Investment gains look good, on paper. Especially in your retirement saving accounts. But things can change quickly in the markets, and those gains can disappear faster than a Fed press conference led by Chairman Powell.

Full Article →Why Isn’t Gold Going Up With Inflation?

Many voices in the gold community are making a simple point. Look at the prices of oil, copper, and other commodities. They are skyrocketing. The mainstream explanation is that the cause of this skyrocketing is the increase in the quantity of what is called “money”.

Full Article →Are Shortages in the Economy Extending to Precious Metals?

While the Fed insists that recent high inflation readings are “transitory” and that long-term inflation expectations remain “anchored” at 2%, investors can’t afford to take their word for it. We must be prepared to navigate unpredictable and erratic markets…

Full Article →Will They Cancel Christmas?

The alarm bells of inflation, supply chain disruptions, and an overvalued stock market are all sounding at the same time. You don’t need to understand WHY things are off-track, so long as you understand your plan to protect yourself and your family from the consequences.

Full Article →The Hidden Thief Picking Social Security’s Pockets

If you had dreams of retiring soon, perhaps even next year, and starting your “dream retirement” off on the right foot … you could be in for a bit of a nasty surprise.

Full Article →Extreme Ratios Point to Gold and Silver Price Readjustments

Kicking the can down the road is the new national pastime. Every time the government’s bills come due, officials at the Treasury Department find creative ways of paying them with money they don’t have.

Full Article →Shocking Truth About US Economy

The large majority of the nation’s spending, and wealth, is handled by people who don’t have much in common with gold bugs – at least not yet. Let’s start with some data.

Full Article →Emboldened, Super-Funded IRS to Target Bank Depositors

New, heavy-handed IRS and Federal Reserve controls along with other threats to financial privacy highlight the importance of holding wealth outside the banking system.

Full Article →Here’s Why Modern Unbacked Money Derives Value from Gold

Money has value, but not because the government says so. In an analysis on Eurasia Review, Frank Shostak goes in-depth in an attempt to answer the question: why does money have value? Opposing the views that the value of money is there because of government reassurances…

Full Article →The Time Is Now

Strong Demand Pushing Bullion Premiums Higher Again. The best time to buy gold and silver was before the world began its slide into insanity. The second best time to buy metals may be now.

Full Article →Unfortunately, like stocks, home prices can drop like a rock at a moment’s notice. That’s one lesson we learned all too well in 2008. Another Great Recession-type plummet in home prices forces many buyers underwater, stranding them with an asset they overpaid for and can no longer afford

Full Article →Because as humans we like to place significance on certain numbers, I’m taking this milestone moment to announce some exciting changes coming to Bullion.Directory – and to start things off, we’re moving domains!

Full Article →Would you rather enter the battlefield with physical gold and silver -encased in a metaphorical Abrams M-1 tank – or “armed” only with a sheet of paper showing you have unallocated pile of metals, possibly maybe.

Full Article →Analysts think stagflation might be the boost gold needs right now. The gold market continues to experience strange action, having most recently fallen to $1,720 only to bounce back to $1,760 by Friday’s time. It was a repeat of the week before, where strong selling pressure was met with a lot of buyers.

Full Article →Inflation Tax Coming for Investors

The post-COVID inflation surge that was supposed to be “transitory” is looking a lot more permanent. On Friday, the Bureau of Economic Analysis Friday released data on Personal Consumption Expenditures (PCE), the Federal Reserve’s preferred inflation gauge.

Full Article →The Fed’s ‘Dangerous’ Path Toward Debt Monetization

A prominent U.S. Senator just called the head of the nation’s central bank “dangerous.” Unfortunately, the true dangers of U.S. monetary and fiscal policy were lost on everyone involved. On Tuesday, Federal Reserve Chairman Jerome Powell testified before the Senate banking committee…

Full Article →China Gold Buying Surges on Evergrande Crisis

It’s easy to forget that a crisis is brewing when it’s overseas. Yet to anyone familiar with the situation, the Evergrande housing crisis in China has all the makings of a repeat of the 2008 financial crisis.

Full Article →Another Debt Ceiling Hike Won’t Fix What’s Broken

Washington DC politicians are busy cobbling together yet another bi-partisan bill to raise the federal borrowing limit. Congress imposed the debt ceiling on itself in 1917 – Democrats and Republicans have worked together to circumvent it ever since.

Full Article →Gold 1 – Bitcoin 0

A leader of the crypto revolution is borrowing dollars. Without any awareness of the irony, crypto promoters say that this validates crypto. That a crypto company borrowed dollars supposedly validates crypto. Think about it, take as long as you need.

Full Article →Evergrande Contagion Threatens to Collapse the Everything Bubble

Evergrande, a real-estate colossus in China, is collapsing. Don’t expect the collapse to be contained to China. The global macro implications are huge. At some point in the near future, constant interventions by the Federal Reserve and Treasury won’t be able to stave off a major crisis.

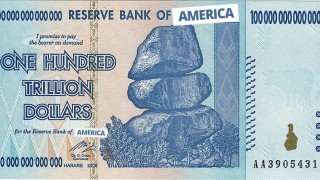

Full Article →Coming Soon: Trillion Dollar Coins

Credit risk out of China and debt ceiling drama in Washington are driving precious metals markets this week. Gold and silver attracted some significant safe-haven buying as equity markets succumbed to selling.

Full Article →America’s central bankers are tasked with impartial oversight over aspects of the American economy. But could these individuals be making decisions on interest rates and bailout operations based on what is best for their own personal investment portfolios?

Full Article →Futures Speculators Crushed (Again)

The gold and silver futures markets were designed to increase volatility and discourage physical ownership of precious metals, as revealed in 1970s-era disclosures. The futures markets have also created opportunities for manipulation.

Full Article →Finally, Some Good News for Social Security

Time is running out on any possibility that the Social Security Trust will be able to provide the expected benefits to beneficiaries after 2033. That is a bitter pill that Americans will have to swallow in 12 years. But there are at least three spoonfuls of sugar that might help it go down (if you don’t choke).

Full Article →Gold and Silver Price Fundamentals Update

There is a pattern we see often in both metals. Price weakness tends to be driven by futures speculators liquidating positions. This means that the metal becomes scarcer. It stops going into the warehouse. Instead, it can begin coming out if it gets scarce enough.

Full Article →Here’s Why Gold is King of the Commodities

In a recent analysis, the World Gold Council commented that we are entering a commodities supercycle. Between higher inflation and shortages of basic materials expected for the foreseeable future, it’s not a difficult notion to entertain. And out of the various commodities, gold is once again emerging as a shoo-in for the top spot.

Full Article →The Story of Silver’s Future as Money Is Yet Untold

In addition to the white metal’s growing uses in high-tech and alternative energy industries, some silver bulls are banking on rising bullion demand by retail investors and a possible reinvigoration of its use as currency…

Full Article →Bond King Declares: Financial Assets Are ‘Garbage’

“Bond King” Bill Gross warns that stocks and bonds could become tantamount to garbage. Gross sees inflation, coupled with waning demand for Treasuries by foreign central banks, forcing bond yields to rise.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.