It’s not fair. It seems these days everything claims to be *something something* gold. Oil is black gold. Melted cheese is liquid gold. There’s even red gold, a tomato company. It’s just not fair! It’s time to turn the tables, and the tide. To flip this thing on its head.

Full Article →The last time America saw such a vast surge in gas prices was the 1970s energy crisis. That crisis led directly to a decade of stagflation, a toxic brew of rapidly-rising prices, a 50% drop in the stock market, unemployment over 10%, shrinking GDP and widespread civil disorder.

Full Article →4 Scenarios for BIG Moves in Precious Metals

Direction, magnitude, and timing are difficult to predict. But precious metals bulls are eying massive upside potential for gold and silver as war and inflation stoke safe-haven buying. What follows are four major macro scenarios that could impact metals markets…

Full Article →The number of black swan events since mid-2019 is astounding. These days, investors are constantly waiting for the next financial or geopolitical calamity, with some new sources of disruptive events added to the mix.

Full Article →Currency Wars Center on Russian Gold

In response to Russia’s war on Ukraine, the U.S. and G-7 countries have launched a currency war against the Kremlin. Sanctions imposed on the Russian central bank have effectively blacklisted the country from the U.S. dollar-dominated global financial system.

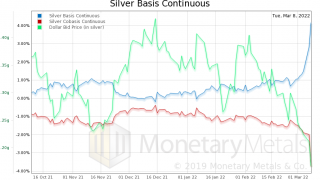

Full Article →We have recently seen an increase in social media posts about the big increase in short positions by the bullion banks. What would motivate them to short a commodity during this period of inflation, much less a monetary metal when central banks are printing money with reckless abandon?

Full Article →Is there Gold in the Metaverse?

Imagine all the people… living life in the Metaverse. Once we immerse ourselves in the digital sphere, gold may go out of fashion. Or maybe not? Do you already have your avatar? If not, maybe you should consider creating one

Full Article →Say what you will about Russia’s government, you can’t deny they understand the importance of investing in physical gold. Accumulating $140 billion of an asset with zero counterparty risk was a smart move. Now Russia’s gold bullion is likely to prove its merit once again.

Full Article →The biggest financial paradigm shift in our lives is underway, and there’s no turning back. No one knows exactly what it’s going to look like going forward nor how we’ll be able to get there. Not sure you “have enough”? Well, then don’t just stand there. Do something productive!

Full Article →Recent News Points to Recession – So What Happens When the Fed Raises Interest Rates? Countless publications are saying recession coming. With the Fed likely to raise interest rates several times this year, will it trigger a recession?

Full Article →Gold Jumps In Spite of Ultra-Hawkish Fed

The FOMC finally raised interest rates and signaled six more hikes this year. Despite the very hawkish dot plot, gold went up in initial reaction. It’s also worth mentioning that the Fed deleted all references to the pandemic from the statement. Instead, it added a paragraph related to the war in Ukraine,

Full Article →Gold Falls Despite Ongoing War and Inflation Surge

It seems that the stalemate in Ukraine has slowed down gold’s bold movements. Will the Fed’s decision on interest rates revive them again? Bullion.Directory precious metals analysis 15 March, 2022 […]

Full Article →Recent news has been full of ominous developments for the dollar; Russia and China have already established trade without need for U.S. dollars signing a treaty in 2019 which provides for using their national currencies in trade. U.S. sanctions on Russian exports will only increase non-dollar trade between those Eastern powers.

Full Article →Hearing more about gold on your favorite financial news channels in recent weeks? Experts say that the principal energy behind gold’s recent price surge has been Russia’s invasion of Ukraine – but they also say renewed fears of stagflation are providing additional buoyancy to the metal’s price.

Full Article →As Gas Prices and Ukraine Conflict Help Gold Rise – Many experts agree that all the fundamentals are there for gold to have outstanding price performance. Gold often captures all the headlines which can lead to silver’s potential being ignored.

Full Article →Gold Likes Recessions – Will High Interest Rates Lead Us There?

We live in uncertain times, but one thing is (almost) certain: the Fed’s tightening cycle will be followed by an economic slowdown – if not worse. There are many regularities in nature. After winter comes spring. After night comes day. After a Fed tightening cycle comes a recession.

Full Article →Can they do it? How would the world react? The Russian central bank reportedly has over 2,000 tonnes of gold. We have seen three arguments repeated many times, both in finance/economics articles and on social media.

Full Article →Two Weeks and Counting – How Does War Affect Gold?

With each day of the Russian invasion, gold confirms its status as the safe-haven asset. Its long-term outlook has become more bullish than before the war. Two weeks have passed since the Russian attack on Ukraine. Two weeks of the first full-scale war in Europe in the 21th century, something I still can’t believe is happening.

Full Article →The term inflation is used by many people to mean rising consumer prices, regardless of the cause. Though most are aware of non-monetary causes, there is a tendency to scrutinize the quantity of dollars whenever prices are rising.

Full Article →Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Full Article →After rallying over the $2,000/oz milestone this morning, the gold market may now be poised to run to new record highs. A major technical breakout out of last year’s consolidation pattern had already been established in February. A trend change of this significance can be expected to last not days or weeks, but months… perhaps years.

Full Article →Ukraine’s Defense Shines – As Does Gold

Russian forces have made minimal progress against Ukraine in recent days. Unlike the invader, gold rallied very quickly and achieved its long-awaited target – $2000! Russian troops continued their offensive and – although the pace slowed down considerably – they managed to make some progress

Full Article →After a steady week of gains, gold has had a volatile Friday, of the kind that is very much to the gold bug’s liking. Bullish forecasts for $2,000 gold this year were expedited with force by the Russia-Ukraine conflict. We’re now thinking $2,000 will be the price that could define the long-term trajectory of gold’s price.

Full Article →These are uncertain times for long-term savers. That statement is accurate even if all you think about is the Russian invasion of Ukraine. As you likely know, global financial markets have demonstrated significant volatility during this time of Ukranian strife…

Full Article →Goldco, a leading precious metals provider, today announced its partnership with Sean Hannity, one of the Nation’s top talk show hosts and conservative political commentator. Mr. Hannity’s endorsement of Goldco’s product offerings comes at a time when the U.S. is suffering…

Full Article →Fighting Continues: Good for Ukraine… and GOLD

What does the ongoing war in Ukraine mean for the precious metals market? Well, the continuous heroic stance of President Volodymyr Zelenskyy and Ukrainian defenders is not only heating up the hearts of all freedom-lovers, but also gold prices.

Full Article →Last week has been a volatility showcase that is rarely seen in the gold market. Russia’s invasion of Ukraine sent gold flying past its 2011 high and up to $1,976, the highest level in a year and a half. The next day gold posted considerable losses and ended Friday’s trading session around $1,890

Full Article →As Ukraine Resists Will Gold Withstand Bear Invasion?

What does the war between Russia and Ukraine imply for the gold market? Initially, the conflict was supportive of gold prices and the price of gold soared on Thursday. However, the rally was very short-lived, as the very next day, gold prices fell and gold’s performance looked like “buy the rumor, sell the news.”

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.