate quickly. Silver demand has outstripped supply for three straight years and the Silver Institute projects another market deficit this year.

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Saxo Bank says gold is facing biggest tailwind since the lockdowns, the normalization of the gold/silver ratio and Chinese citizens might finally get easy access to genuine gold.

Full Article →Many Countries Now Turning to “Stateless Currency” Gold

Many central banks are opting for a “stateless currency” – gold. That’s how a recent article published by Nikkei Asia put it, noting that “central banks are diversifying away from the dollar and yuan.” Central banks globally added a net 483 tons of gold through the first six months of this year, 5 percent above the record of 460 tons in H1 2023.

Full Article →Precious Metals Update 8/09/2024

Wow, what a week! Market whiplash was on the menu. Buy the dip in gold wins again! The stock indices dip on Monday was reminiscent of October 19, 1987. James Baker, the US Treasury Secretary at the time, was at odds over currency valuations and interest rates with our trading partners. Push came to shove the following week and world markets tanked

Full Article →Why the Fed Can’t Win – and We All Lose. Inflation has slowed, but the economy is stagnating. With an imminent recession ahead, the Fed’s stuck between a rock and a hard place. Here’s why we’re trapped with them… If rates start falling, that would certainly get speculators excited. But let’s examine the situation a little more closely.

Full Article →The idea is pretty simple. The U.S. Treasury could mint a $1 trillion platinum coin, deposit it at the Federal Reserve, and then the federal government could write checks against that asset. Voila! Budget problem solved. Now, it may sound a little bit like creating money out of thin air… That’s because it is.

Full Article →Recently, investors have realized that bad economic news is in fact bad news, and the global financial system is reeling. Here’s what happens next… Recessionary fears renew as sentiment shifts in favor of gold, is the world ill-prepared for a consumer-driven supply glut, and guess who’s been fudging the news about their gold purchases?

Full Article →I Thought Gold Was a Safe Haven! Why Did It Tank With Stocks? It was a bloody Monday in the stock market as analysts digested the dreary jobs report released Friday and suddenly discovered the rot in the economy’s foundation. So, What Happened to Gold?

Full Article →Stocks Crashing: Will Fed Pivot or Panic?

It’s no longer a question of whether the Federal Reserve will cut interest rates. It’s a question of how soon central bankers will cut and how big they will go. Last week’s ugly economic reports on manufacturing and employment helped trigger a mini-meltdown in the stock market – one that continues today.

Full Article →Central Bank and Over-the-Counter Buying Pushed Gold Demand to Record Levels in Q2. Gold demand was up 4 percent to 1,258 tons in the second quarter, the highest level on record since the World Gold Council started compiling data. Demand for gold was strong in the second quarter despite record gold prices.

Full Article →The Bullion Dealer of the Year 2025 shortlisting vote has now closed. Votes for past category winners and new companies added by the public will be counted over the weekend, with finalists announced 5 August. The main public vote begins August 28, 2024 running until October 23 with winners announced November 6.

Full Article →A new major currency will be hitting the world stage soon as BRICS – being the economic block of Brazil, Russia, India, China, South Africa, and a growing number of non-western nations – is coming closer to officially launching its collective tender. Details of the currency, which will be called The Unit, have been announced

Full Article →On July 26, the national debt blew past $35 trillion for the first time. We are now cursed with a debt of $35,001,278,179,208.67. This milestone will likely raise some eyebrows, but nobody will do anything about it. And sadly, most people don’t care.

Full Article →Bidenomics has pretty much played out as a disaster so far, especially for older Americans saving for their retirement. Now we might be able to see some light at the end of the tunnel. Unfortunately, now that Biden knows he won’t be the next president, the gloves are off. He can do whatever he wants, without much political pressure.

Full Article →Americans are questioning all sorts of government functions these days. For example, the majority of people, according to polls, have doubts as to whether U.S. elections are free and fair. Some believe the federal justice system has been weaponized and used against those in political opposition.

Full Article →The 2024 Summer Olympics kicked off over the weekend. Thousands of athletes from all over the world have converged on Paris with one goal in mind. Win silver! Now, you’re probably thinking, ‘Umm… Mike, they’re going for gold.’ And technically, you’re correct. But did you know that gold medals are mostly made from silver?

Full Article →Yesterday, gold dropped $62.20 an ounce and silver dropped $1.35 an ounce. As of this writing, gold has bounced back over $30 per ounce and has rebounded above its 50-day moving average and continues to be well above its 200-day moving average. Both averages are what money managers and professional traders follow.

Full Article →How will the upcoming presidential election impact the gold market? Biden has dropped out of the presidential race. It appears Kamala Harris has the inside track to the Democratic Party nomination, but that isn’t a foregone conclusion. Polling currently shows Trump and the Republicans holding an edge, but we are a long way from November…

Full Article →Unless you live in a cave located in the remote regions of the world, you probably heard about the Crowdstrike outage. A simple IT mistake (not even an act of cyberterrorism!) took down the world’s computers on July 19, costing over $5 billion and disrupting countless lives. Here’s how to be ready next time…

Full Article →On July 16, a jury convicted Senator Bob Menendez (D-N.J.) on 16 counts, including wire fraud, bribery, and extortion. At least he accepted bribes that would retain their value. Let me be clear: you really shouldn’t take bribes. But if you do (don’t), get it in gold.

Full Article →This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Gold hits $2,424 on speculations of a rate cut, shifting our understanding of the gold market, and Africa’s turn to gold is sending us signals.

Full Article →Gold and silver each retreated in price today with silver down about 3% and gold down about .25%. The significance of the gold drop is not the change from yesterday’s close. The significance is that it reached an all-time high then reversed over $25 per ounce. Buy the dip!

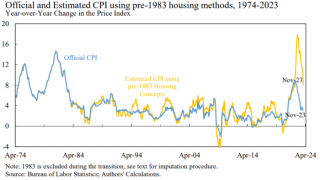

Full Article →If you have that strange feeling like the full story about the U.S. economy isn’t being told, you’re not the only one. You might even be feeling like things are much worse than the Administration keeps touting through the corporate media. In fact, in this piece we’re going to explore several examples that illustrate just how the American public is being sold

Full Article →The federal government ran another big deficit in June, as the national debt inches closer to $35 trillion. $35 trillion USD. Trillion with a ‘T.’ That’s an unfathomable number. It’s meaningless to most people. We simply can’t comprehend a number that big.

Full Article →Gold-backed exchange-traded funds (ETFs) reported net inflows of gold for the second straight month in June. With European funds leading the way, net gold holdings by ETFs globally increased by 17.5 tons last month. May was the first month of positive flows into ETFs in 12 months.

Full Article →The June employment report was released this morning and showed a continued labor market slowdown. About 200,000 jobs were created in line with expectations though continuing a downward trend. The unemployment rate edged up to 4.1% which was the highest reading since October 2021. One less talking point for Joe Biden as he …

Full Article →I’ve written a lot about the fact that silver appears to be underpriced given both technical factors and the supply and demand dynamics. Platinum may be even more undervalued, hovering around $1,000 an ounce. To put that into perspective, platinum hit an all-time high of $2,213 an ounce in March 2008…

Full Article →This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: Gold is making another run towards $2,400, emerging market central banks to continue buying gold for decades, and why younger generations are three times more likely to buy gold than older ones.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.