If you were awake at all this week, you caught glimpses of the stock market drama.

Bullion.Directory precious metals analysis 23 July, 2021

Bullion.Directory precious metals analysis 23 July, 2021

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Monday. Huge sell-off, the worst one-day decline since October 2020.

Tuesday: Big rebound recaptured 80% of Monday’s losses.

Wednesday: Rally continues, Monday’s losses fully recouped

Thursday: Stocks rise a bit, ended the day up.

Friday: All major indices up, near their record highs.

And that’s just the numbers… Financial media headlines were absolutely schizophrenic. We saw everything from “Dow Plunges on Covid Resurgence” and “Speculators Flee Suddenly Volatile Market” to “Wall Street Ends Higher, Powered by Strong Earnings, Economic Cheer.”

Economic cheer? Let’s take a closer look at that last article…

It starts with the typical bullish post hoc rationalization for the market’s response: “robust corporate earnings and renewed optimism about the U.S. economic recovery fueled investor risk appetite.”

Yay Wall Street! Stocks tried to go down and failed, everything’s all better. Move along, nothing to see here…

Amid all the hysteria, there were a few interesting tidbits: this CNBC article and another published on Monday both emphasized market volatility. Both titles read like a PR firm’s damage control efforts: “Don’t make this mistake,” and “volatility can be a good thing.”

Don’t be afraid of volatility! It’s a good thing!

While volatility can be troubling for investors, experts caution against any hasty selling when markets fall. In addition, slumping stock prices can be a prime buying opportunity that investors should take advantage of.

Volatility is a “normal part of the process of investing.” And if your stocks go down, well, buy more of them!

The article warning investors not to sell stocks offered longer-term and somewhat reassuring perspective: “Between 1900 and 2017, the average annual return on stocks has been around 11%. After adjusting for inflation, that average annual return is still 8%.” And if you want to gain the rewards out of investing, you’ll just have to “sit through the losses.”

In this particular case, sitting through the losses took all of 48 hours.

Remember what we said about a PR firm’s damage control? Doesn’t it strike you as more than a little odd that it only takes a single day of stock losses for CNBC to roll out the big guns to shame investors into staying in stocks? Just a bit of overkill?

Here’s what we think is going on…

Consider this Tuesday quote from Chris Zaccarelli, CIO at Independent Advisor Alliance:

We willing to let the sell-off run its course and buy the dip on the belief that the economy will fully recover and return to its prior growth trajectory, bringing most of the cyclical companies in the airline, travel and leisure industries along with it. [emphasis added]

Oh, I’m sorry, were you expecting some economic analysis? Maybe an explanation of why the market sold off just the day before? A discussion of fundamentals? Just possibly a number?

Sorry to disappoint you. Nope, the Chief Investment Officer of an organization of financial advisors is basing his forecast on one word:

Belief

So long as you believe markets will go up, they’ll go up. That’s bubble thinking in a nutshell.

Even so, that’s not the reason those articles we mentioned above sound so panicked and strident.

Staying the course is fine (if it’s the right course)

Sometimes, it’s smart to question the mantra from the mainstream media that keeps saying “stay the course.”

What if it’s the wrong course? What if it’s leading you somewhere you don’t want to go?

Should you just blindly “stay the course” then?

After all, there’s no such thing as “one size fits all” solution when the markets are this chaotic. It might be a good idea not to take what reads like “damage control” hand-waving as gospel, and consider your own approach.

Now, let’s talk about what the PR damage control team is really afraid of.

Volatility is a symptom

Volatility, or the frequency and more importantly intensity of extreme swings in stock prices is increasing. According to Corey Hoffstein:

Were we to analyze weekly returns for the S&P 500 over time, one of things we would notice over the last 20 years is that they’ve become increasingly fat-tailed. In other words, more extreme returns – both positive and negative – are happening with greater frequency. [emphasis added]

By itself, this is not an argument against stocks. Because those more extreme returns, are both positive and negative, right? Hoffstein is basically warning that moves will be bigger, and investors who own stocks will maybe need to stock up on extra Tums. The volatility, the giddy rises and vertical plunges, should balance out over the long-term.

