How can you tell when a big economic bubble is forming? When Wall Street tells Main Street, ‘It’s not a bubble.’ The old joke goes: “How can you tell when a lawyer is lying? Their lips are moving.” Now there is a new joke, according to Charles Hugh Smith…

Full Article →It’s Your Retirement: Shouldn’t You Decide How to Save?

The days of pensions, however, are pretty much over. Nearly every corporation rebelled against the uncertain, long-term costs associated with securing their former employees’ retirements. Instead, they argued for (and got) a different kind of employee retirement benefit…

Full Article →Wall Street stock brokers coined the phrase “Put 10% of your portfolio in gold and hope it doesn’t go up.” There’s a very good reason for this. When gold’s price is steady, or posting mild gains, that means there’s no market mayhem going on. Gold’s two previous all-time highs, in 2020 and 2011, both came during times of enormous global distress.

Full Article →A few recent articles bring to the public’s awareness that wealthy investors are preferring not to sell their assets, and thereby pay capital gains taxes. Instead, they borrow against them, on margin…

Full Article →When is the Time to Sell Precious Metals?

Humans are emotional creatures and studies show most of us make poor choices when it comes to timing. If you are making a snap decision to sell (or buy) based upon a surge of either fear or greed, odds are you will regret it.

Full Article →One way to look at the price of gold, is that it dropped from its high around $1,900 in early June… Another way is to zoom out, and look at the big picture…

Full Article →Expectations for Fed Tightening Are Misplaced

Fed watchers found some hints about interest-rate tightening in the just-released FOMC’s July meeting minutes. That was all it took to rattle Wall Street. Stocks have since recovered some of the initial losses, but it looks like history is about to repeat.

Full Article →The markets are severely overvalued, according to both the Buffett Indicator and the Schiller P/E ratio. Taken together, these are a reliable indicator that Wall Street isn’t thinking clearly…

Full Article →I don’t believe that the inflation we’re seeing – especially in the U.S. – is in FedSpeak, “transitory.” The indications and real-world price-increase in so many things I want to buy, if they’re in stock, are growing, and unlikely to go back down anytime soon.

Full Article →Will the U.S. Currency Regime Fall?

The U.S. government’s nearly two-decade-long, multi-trillion-dollar “nation building” effort in Afghanistan may now have nothing to show for itself. Unsurprisingly, they didn’t see it coming. Central planners almost never do.

Full Article →Sometimes, bad luck can strike. But other times, a catastrophe comes from a series of bad decisions, each the reaction to the consequences of the previous one. On August 15, 1971, President Nixon decreed that the US dollar would no longer be redeemable for the gold owed, even to foreign governments

Full Article →The Federal Reserve has targeted a 2% inflation rate for years, as though it’s a holy grail. As though 2% inflation was an economic panacea that would perfectly balance employment, business investment and bank lending. Recently, the Fed has loosened the reins on inflation and let it charge ahead. Quite a bit…

Full Article →Most gyms have a punching bag in the corner. When someone feels frustrated or wants to show off, he can hit it. The gold standard is the punching bag in the economists’ gym. In an InsideSources op-ed, David Beckworth and Patrick Horan argue, “A new gold standard would do much more harm than good.”

Full Article →Debt Ceiling and Budget Battles to Underpin Gold Prices

A mysterious $4 billion sell order – suspiciously placed during the most illiquid time of the day – caused a waterfall $100 decline in gold prices while silver dropped in tandem by over $1.30 per ounce. Among the major issues investors are eyeing this month is the debate over the federal debt…

Full Article →This is significant, as it’s what one expects to see if the post-Covid bull market in silver is still intact. Leveraged speculators are just trying to front-run whatever move they expect next. They do not move and hold the price durably.

Full Article →It is often excruciating to own metal when the short run price action is completely disconnected from fundamentals. The price smash in the last couple trading days is a case in point. Nobody can make a coherent fundamental case for the move lower. It is best to simply remember there are very good reasons to own physical metal…

Full Article →Gold and Silver Rebound From ‘Flash Crash’

GOLD AND SILVER PRICES stabilised from a flash crash to hit 4 and 8-month lows respectively at the start of Asian trading today due to low liquidity and Fed tapering fears, while oil slid further on concerns over new coronavirus related restrictions in Asia.

Full Article →What’s Going to Happen When the Debt Comes Due?

How they decide to answer it – or evade it, as the case may be – will have profound implications for investors and anyone who holds U.S. dollars. For months, the financial media has been running stories about how the pandemic led to a surge in savings…

Full Article →Bond yields are telling us gold should sit at $2,000: A recent analysis by Credit Suisse suggests that gold’s price is quite a ways off from where it should be. According to the bank’s analysts, gold’s current fair value is around $1,914 when taking into account market conditions.

Full Article →Going For Gold: Building a Winning Portfolio

In a yield-starved environment where bonds and cash are returning less than inflation, there are no guarantees. But there are certainly opportunities outside of fixed income instruments. Investors who try to sprint their way to success risk hurting themselves in the process. Going for fast-moving penny stocks or cryptocurrencies can lead…

Full Article →The government’s liabilities are the assets of everyone else: individuals, pension and insurance funds, commercial banks, and the Federal reserve. All of these parties lend to the government, though often without knowing.

Full Article →One thing is certain, we sure are living in strange times and for retirement savers, that can also mean levels of anxiety that rise a lot faster than IRA balances. From mistakes anyone can make that could derail their retirement, to ongoing market volatility that the media claims is a “good thing,” there are…

Full Article →We’re seeing the argument, again, that silver stocks are being consumed in solar panels, medical applications, and of course, electronics. This argument has a certain temptation. After all, the standard assumption is that value is inversely proportional to quantity…

Full Article →Despite the effort to “squeeze” the bullion banks, silver has yet to push through the $30 barrier, and gold remains below the high put in nearly a year ago. The effort has been valiant. Demand for physical bullion is unprecedented. However, the paper markets, where price discovery is purportedly done, remain untethered…

Full Article →Financial media headlines were absolutely schizophrenic. We saw everything from “Dow Plunges on Covid Resurgence” and “Speculators Flee Suddenly Volatile Market” to “Wall Street Ends Higher, Powered by Strong Earnings, Economic Cheer.”

Full Article →It was July 2016 when we offered our first Gold Fixed Income True Gold Lease. The gold lease was to Valaurum for manufacturing their flagship product, theAurum®. Ever since then we’ve been busy Unlocking the Productivity of Gold™ for the good of our clients, and the world…

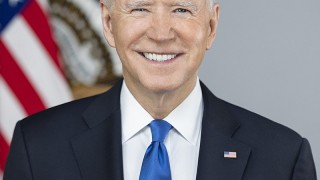

Full Article →This week Biden superficially addressed the problem by admitting the obvious – that prices have been rising rapidly this year – while denying that the inflation surge represents anything out of the ordinary. Trust the experts! After all, when have they been wrong about anything…

Full Article →Reddit’s silver “apes” expect 100% to 1,000% gains on their new silver push. Whoever thought that the Reddit-fueled attempt to squeeze silver and expose big bank manipulation of the metal’s prices was done is in for a surprise, via Fox Business

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.