Precious metals markets traded into an important technical juncture ahead of Wednesday’s Federal Reserve policy announcement. Bank of America analysts stated that this week’s meeting is “one of the most critical events for the Fed in some time.”

Full Article →The last year has been extraordinary. There have been COVID lockdowns, a disputed presidential election, and multi-trillion-dollar federal deficits and bailouts. The Federal Reserve has injected more money into markets than ever before.

Full Article →Since the pandemic began a year ago, the term “new normal” has become part of the American lexicon. Not “new” as in better or improved. But rather “new” as in contrast to the way things used to be. Much of the mainstream discussion argues that returning to the “old” normal isn’t likely to happen. Things like pre-pandemic employment, closer-to-normal price inflation, and less economic uncertainty just aren’t on the map.

Full Article →GOLD erased the last of this week’s earlier 2.4% rally in London trade Friday, moving back to $1705 per ounce as silver held 1.3% firmer and platinum prices showed a 4.6% weekly gain.

Full Article →GOLD PRICES traded near 1-week highs after rising and then slipping $10 from $1740 per ounce in London trade Thursday, and bullion reached the highest so far in March for Euro investors as longer-term interest rates retreated further from this month’s spike after the European Central Bank vowed to raise the pace of its government bond purchases to ensure “favourable financing conditions”.

Full Article →No less an establishment thinker than former U.S. Treasury Secretary, Lawrence Summers, opines, “I think there’s a real possibility that within the year, we’re going to be dealing with the most serious incipient inflation problem we have faced in the last forty years.”

Full Article →DMCC: Perfecting Dubai Good Delivery

Mapping Dubai’s Journey Towards a Golden Future: Dubai’s reputation as a major gold-trading hub has been harmed recently in what has at times seemed to be a concerted attack on the Emirate by a small group of well-connected individuals and a protectionist agenda…

Full Article →In a recent interview, Digix co-founder and COO Shaun Djie spoke about the comparisons between gold and bitcoin, the metal’s role in the monetary system and what investors can expect in short-term economic conditions.

Full Article →Supporters of the World Economic Forum’s all-encompassing Great Reset agenda are eyeing BIG changes for the global monetary system. Plans that might once have been dismissed as pure speculation or conspiracy theories are now being openly pushed by people who occupy the highest levels of power.

Full Article →It is an extraordinarily dangerous time for bullion banks to continue selling silver they don’t have. Their play is to destroy sentiment and shake investors out of the market. Thus far, at least on the physical front, this effort appears to be backfiring.

Full Article →IRAs Bridge the Social Security Income Gap

We’ve reported many reasons why you should not rely solely on Social Security to fund your golden years. Those reasons are in addition to the official advice that Social Security is only designed to replace about 40 percent of your pre-retirement income. Which naturally might get a retirement saver to think: “What about the other 60 percent?”

Full Article →GOLD PRICES slipped back below $1800 per ounce Wednesday as longer-term interest rates rose further on government bonds, hitting new multi-month and multi-year highs for rich Western economies’ borrowing costs as new US President Joe Biden pushes for $1.9 trillion in Covid relief and stimulus.

Full Article →FRESH outflows from gold-backed ETFs failed to stop the metal holding above what traders called the “psychological $1800 level” in Asian and London trade Tuesday, defying yet more investment liquidation as longer-term interest rates reach multi-year highs

Full Article →Gold Price to $2,000 in 2021: BoA Analysts

Bank of America sets a 2021 gold price target of $2,000, why silver could jumpstart the next precious metals bull cycle, and thefts of catalytic converters from cars are on the rise, driven by high prices in platinum and palladium.

Full Article →Yellen Forces Fed to Begin Downsizing from $7.5 Trillion

The Fed attempts to maintain control of various rates (including inflation, unemployment and long-term interest rates) through its monetary policy decisions. In the past, poor choices arguably led to both the dot-com bubble and the Great Recession. But that’s old news.

Full Article →What IS The Real Purpose of Money?

“Money is a matter of functions four: a medium, a measure, a standard and a store.” Or at least so says an old rhyme once used in economics books. And let’s face it, three of these functions are clear. A medium of exchange is what people use to pay for goods.

Full Article →Backwardation + Evidence of Silver Supply Squeeze

In recent months, the numbers of people standing for delivery of the metal on their futures contracts has spiked. If that trend continues in March, which is the next delivery month, it may be a bigger “Come to Jesus” moment than the shorts had in March of 2020.

Full Article →Where Precious Metals Meet FinTech

For this weeks Q&A I’m talking with Mike Greenacre. Mike’s initial career was in the geophysical exploration industry, working in Africa, US, Middle East and Asia, beginning his trading and brokerage career in Switzerland, with an initial focus on steel and iron ore.

Full Article →Near-Zero Rates Sound Good (Until This Happens)

In some cases, the idea of a “near-zero interest rate” is a good thing. For example, if you qualify for 0% interest when you buy a car, you save money…

Full Article →Energy Metals Leading the Charge

What’s driving these “energy” metals? Besides ongoing currency depreciation and the risks of higher inflation, which will help boost all hard assets over time, rising demand for electricity in general and electric vehicles in particular.

Full Article →Silver Situation Update

In the last two weeks, there has been a greater awakening about the silver story – its growing industrial uses, its growing investment demand, and the pre-existing bullish posture of the silver market itself.

Full Article →Weekly News: US Mint All Out of Silver and Gold

Stories include: U.S. Mint can’t keep pace with demand again, Goldman chief calls silver a supercharged version of gold, and amateur prospector unearths a long-lost golden treasure from Medieval times.

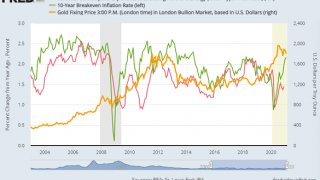

Full Article →How Precious Metals Generate Positive Real Returns

One of the most bullish backdrops for precious metals is an environment of negative real interest rates – that is, when bonds and cash yield less than the inflation rate. […]

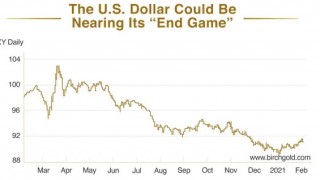

Full Article →Is the U.S. Dollar Nearing the “End Game”?

Jim Rickards said back in 2016: “The dollar won’t lose its reserve currency status overnight” — and he was right. But a new and disturbing signal could finally be revealing the end game.

Full Article →WILD Silver Market Swings… What Next?

As extreme market conditions drive tremendous volatility in silver spot prices, buyers are exerting unprecedented pressures on retail physical bullion products.

Full Article →Georgette Barnes: Meet the Woman Striking Gold in West Africa

This week’s TalkMining interview is with Georgette Barnes Sakyi-Addo Executive Director at Georgette Barnes Limited, Volunteer President at Women In Mining, Co-Founder of the Accra Mining Network and volunteer Elected President of the Association of Women In Mining In Africa.

Full Article →Weekly News: Silver Skyrockets on Retail Thrust

Stories include: Day traders piling into silver as analysts predict $50 price, gold’s reign as the top asset, and $400 million of civil war gold buried in Pennsylvania might have come to the surface.

Full Article →Having been reading about the great WallStreetBets #SilverSqueeze all weekend and watching zoom call after zoom call of excited precious metals experts getting ready for Silver’s moonshot this week I started to get a strange sinking feeling…

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.