Hoffstein seems to be saying stocks aren’t necessarily more dangerous, though they might feel that way. Whether you go through the tunnel or climb over the mountain, you wind up on the other side.

And that’s a perfectly rational perspective.

The only problem is, human beings generally and investors specifically are not rational beings…

Fear is the disease

Just like other animals, humans evolved in an environment of predators and prey. Fear and greed are hard-wired into our brains. Why? Because the ancestor human beings who weren’t sufficiently fearful or greedy all died.

Imagine for a moment you’re a primitive hunter-gatherer out looking for food. You see a bush with berries on it. What do you do?

You pick the berries.

What if you see a lion hiding in the bush?

You run.

The real question, though, is this:

What if you don’t see the lion hiding in the bush?

The bush? That’s today’s market. The berries are potential profits.

What about the lion? Is he in there or not?

Here are some signs a lion might be lurking…

Of course, in our analogy the “lion” is the next potential market correction hiding amongst all of the volatility, ready to prey on your retirement savings.

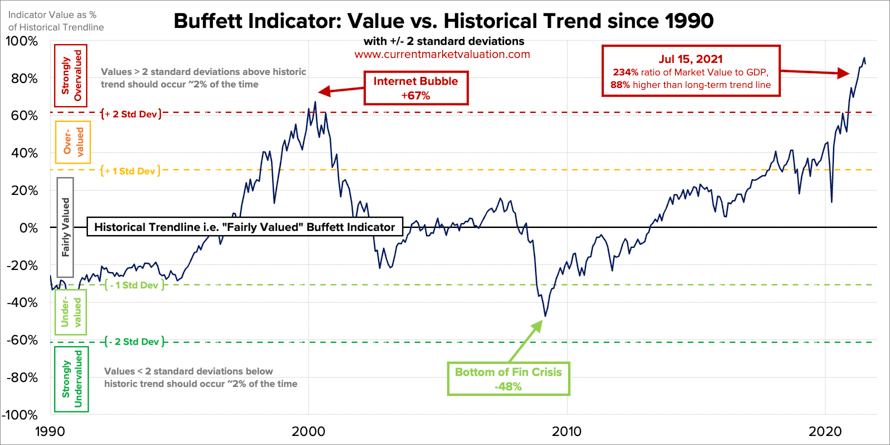

Take a look at the Buffett Indicator. The market is severely overvalued.

That’s just one number. If you prefer the Shiller PE ratio, stocks are only 2.5x higher than they should be. The simple PE ratio? The S&P 500 is 3x overvalued.

And that is exactly why the PR damage control team pulls out the stops after a single day when markets end in the red. Because the current state of the market is built on that one word we highlighted earlier:

Belief

And when that belief gets disrupted, what happens?

That’s when you see the lion, and you realize no number of berries is worth the risk. That’s when fear takes over.

Extreme volatility is a symptom of that fear. It warns us just how fragile the current market is. Monday warned us that a whole lot of investors were ready to run to the exits. (By Wednesday, presumably, they’d decided the scary lion they’d glimpsed was just a shadow and were back for more berries.)

We’ve already seen a truly absurd amount of manic investor behavior. That’s another signal for the final stages of a bubble (and it always has been).

Now is the perfect time to decide if you want to continue down this particular course…

Rationality vs. the PR damage control team

No amount of positive news stories and chastisements to “stay the course” will prop up a market bubble – even if stocks were driven higher by manic gambling by first-time investors piling into the stock market casino.

Consider your personal strategy. Consider both potential upsides (the berries) and downsides (the lion). Consider not just the odds, but also the stakes. During volatile market conditions, operating without a plan can put your future at risk. You do not want to risk getting trampled by a crowd of berry-pickers all fleeing the same lion.

Planning, diversifying,and maintaining control of your retirement savings can help you choose the right track, and then help you stay on it.

Physical precious metals like gold and silver may be a part of your plan. Not only do precious metals make great hedges against inflation, gold is usually the asset most investors run to when the stock market lion roars.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Leave a Reply